Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

2020-04-29 • Updated

The NZD has been frequently appearing in the “Best performers” list lately. That is because New Zealand, similar to Australia, managed the virus pretty well and is lucky to be among the first countries to get out of the hibernation state together with China.

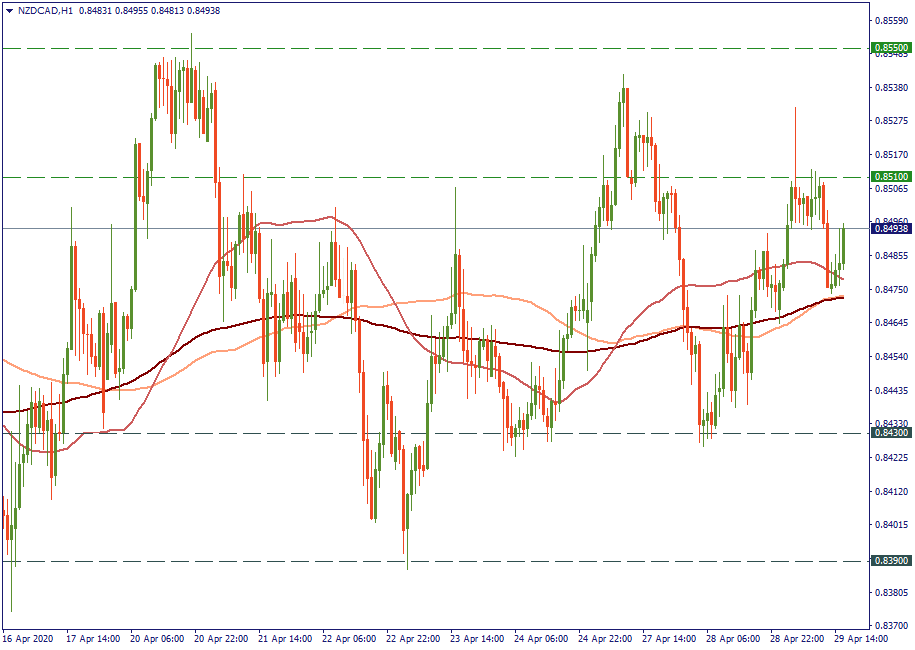

Although the NZD/CAD, particularly, presents a volatile picture, still we see that the NZD keeps fighting and has been doing that pretty well. The short-term picture is oriented sideways and at the very least gives the same hope for bulls as the bears may take. Note that the Moving Averages have started to reconfigure themselves in ascending order during the last week, which indicates an intention to rise. Fair enough, what is the long-term layout then?

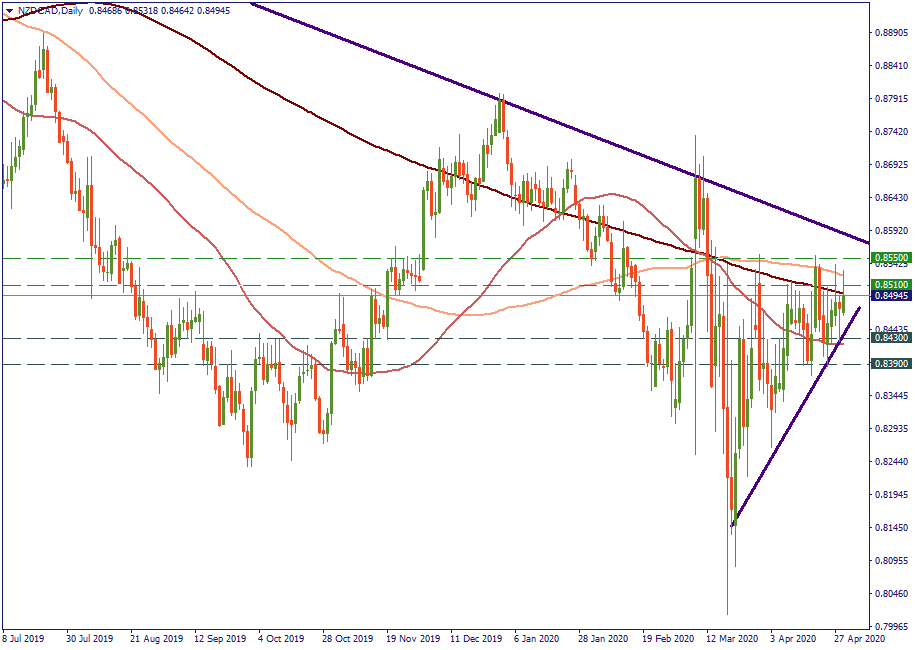

One-year horizon gives a different scenario. Generally, the NZD/CAD is in decline. The volatility is there, but the downturn is pretty consistent, although not without intermittent upswings. The very last episode, apart from a highly volatile earthquake-like behavior, gives a bullish impression. That trend collides with the larger downward trajectory almost exactly where the currency trades now. That suggests that we will see, first of all, further volatility as the two trends will be fighting to impose one of another. Secondly, we are still likely to have NZD/CAD keep losing value in the long-term as the fundamentals suggest. However, the short-term picture is probably going to be sideways, as it appears from the H1 chart.

Resistance: 0.8510; 0.8550

Support: 0.8430; 0.8390

Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

Bearish Scenario: Sell below 39600... Anticipated Bullish Scenario: Intraday buys above 39750... Bullish Scenario after Retracement: Intraday buys above 39150

Bearish scenario: Shorts below 18100 with TP1: 17900... Anticipated bullish scenario: Intraday Longs above 18130 with TP...

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!