The energy industry has undergone several major changes in the XXI that are becoming increasingly apparent…

2019-11-11 • Updated

The earnings season continues in the United States. Every week we tell you which large American companies are going to release their earnings reports. You can trade stocks of each of these companies with FBS. To learn more, please check this info.

Walmart

Date: February 19

EPS forecast: $1.33

Revenue forecast: $138.81B

The world’s biggest retailer will report its Q4 results on Tuesday. Investors are eager to find out how Walmart performed in the battle for customers during the Christmas holiday season.

According to the official data, US retail sales declined in December by the most since 2009. Yet, Walmart’s sales and revenue growth are expected to be higher than a year ago. The grocery business may have given it a boost. However, its profit margins may be at the weakest in many years. The rising transport and labor costs can account for that. In addition, the company’s financial statement will also show how much Walmart pays to develop online sales in order not to fall behind its main competitor Amazon.

All in all, Walmart’s sales act as an indicator of the health of the entire US consumer sector. As a result, this earnings report can have an impact not only on the value of Walmart stock but also on the exchange rate of the USD.

Walmart stock was down by 3.5% in 2018. The start of this year was more positive. The price went above January highs and approached 100.00. According to 32 analysts surveyed by FactSet, the stock’s average target price is 106.57. Notice that Walmart has beaten FactSet EPS expectations in 13 out of the last 14 quarters. Technically, above 100.44, there’s resistance line in the 104.70 area. Support is around 93.00.

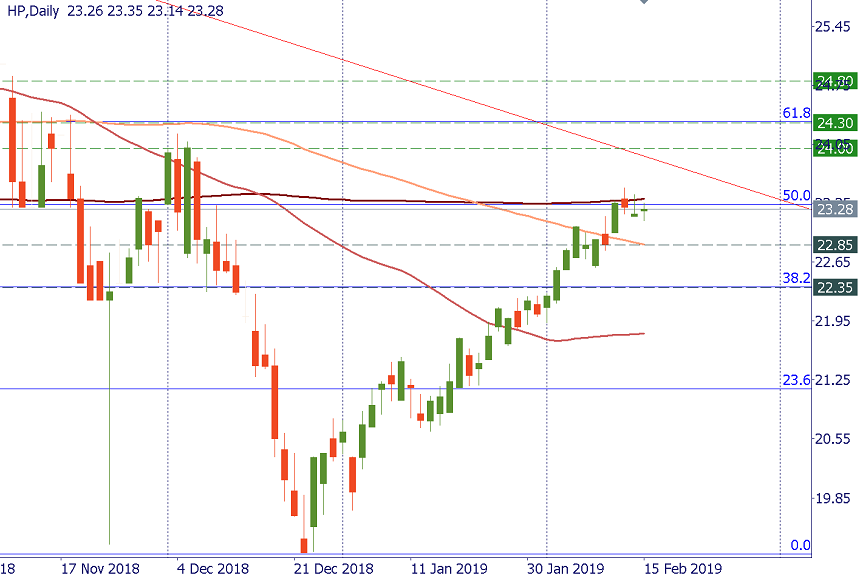

HP

Date: February 21

EPS forecast: $0.35

Revenue forecast: $7.63B

According to expectations, HP will release flat earnings compared to the year-ago quarter. The revenue is also expected to show zero growth compared with the same quarter of the previous year. Notice, however, that over the last four quarters, the company has beaten consensus EPS estimates four times.

After a turbulent year, the stock returned above the levels of early 2018. It has been steadily pushing up from the minimum of 19.20 set in December. The price has reached resistance of 50% Fibo and 200-day SMA (23.40). Rise above this level is needed to open the way up to 24.00, 24.40 and 24.80. Support is at 22.85 and 22.35.

The energy industry has undergone several major changes in the XXI that are becoming increasingly apparent…

More and more analysts are sure Brent oil will surpass $100 a barrel. So how heavily will oil move the markets, and what will the direction of the movement be? Let's find out!

About PayPal PayPal is an electronic commerce company that facilitates payments between parties through online transfers…

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!