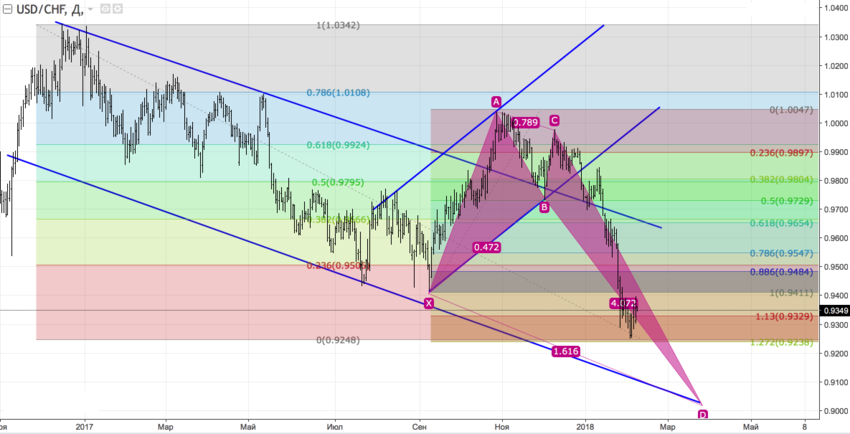

The month of February saw markets make several instinctive moves as well as create opportunities for proper leveraging of fundamental releases. Despite being a leap-year, there wasn’t any real impact on price delivery in the course of the month. As we await the opportunities that lie ahead in the month of March, here are a few thoughts to consider.