Escenario bajista: Ventas por debajo de 80.00 con TP1:79.34, TP2: 78.94,TP3: 78.55 y 78.00 Escenario alcista: Compras sobre 78.00 (esperar retroceso hacia zona) con TP:79.34 TP2:80.00 y TP3: 81.00

2019-11-11 • Actualizada

The beginning of the month was quite eventful for the Turkish lira. However, this week it started to lose its volatility.

What is happening?

The Turkish lira started to gain its momentum during the first week of November. It was supported by the higher-than-expected level of manufacturing PMI at 44.3 in October, but mostly by the political factor. In October, Turkey finally released from prison a US Pastor Andrew Brunson, who has been held for fake accusations of terrorism and espionage. In addition, Turkey removed the counter-sanctions on two US ministers. In addition, Turkey was added by the White House into the list of the 8 countries, who would continue buying Iranian oil despite sanctions. As a result, USD/TRY fell significantly.

However, the overall economic conditions of the country are still unstable. The level of consumer inflation released on November 5 hit 25.24% - the highest level in 15 years. In addition, the hawkish statement by the Federal Reserve last week made the US dollar strong. That fact weakened USD/TRY.

That is why the government started to implement measures to reduce the depreciation of the Turkish lira and to take control of the price behavior. The Treasury and Finance Ministry reduced the current account deficit amid the expectations for positive data by the end of 2018. These expectations include the country’s inflation rate target at 23.5% this year, 15.9% in 2019, 9.8% in 2020. Other measures included a 10% cut on prices, a decrease of interest rates on loans by 10% and tax cuts on furniture and vehicles.

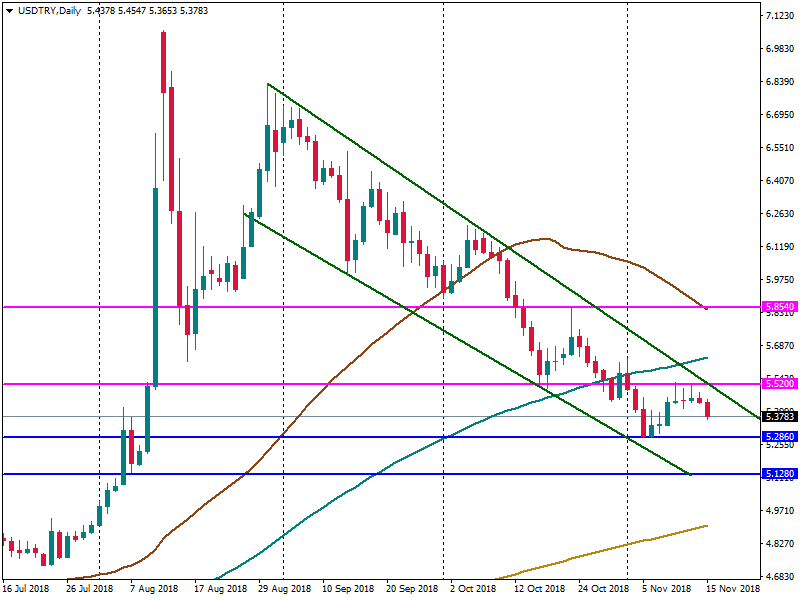

For now, USD/TRY is trading within the downward moving channel formed within the August maximum and September’s minimum. The pair has been stuck between the strong support at 5.2860 and the upper border of the downward channel since the beginning of the week.

If the Turkish lira is supported by the positive news, USD/TRY can fall below 5.2860. In that case, the next support lies at 5.1280.

On the other side, if the strong US dollar breaks the upper border of the channel and pulls the price above the resistance at 5.52, the bullish pressure for the pair increases. In that case, watch the next resistance at 5.8540.

Escenario bajista: Ventas por debajo de 80.00 con TP1:79.34, TP2: 78.94,TP3: 78.55 y 78.00 Escenario alcista: Compras sobre 78.00 (esperar retroceso hacia zona) con TP:79.34 TP2:80.00 y TP3: 81.00

Panorama Fundamental Los precios del petróleo crudo están bajo presión a medida que Estados Unidos aumenta significativamente su tasa de exportación diaria a casi 6 millones de barriles, creando un superávit que eclipsa los modestos esfuerzos de…

En este artículo destacamos los principales conductores fundamentales de los precios del crudo y el análisis técnico del XTIUSD Y XBRUSD

Escenario bajista: Ventas por debajo de 1.0820 / 1.0841... Escenario alcista: Compras sobre 1.0827...

Escenario bajista: Ventas por debajo de 2200 / 2194... Escenario alcista más próximo: Compras sobre 2197... Escenario alcista tras retroceso: Considera compras en torno a cada zona de demanda...

Escenario bajista: Ventas por debajo de 5220 ... Escenario alcista: Compras sobre 5225 (Si el precio falla en romper por debajo con decisión)

FBS mantiene un registro de tus datos para ejecutar este sitio web. Al presionar el botón "Aceptar", estás aceptando nuestra Política de Privacidad .

Su solicitud ha sido aceptada

Un gerente le contactará pronto

La próxima solicitud de devolución de llamada para este número telefónico

estará disponible en

Si tienes algún problema urgente, contáctanos a través del

Chat en vivo

Error interno. Por favor, inténtelo nuevamente más tarde

¡No pierdas tu tiempo – mantente informado para ver cómo las NFP afectan al USD y gana!