Coinbase (#COIN) saw its revenue rise to $773 million in Q1 2024, marking a 23% increase from the previous quarter and surpassing analyst expectations.

2020-09-03 • Updated

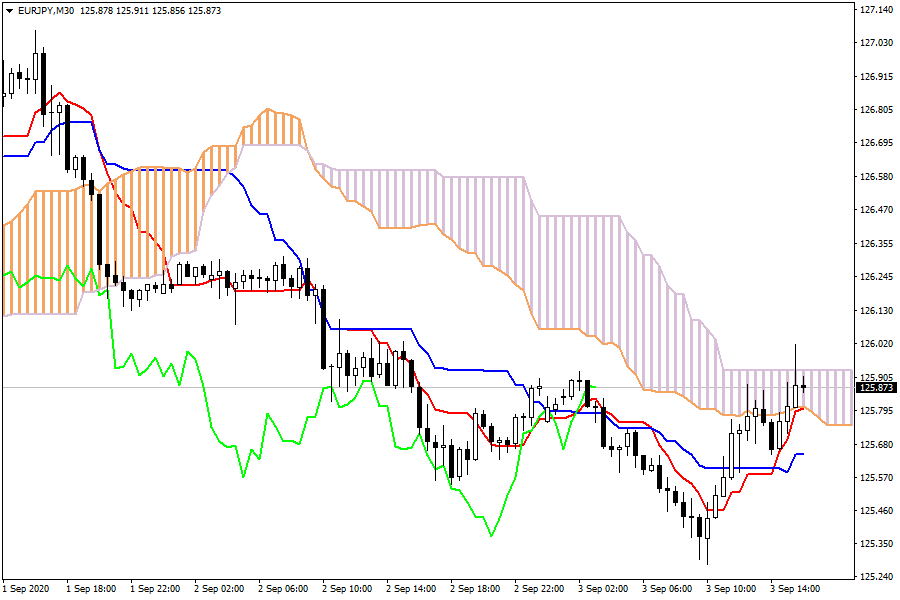

EUR/JPY: The EUR/JPY pair is now trading within the cloud. An upward wave would lead the exchange rate to exit the Kumo, confirming the bullish scenario.

The SP500 and Nasdaq were set to ease from record levels at the opening on Thursday as the tech rally is cooling and weekly jobless claims fueled worries about the US labor market.

The US monthly payrolls which are watched closely are set to come out on Friday.

Wall Street has rallied in recent weeks with the S&P 500 and Nasdaq hitting new closing highs, driven by the strength in tech-focused companies and unprecedented fiscal and monetary stimulus measures.

The Nasdaq has surged about 80% from its March 23 lows and the S&P 500 and Dow have gained about 60% from their lows. The blue-chip Dow needs to advance just about 2% to surpass its pre-crisis high hit in February.

The dollar’s bounce extended on Thursday as investors trimmed bets against the greenback and sold the euro on concerns that the European Central Bank was worried about its rise.

Coinbase (#COIN) saw its revenue rise to $773 million in Q1 2024, marking a 23% increase from the previous quarter and surpassing analyst expectations.

Bearish scenario: Shorts below 18100 with TP1: 17900... Anticipated bullish scenario: Intraday Longs above 18130 with TP...

During his program on CNBC on February 28, Jim Cramer expressed frustration with the impact of earnings reports on market behavior, noting how they often prompt rash decisions by average investors. He criticized the short-term focus and lack of attention to nuance in news coverage of earnings. Cramer cited examples of Home Depot and Lowe's, highlighting how investors reacted hastily to headline news without considering the broader context provided in earnings calls.

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!