Technical outlook and ideas for Forex pairs

What is happening?

Some traders like fundamental analysis, which includes news, macroeconomic events, and financial statements. Others prefer to “trade the chart”. They assume that the price chart includes everything they need to know. If you regard yourself as a technical trader, this article is for you! We have outlooked several promising Forex pairs so that you don’t have to.

EUR/USD

Euro has broken through an ascending channel and now trying to fall further. Dollar is strengthening, so we would expect a plunge to the 1.18 level. The rise of the euro is less likely and only will postpone the inevitable fall.

EUR/USD H1 chart

Support: 1.1818; 1.1800

Resistance: 1.8550; 1.1900

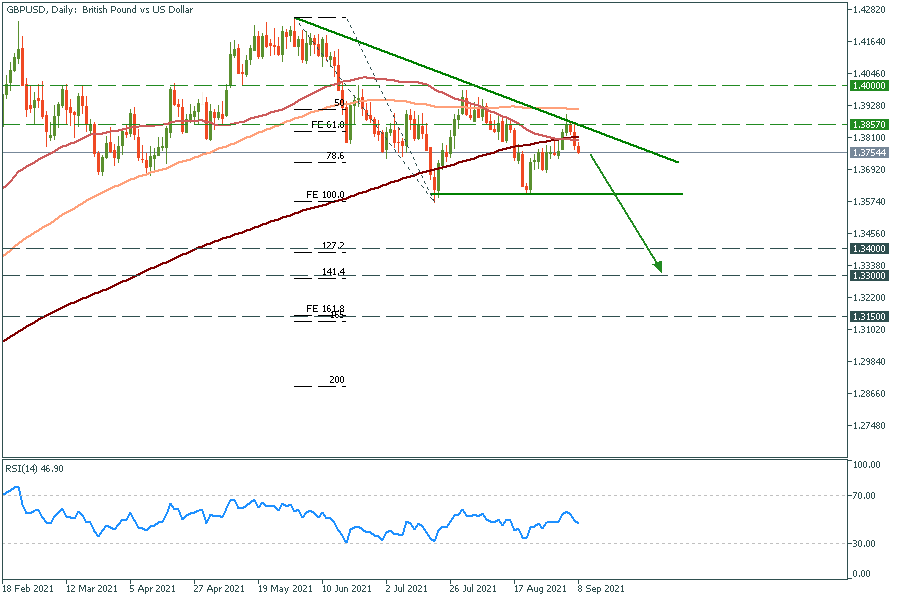

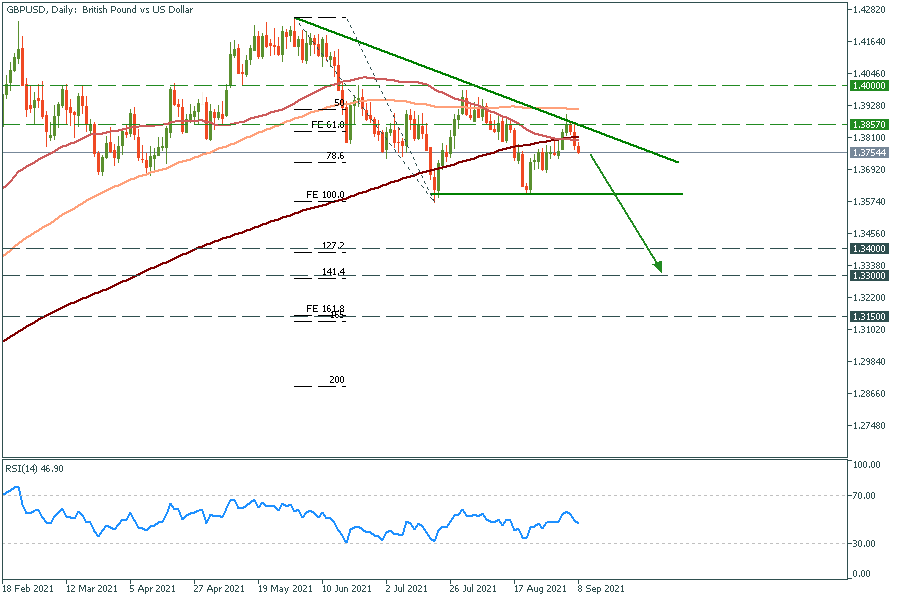

GBP/USD

We get even more certain about the greenback movement when we look at the British pound chart. A nice accurate descending triangle is forming, divergence on RSI has already worked and we don’t see any signs of reversal movement. Fibonacci extensions help us set targets for this movement. By the way, we have a video about a Fibonacci tool, check it out!

GBP/USD daily chart

Support: 1.3400; 1.3300; 1.3150

Resistance: 1.3857; 1.4000

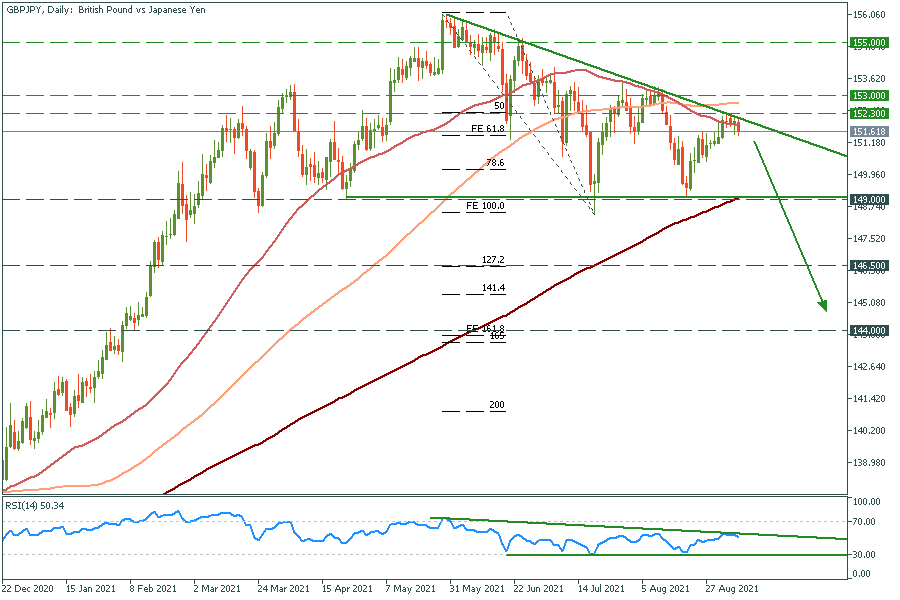

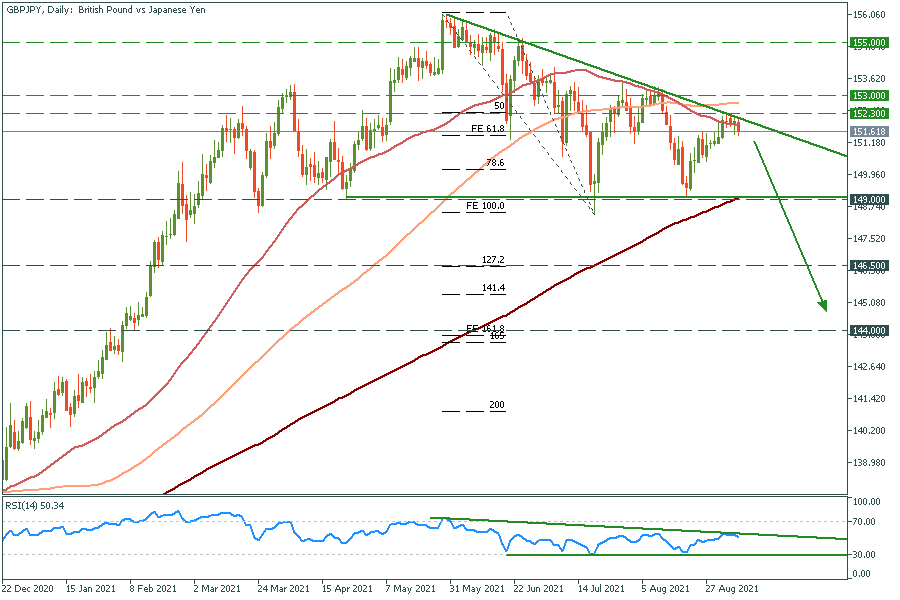

GBP/JPY

This pair is even more bearish than GBP/USD, so I would consider selling the pound in every pair. A descending triangle is forming for almost 5 months and RSI is ready to be broken downwards as well. Targets are on the chart and below this text.

GBP/JPY daily chart

Support: 149.0; 146.5; 144.0

Resistance: 152.3; 153.0; 155.0

EUR/CAD

Euro has managed to overcome 50 and 100 moving averages on the daily chart and now the only serious resistance on its way to the moon is 200MA. Passing this area is just a matter of time.

EUR/CAD daily chart

Support: 1.4850; 1.4615

Resistance: 1.5030; 1.5230; 1.5300; 1.5400

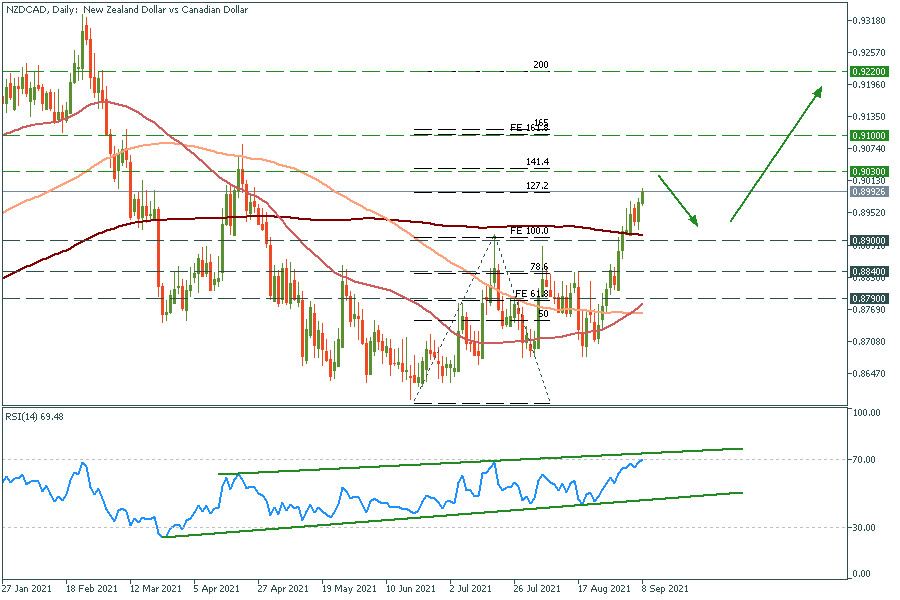

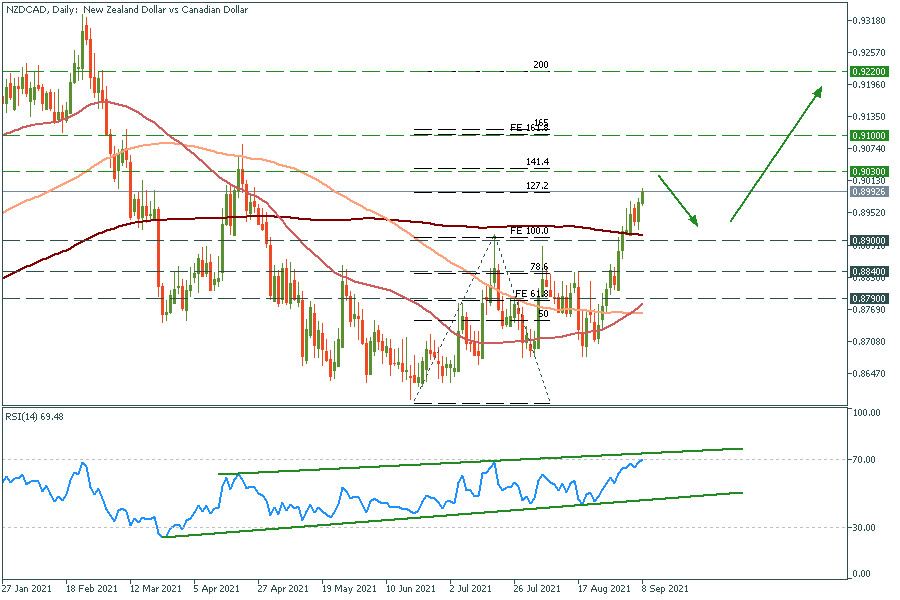

NZD/CAD

The technical strengthening of the New Zealand dollar is quite obvious if we look at NZD/CAD pair. On the daily chart, the breakout of the 200 moving average has been completed and after a small pullback (which might occur according to the RSI) the price will skyrocket to the highlighted levels.

NZD/CAD daily chart

Support: 0.8900; 0.8840; 0.8790

Resistance: 0.9030; 0.9100; 0.9220

LOG IN