Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

2021-01-11 • Updated

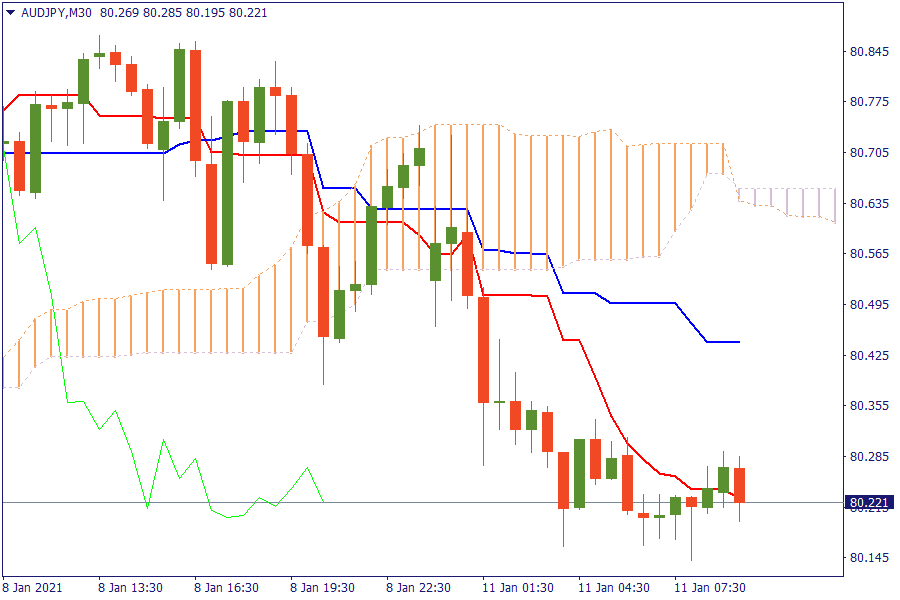

AUD/JPY: The pair is trading below the cloud. Further bearish pressure will lead the currency pair to retest the previous lows.

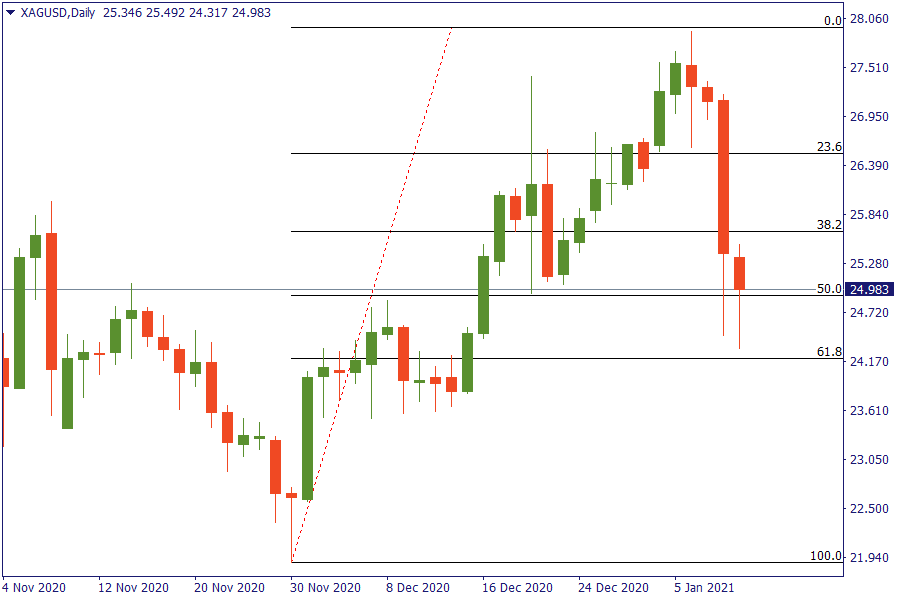

XAG/USD: Silver stands above 50% retracement level with an indecision between bulls and bears.

Asian equity markets began the week indecisively as ongoing COVID-19 concerns and US-China tensions contributed to the cautious mood. US House Speaker Pelosi said the House will take up a resolution to impeach US President Trump unless VP Pence and the cabinet invoke the 25th amendment. Treasury yields were at a 10-month top as "trillions" in new U.S. fiscal stimulus plans were set to be unveiled this week, stoking a global reflation trade.

Oil prices fell on Monday, hit by renewed concerns about global fuel demand amid tough coronavirus lockdowns in Europe and new curbs on movement in China, the world's second-largest oil user, where infections jumped. Mainland China saw its biggest daily increase in virus infections in more than five months, authorities said on Monday, as new infections rose in Hebei, which surrounds the capital, Beijing. Looking ahead, highlights from macroeconomic calendar include Eurozone Sentix Index, BoE's Tenreyro, ECB's Lagarde, Fed's Bostic and Kaplan speeches.

Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

Bearish Scenario: Sell below 39600... Anticipated Bullish Scenario: Intraday buys above 39750... Bullish Scenario after Retracement: Intraday buys above 39150

Bearish scenario: Shorts below 18100 with TP1: 17900... Anticipated bullish scenario: Intraday Longs above 18130 with TP...

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!