Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

2020-05-21 • Updated

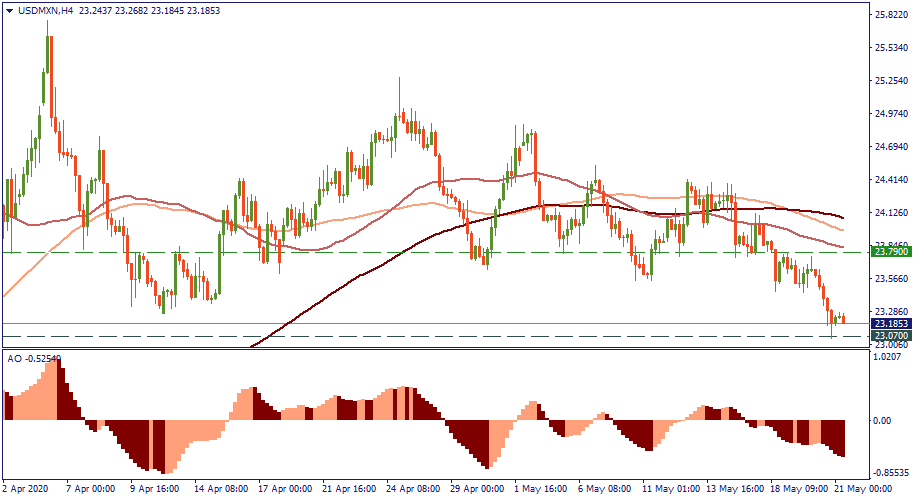

On the H4 chart of the USD/MXN, the USD lost its value to drop below the Moving Averages. It trades slightly above the tactical support of 23.07 and appears to be going in consolidation at that level.

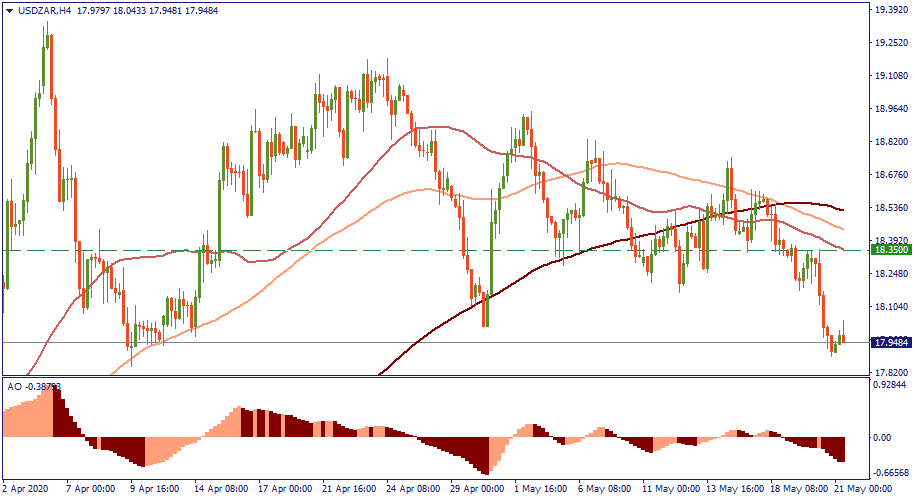

The picture with the USD/ZAR is almost identical: the price drops below the Moving Averages, which are grouped now above the resistance of 18.35 and configured in descending order, and is approaching the local support.

The question is: what happens next? Technically, the price will likely bounce upwards from the support level with which it is flirting now for both currencies. The Awesome Oscillator supports that reasoning because it is bottoming out at a pretty low level compared to the previous drops. That hints that further decline is more unlikely than not.

Therefore, prepare to buy while the USD is hesitating to come back at the MXN and ZAR with another bullish onslaught.

However, it is just a technical view; let’s check with the fundamentals

The Mexican peso and the South African rand just have two very similar movement pattern in relation to the US dollar, but they are not the only currencies from the developed world which see the local devaluing of the USD. If you look at the Brazilian real and the Turkish lira, these would also show are a local drop of the greenback, although overshadowed by a larger (and an ever-continuing) upward trajectory. That means that all these currencies share similar characteristics and are affected by similar factors in relation to the USD.

The main factor is the strength of the USD as the prime emblem and functional element of the strongest economy in the world - hence the inherent decline in the relative value of the MXN and ZAR, followed by the TRY and BRL against the USD. The fact that the Mexican peso and the South African rand show similarity in how they move against the greenback merely means that Mexico and South Africa have similar economic strength against the US economy while, for example, Turkey and Brazil have less to say against the USD because their economies are not as robust.

Second, these currencies, being exotic and hence enjoying a significantly lower demand are much less exposed to the results of the economic actions of their own governments as they are to those of the United States. That is, the behavior of the USD/MXN and USD/ZAR is almost entirely dictated by the state of the USD alone, making the MXN and ZAR in their own sense quite irrelevant to what we see on the chart. In a nutshell, with the exotic currencies, the USD dictates almost 90% of what is happening.

Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

Bearish Scenario: Sell below 39600... Anticipated Bullish Scenario: Intraday buys above 39750... Bullish Scenario after Retracement: Intraday buys above 39150

Bearish scenario: Shorts below 18100 with TP1: 17900... Anticipated bullish scenario: Intraday Longs above 18130 with TP...

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!