Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

2020-11-11 • Updated

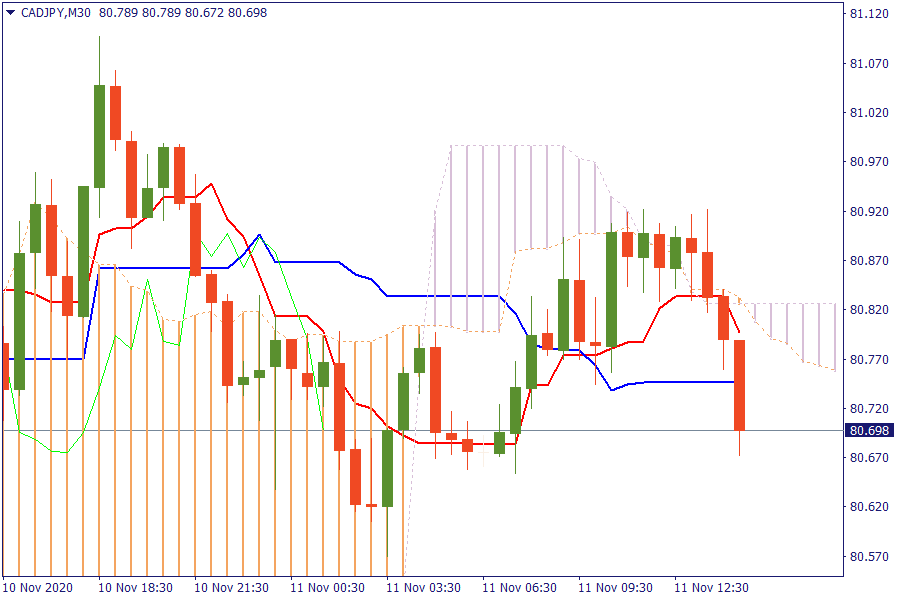

CAD/JPY: The pair is trading below the cloud. A downward pressure would lead the pair to exit further the cloud, confirming a bearish outlook.

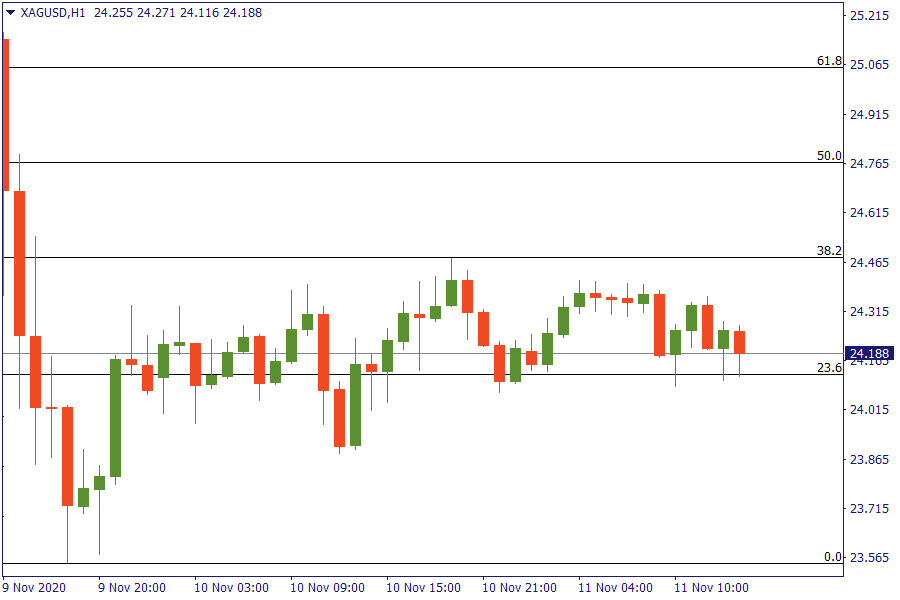

XAG/USD: Silver after a remarkable sell off is trading above 23.6% retracement area. Bulls still hesitate to send price higher.

U.S. stocks are seen opening higher Wednesday, with gains seen across all sectors as the optimism following the news of a workable vaccine for the Covid-19 virus persists. The Dow Jones Industrial Average is up 11% in November, rising in six of the last seven sessions and closing in on a new record high, while the Nasdaq Composite has fallen for the last two days. The United States reported a record number of new Covid-19 cases for the seventh day in a row on Tuesday, while the number of deaths surged to their highest daily count since August and hospital admissions hit an all-time high. Oil prices pushed higher Wednesday, continuing the recent positive tone generated by Pfizer’s vaccine news, and helped further U.S. crude inventories falling by more than expected.

Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

Bearish Scenario: Sell below 39600... Anticipated Bullish Scenario: Intraday buys above 39750... Bullish Scenario after Retracement: Intraday buys above 39150

Bearish scenario: Shorts below 18100 with TP1: 17900... Anticipated bullish scenario: Intraday Longs above 18130 with TP...

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!