Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

2020-10-26 • Updated

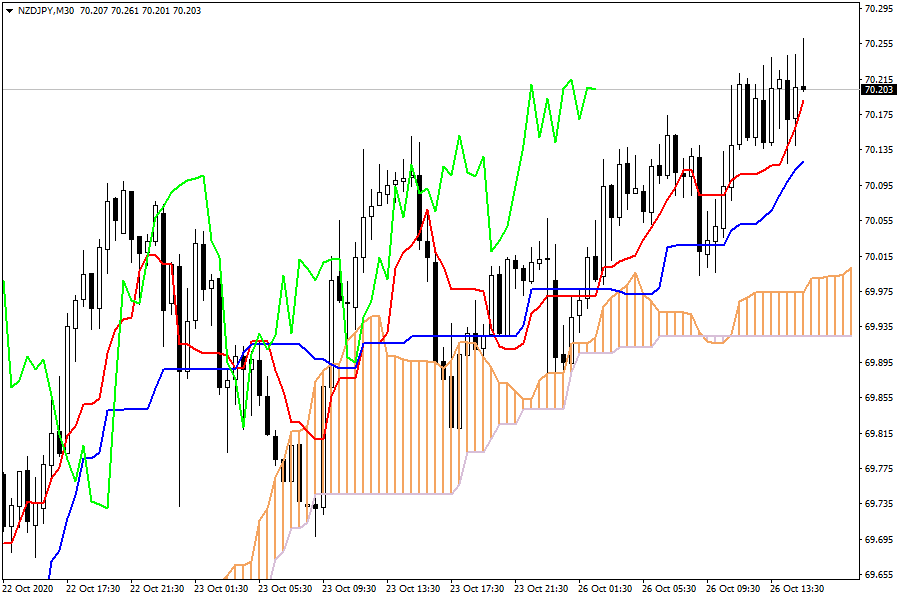

NZD/JPY: The pair is trading in a bearish sentiment below the cloud. The currency pair has just surpassed the Kijun-sen and the Tenkan-sen, confirming a bearish momentum.

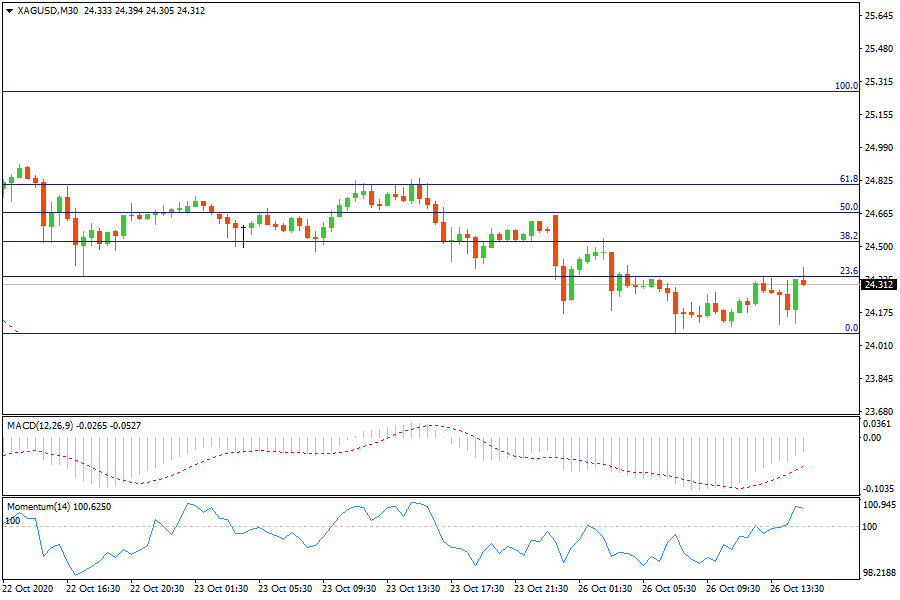

XAG/USD: Silver moves below the 23.6% retracement level. It seems that silver minimized earlier losses and is ready to move higher.

Wall Street was set to start the week on a dour note on Monday as surging coronavirus cases and a stalemate in Washington over the next fiscal aid bill darkened the economic outlook in the run up to Nov. 3 presidential elections.

New infections touched record levels in the United States recently, with El Paso in Texas asking citizens to stay at home for the next two weeks. In Europe, Italy and Spain imposed new restrictions.

US House Speaker Nancy Pelosi on Sunday said the Trump administration was reviewing the latest proposal for COVID-19 relief over the weekend and that she expected a response on Monday. Meanwhile, more than 59.1 million Americans have already voted in person or by mail as President Donald Trump and Democratic challenger Joe Biden enter their final full week of campaigning.

Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

Bearish Scenario: Sell below 39600... Anticipated Bullish Scenario: Intraday buys above 39750... Bullish Scenario after Retracement: Intraday buys above 39150

Bearish scenario: Shorts below 18100 with TP1: 17900... Anticipated bullish scenario: Intraday Longs above 18130 with TP...

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!