Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

2020-11-03 • Updated

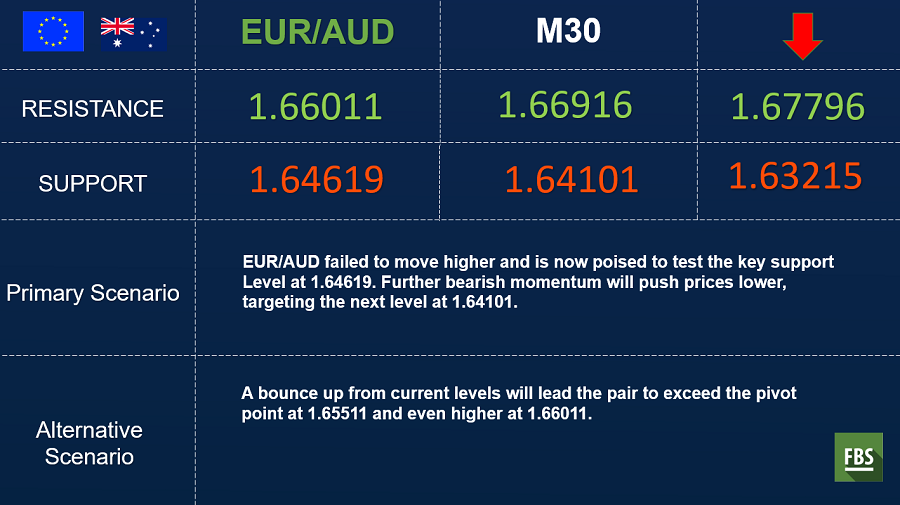

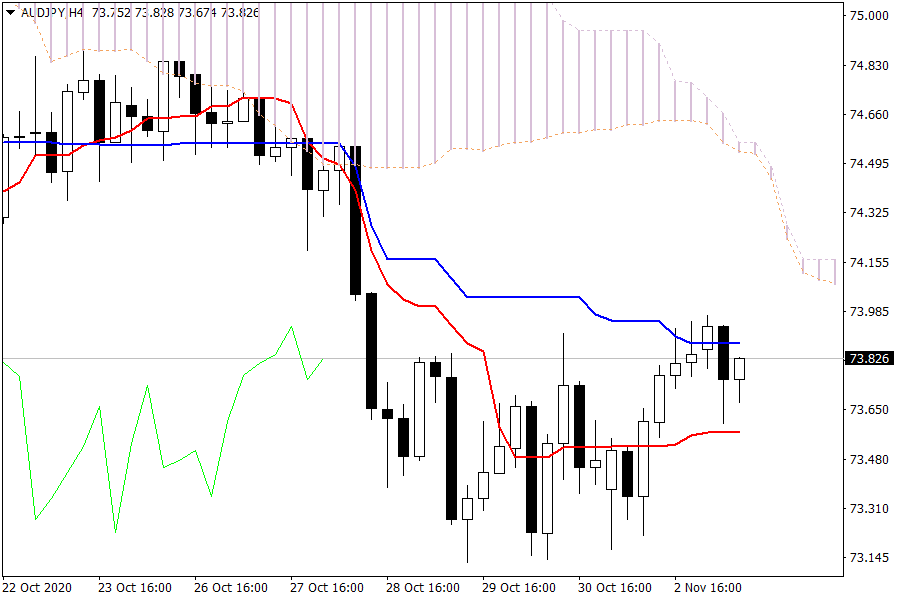

AUD/JPY: The AUD/JPY pair is trading between the Tenkan sen and the Kijun sen levels. A failed attempt to move higher will push prices to violate the Tenkan sen level, pushing the market to retest the previous lows.

Today's key event is the US election, where the Democratic party leads according to some polls. Joe Biden, the Democratic presidential candidate, has a 61% chance of winning the presidential election tonight according to the latest update from prediction markets. One of the key states to follow is Florida that is expected to deliver a result early Wednesday morning as it has already started to count mail votes. Trump cannot win without Florida but Biden can still pull it off without it, so a Trump victory in Florida may imply that we won't know the election result for a couple of days.

Despite a strong session for risk, FX moves were very limited in the start of the week. EURUSD grinded a little lower towards the low 1.16s while currently is trading in the mid 1.16 area.

US ISM manufacturing rose to 59.3 in October from 55.4, higher than the consensus expectation of 56.0, signaling that the pace of recovery in the manufacturing sector is accelerating.

Oil rebounded to USD39/bbl yesterday on positive risk sentiment and the news that OPEC could be mulling delaying planned output hikes by three months. Russian producers yesterday met with the Russian oil minister to discuss this option. OPEC is planning to meet on 30 November-1 December.

Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

Bearish Scenario: Sell below 39600... Anticipated Bullish Scenario: Intraday buys above 39750... Bullish Scenario after Retracement: Intraday buys above 39150

Bearish scenario: Shorts below 18100 with TP1: 17900... Anticipated bullish scenario: Intraday Longs above 18130 with TP...

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!