Saudi Arabia and Russia, two of the world's largest oil producers, have decided to extend cuts to their oil production to support oil prices and boost income. This move comes despite weakened demand due to the sluggish economy.

2022-06-06 • Updated

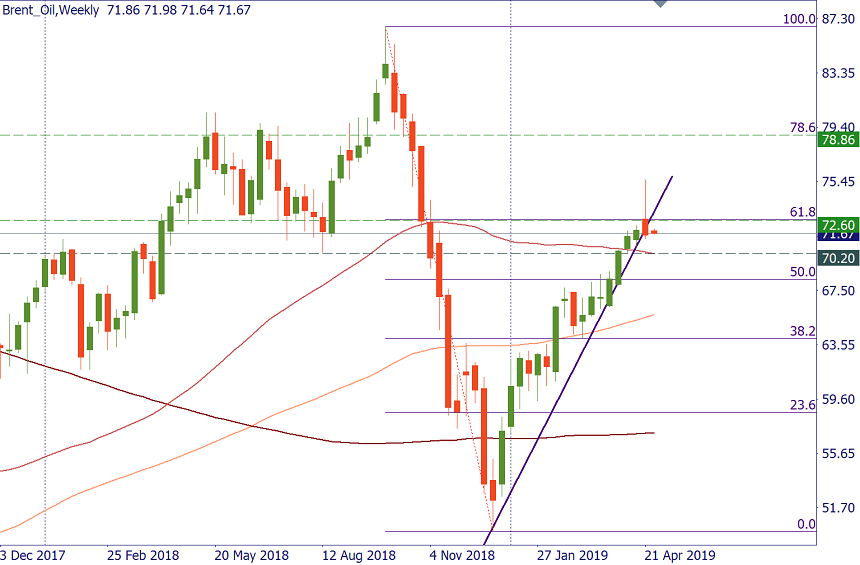

On W1, Brent oil formed a bearish candlestick with a long upper shadow. All things equal, it will be difficult for bulls to keep pushing higher immediately after such a pattern. In addition, the price failed to close above the 61.8% Fibo retracement of the 2018 decline at 72.80. In this area, there’s also the weekly pivot point. As long as the price stays below this level, it’s vulnerable for a bearish correction.

Notice that if you want to trade Brent, choose BRN-19M in your MetaTrader (File - CFD Futures).

Here’s a trade idea adjusted for the chart of the June futures contract:

SELL 71.50; TP 70.30; SL 71.90

Saudi Arabia and Russia, two of the world's largest oil producers, have decided to extend cuts to their oil production to support oil prices and boost income. This move comes despite weakened demand due to the sluggish economy.

Last week was shocking! The US dollar gained more than 2% against other currencies ahead of the 75-basis points rate hike by the Federal Reserve on Wednesday but dropped after the announcement…

Last week brought a selloff in markets. Some assets reached the most crucial support levels and are likely to reverse in a short term. Be ahead of trends and make the most out of this week!

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!