For the third time in a row, Apple reports a dip in sales as it releases its report for Q2 2023. The announcement led to a 7% drop in stock prices as more investors seemed to lose confidence in the stock’s performance.

2019-11-11 • Updated

Trade idea

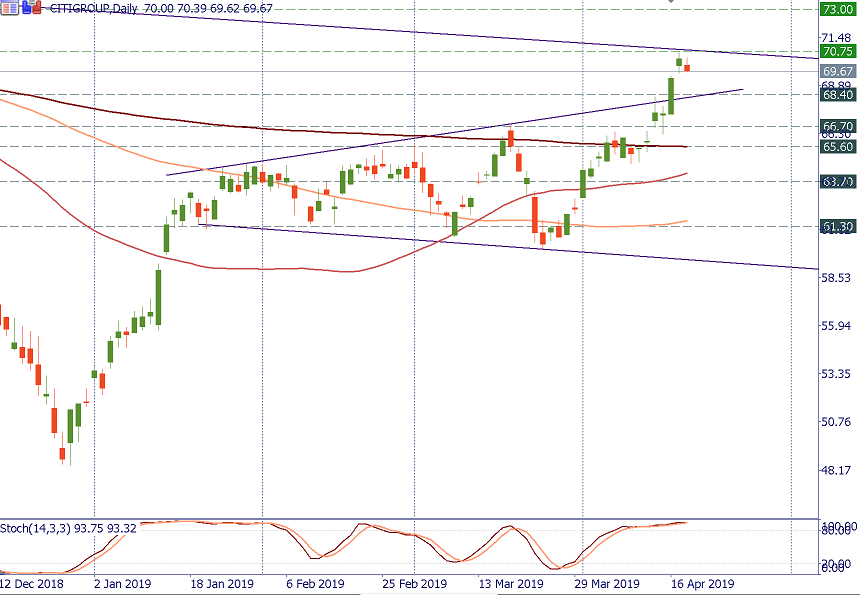

SELL 69.70; TP 68.40; SL 70.00

Citigroup stock jumped this week after the bank released its financial results for Q1. The figures were mixed. On the one hand, earnings beat expectations. On the other hand, revenue fell.

The stock met the resistance of the line connecting 2018 highs in the 70.75 area. The price is overbought, so a correction to the 100-week MA at 68.40 is likely. This level will likely provoke a new demand. When the stock manages to fix above 70.80, it will open the way up to 73.00 and 75.20. Only above 70.80 we will be ready for buying.

For the third time in a row, Apple reports a dip in sales as it releases its report for Q2 2023. The announcement led to a 7% drop in stock prices as more investors seemed to lose confidence in the stock’s performance.

It was an intense week across all the markets! We saw decent movements of major pairs, gas, stock indices, and oil prices. What should we trade this week? Time to check!

Are you searching for trade opportunities for December 6-10? Here you go!

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!