Saudi Arabia and Russia, two of the world's largest oil producers, have decided to extend cuts to their oil production to support oil prices and boost income. This move comes despite weakened demand due to the sluggish economy.

2022-03-15 • Updated

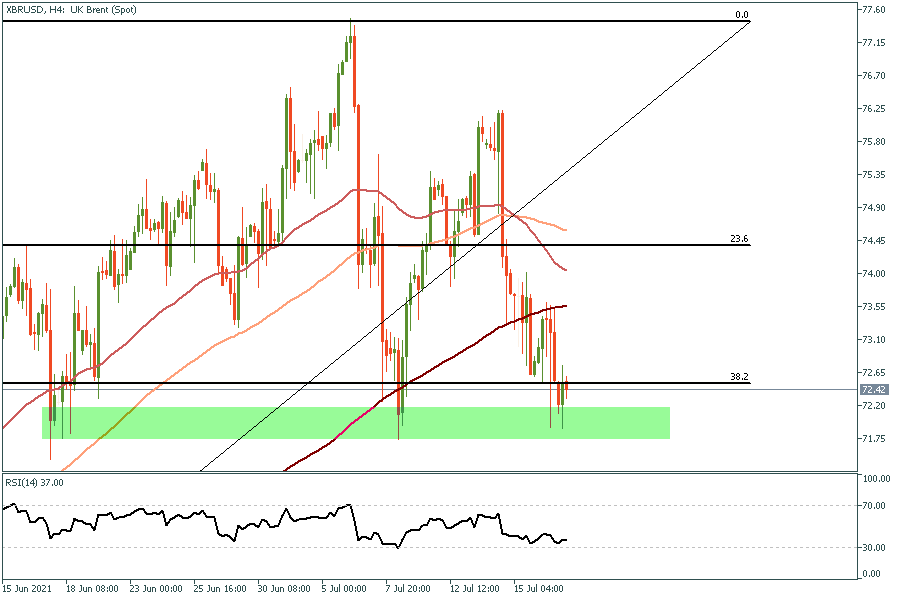

4H Chart

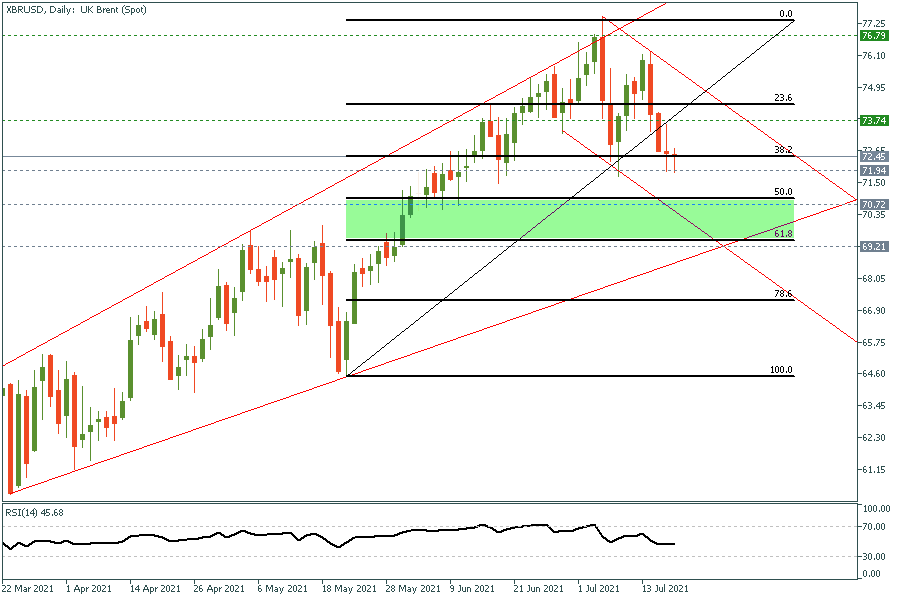

Daily Chart

Crude Oil dropped sharply last week right from our selling zone mentioned in our weekly video between 75.50 and 76.60, Brent Crude declined to 72.20’s nearing our 72.14 target mentioned in our weekly video as well. Now when OPEC+ drama is over, the trend hasn't necessarily changed. There are two factors that we need to keep in mind, i) Iran's supply is still expected to hit the global market soon ii) Covid19 is spreading again with a new variant affecting vaccinated people. Some countries already took new measures such as a partial lockdown. If this continues, Oil is likely to remain under pressure. In the meantime, it's wise to close some of the short positions and wait for another opportunity, while it is also possible to move the stop to our entry.

|

S3 |

S2 |

S1 |

Pivot |

R1 |

R2 |

R3 |

|

72.58 |

72.68 |

72.83 |

72.93 |

73.08 |

73.18 |

73.33 |

Saudi Arabia and Russia, two of the world's largest oil producers, have decided to extend cuts to their oil production to support oil prices and boost income. This move comes despite weakened demand due to the sluggish economy.

Oil prices fell to a three-month low following the release of US inflation data which was in line with expectations. The annual inflation rate of 6%...

Western countries are trying to find other options for oil and gas supplies after a 10th package of sanctions, which will put more pressure on Russian oil and decrease global oil supply. Italy, for example, is in talks with Libya.

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!