What happened? It looks like the decline in EUR/CHF to 1…

2020-08-10 • Updated

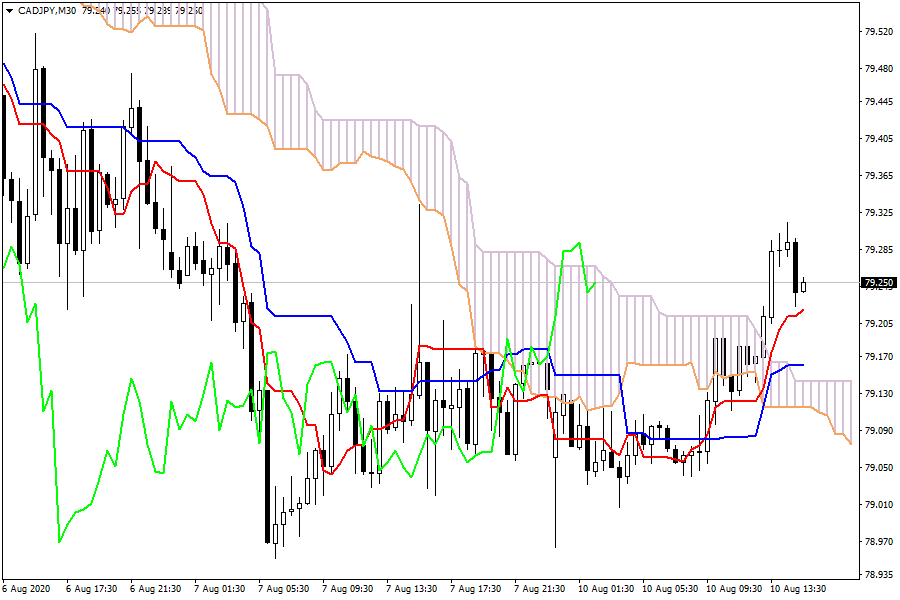

Ichimoku Kinko Hyo

CAD/JPY: The pair is trading in a bullish sentiment below the cloud. The currency pair has just surpassed the Kijun-sen and the Tenkan-sen, confirming a bullish momentum.

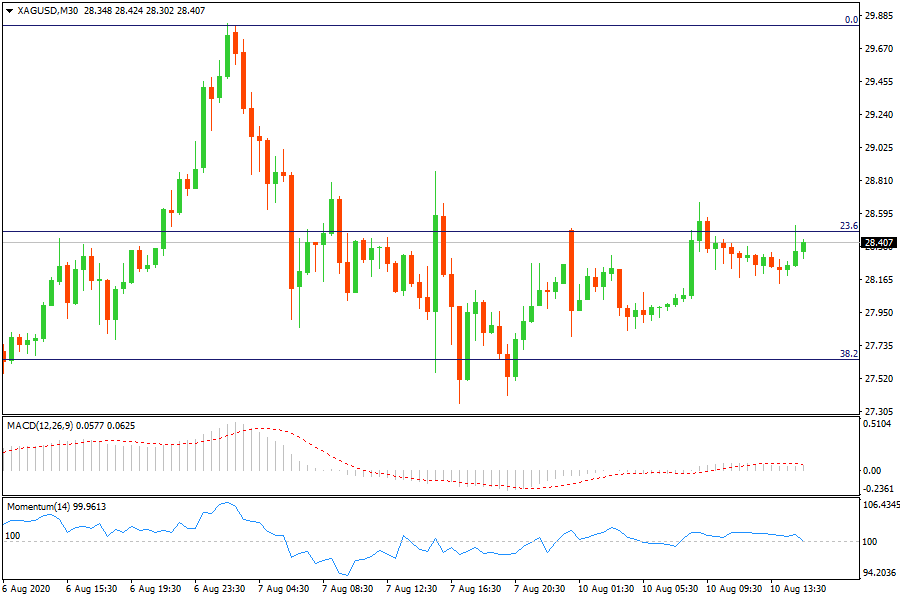

Fibonacci Levels

XAG/USD: Silver is finding a resistance at 23.6% retracement area. Bulls remain strong.

US Market View

China arrested Jimmy Lai, one of Hong Kong’s richest and best-known publishers, on suspicion of collusion with foreign agents. Beijing also said it will sanction 11 US politicians, including Senators Ted Cruz and Marco Rubio, in response to US sanctions announced on the same number of Chinese officials last week. US President Trump issued four executive orders to partially extend the payment of enhanced unemployment benefits, to bridge a gap left by the failure of Congressional Republicans and Democrats to agree on a new package of economic relief measures.

US Key Point

What happened? It looks like the decline in EUR/CHF to 1…

What happened? Japanese shares fell on Monday…

USDCAD began the week slightly higher reaching as high as 1.2510 but failed to sustain these gains.

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!