Coinbase (#COIN) saw its revenue rise to $773 million in Q1 2024, marking a 23% increase from the previous quarter and surpassing analyst expectations.

2020-09-09 • Updated

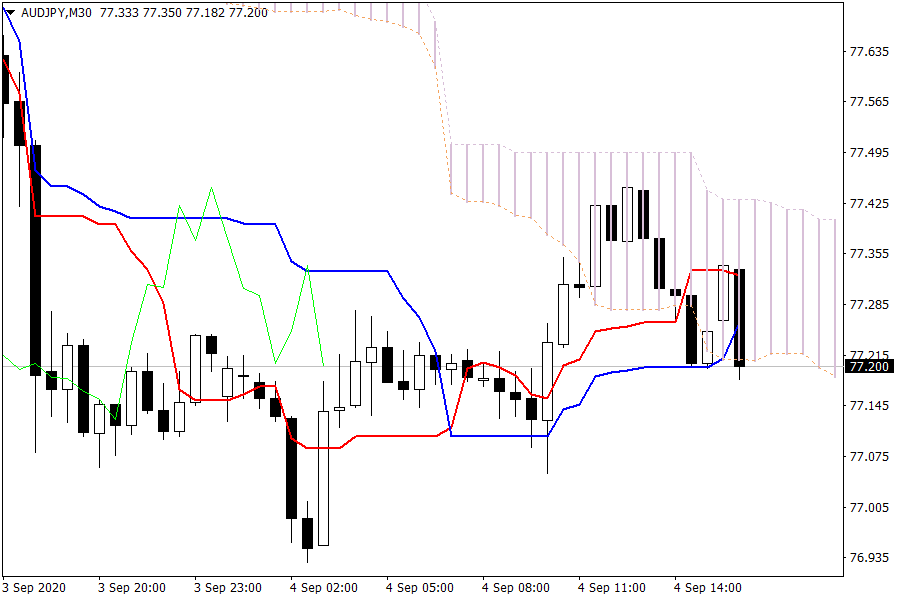

AUD/JPY: The AUD/JPY pair is now poised to exit the Kumo. Further bearish momentum will confirm the bearish sentiment.

U.S. Jobless Rate declined to 8.4% in August. The S&P 500 was set for a higher open on Friday following a brutal selloff in the previous session as a drop in the unemployment rate offset a slide in technology stocks, while investors remained cautious about a patchy economic recovery.

Nonfarm payrolls increased by 1.37 million jobs last month after advancing 1.73 million in July, the Labor Department’s closely watched employment report showed. The unemployment rate fell to 8.4% from 10.2% in July, steeper than the 9.8% fall that economists polled by Reuters forecast.

Apple Inc (AAPL.O), Microsoft Inc (MSFT.O), Amazon.com Inc (AMZN.O), Tesla Inc (TSLA.O) and Nvidia Inc (NVDA.O), which bore the brunt of Thursday’s losses, extended declines to between 1% and 4% in premarket trading.

The US Dollar consolidated gains on Friday but was set for its biggest weekly rise in two and a half months as on overnight drop in high flying US tech stocks fuelled a bout of risk aversion in global markets.

Coinbase (#COIN) saw its revenue rise to $773 million in Q1 2024, marking a 23% increase from the previous quarter and surpassing analyst expectations.

Bearish scenario: Shorts below 18100 with TP1: 17900... Anticipated bullish scenario: Intraday Longs above 18130 with TP...

During his program on CNBC on February 28, Jim Cramer expressed frustration with the impact of earnings reports on market behavior, noting how they often prompt rash decisions by average investors. He criticized the short-term focus and lack of attention to nuance in news coverage of earnings. Cramer cited examples of Home Depot and Lowe's, highlighting how investors reacted hastily to headline news without considering the broader context provided in earnings calls.

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!