This year started with a beautiful bullish price action from the crypto markets. However, the current bearish movement is already causing many investors and traders to panic is interesting. This piece reviews a few trading opportunities I have spotted today in the crypto market. Let's go!

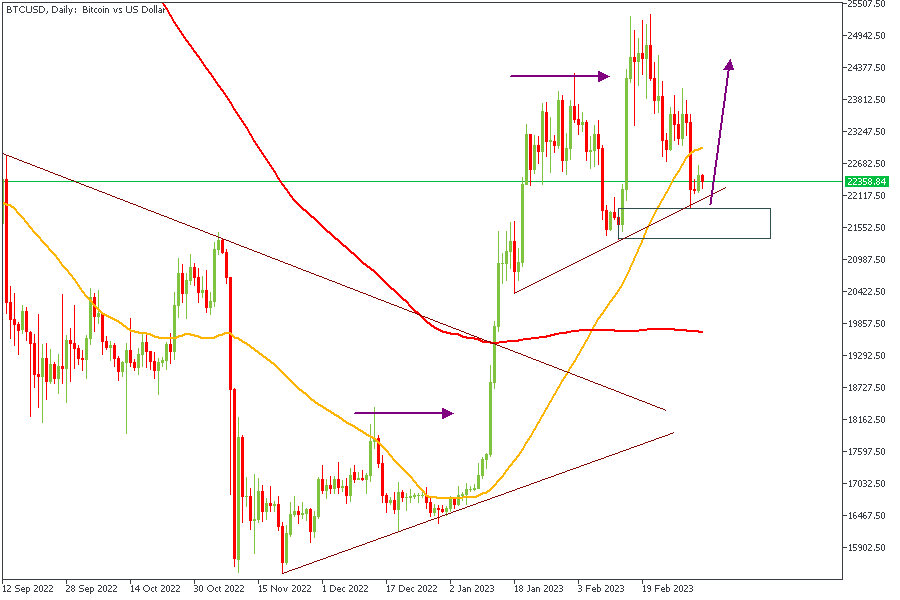

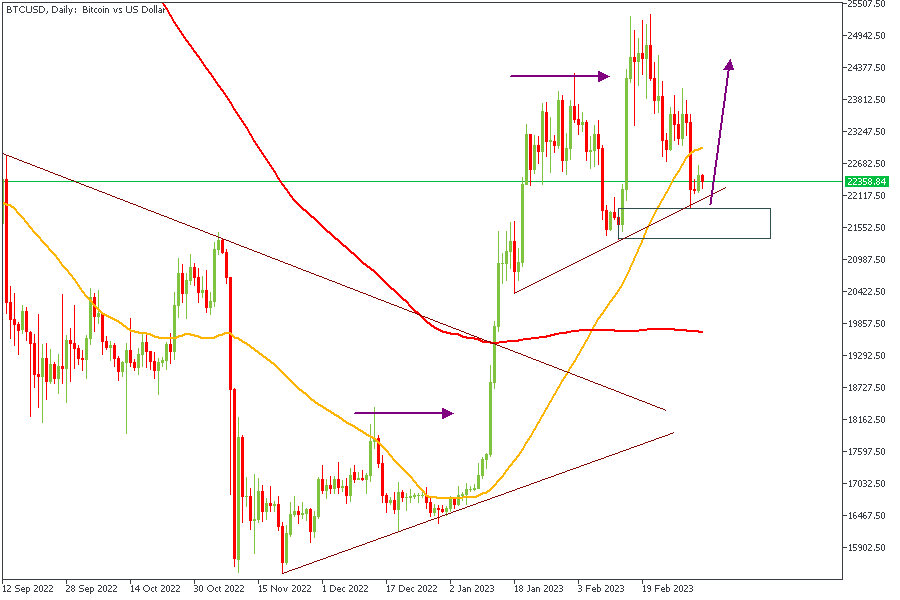

BTCUSD

Here is the daily timeframe chart of Bitcoin. We can see that price has recently broken above the previous high marked by the horizontal arrow. As a result, BTCUSD created a demand area highlighted by the rectangle. This demand zone falls within 88% of the Fibonacci retracement, increasing my bullish sentiment on BTCUSD. The 50-Day moving average trading above the 200-Day MA is also a considerable confluence.

Analysts’ Expectations:

Direction: Bullish

Target: $24400

Invalidation: $21277

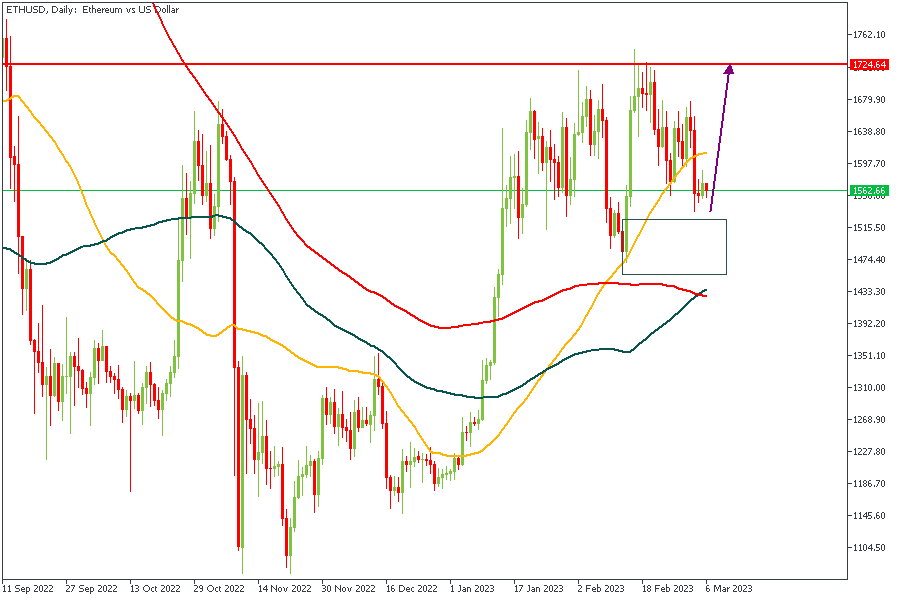

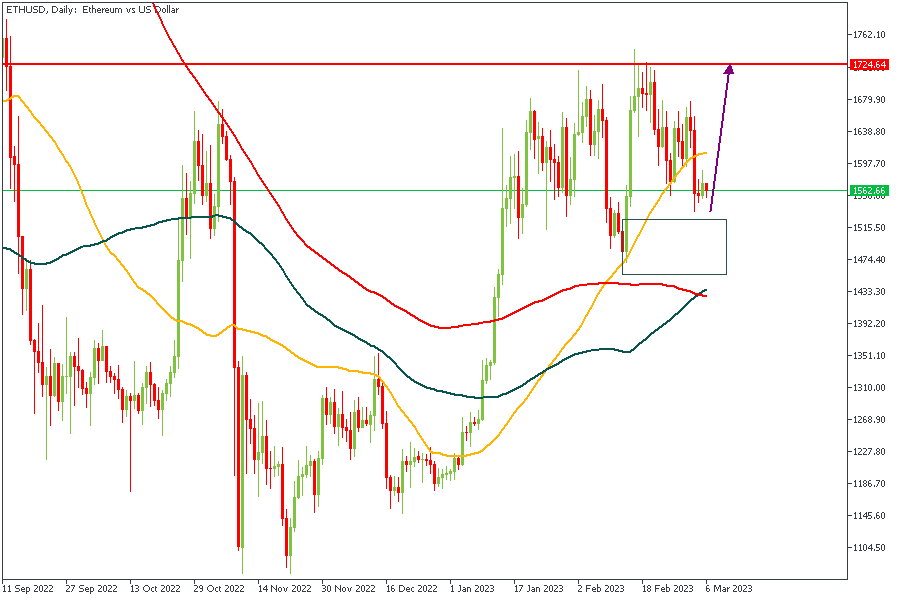

ETHUSD

Similar to the arrangement on BTCUSD, the price action on ETHUSD is also setting up a bullish continuation. ETHUSD's bullish sentiment is based on the confluence of the demand zone, the 50 and 100-period moving averages crossing above the 200-MA, and the 88% of the Fibonacci retracement overlapping the demand zone.

Analysts’ Expectations:

Direction: Bullish

Target: $1683

Invalidation: $1450

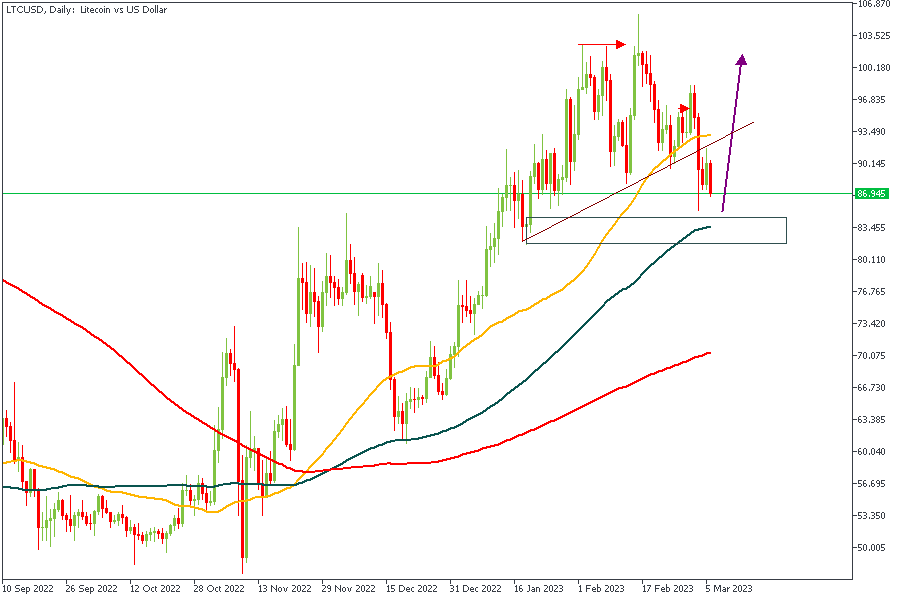

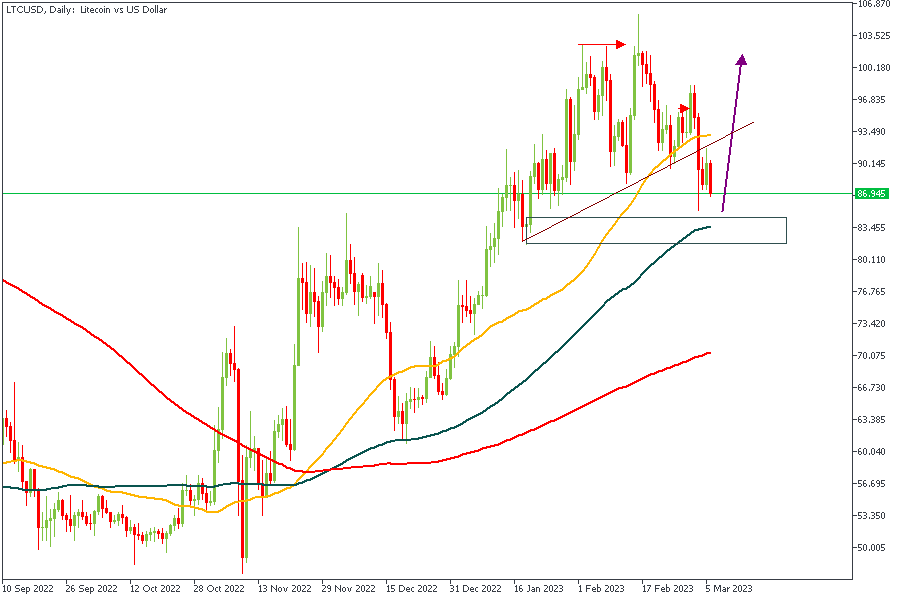

LTCUSD

Litecoin is setting up to resume its bullish momentum. The current price action indicates a break of a structure with the demand zone has not yet been mitigated. As a result of the confluence of the demand zone, the 100-Day moving average support, and the 88% Fibonacci retracement are my confluences for this position.

Analysts’ Expectations:

Direction: Bullish

Target: $99

Invalidation: $81.3

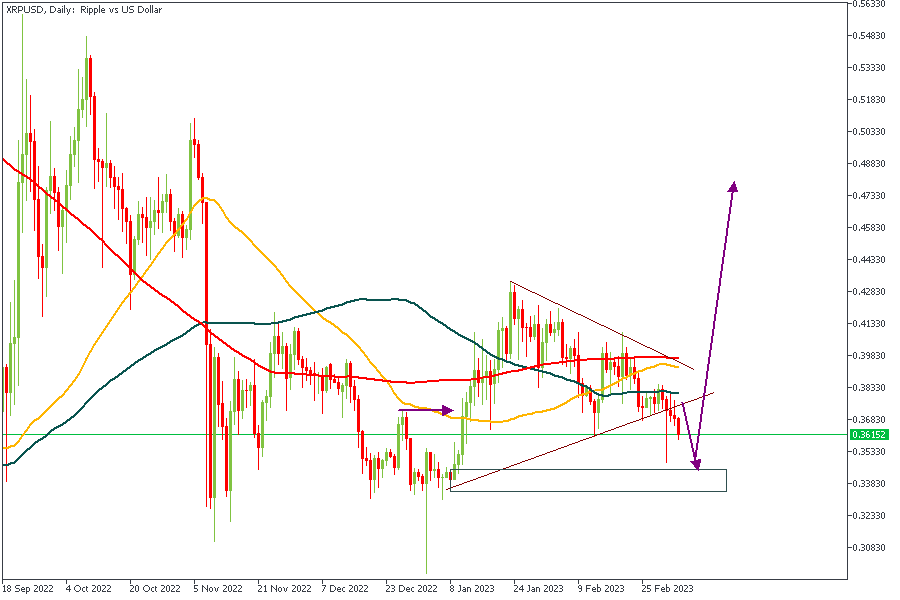

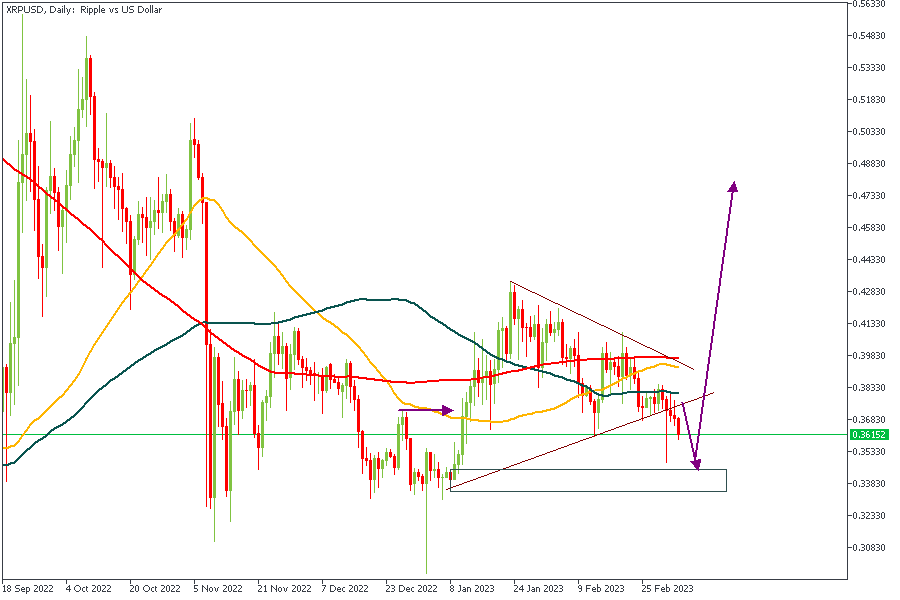

XRPUSD

XRPUSD (Ripple) on the Daily timeframe has recently broken out of a wedge pattern. Right below the trendline support of the wedge is a convenient demand zone from the break of structure marked by the horizontal arrow and is yet to be mitigated. As a result, I expect the price to make a run for the demand zone before returning to resume the trend. My confluences are the demand zone and 76% of the Fibonacci retracement zone.Analysts’ Expectations: Direction: BullishTarget: 0.44491Invalidation: 0.33110

CONCLUSION

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

TRY TRADING NOW

You can access more of such trade ideas and prompt market updates on the telegram channel.