Bearish scenario: Shorts below 18100 with TP1: 17900... Anticipated bullish scenario: Intraday Longs above 18130 with TP...

2020-04-16 • Updated

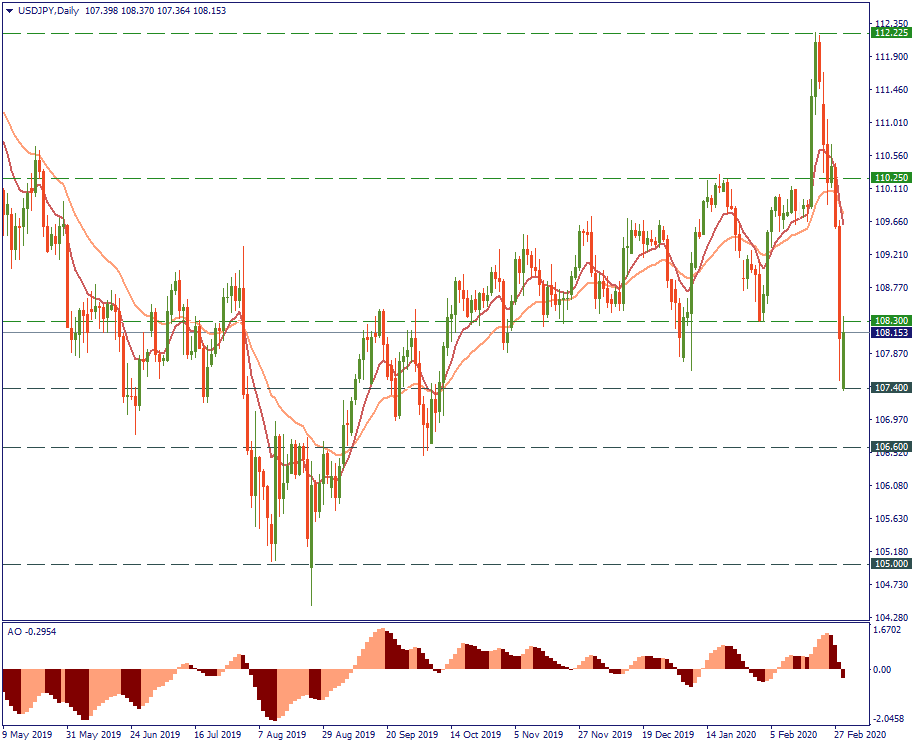

Last day range: 107.36 – 108.37

52-week range: 104.43 – 112.40

We have spoken about the JPY’s return already, and now we need to speak of it again. Why? Look at the chart.

There is hardly any other currency on the Forex market against which the USD lost so much value in the last weeks. The US Dollar was at 112.22 on February 20-21, and just touched 107.40 recently – that’s an almost 5% loss in just two weeks. By the way, current disposition may be a good chance to apply the 30-pips-a-day trading strategy, even though it normally is used on shorter timeframes - now may be a good moment to act on it. But let’s put things into the context and have a mid-term perspective.

On the daily chart below, the recent drop takes the currency pair to challenge the November-2019 lows next. The closest one lies at 106.60 and seems not that far away, especially in the current circumstances. If things go really bad for the USD, the August-2019 low of 105.00 will be waiting down there. Nothing the Fed’s readiness to react to the virus consequences by reducing the interest rate on March 18, keep your hand on the pulse and watch the dynamic: if there is no change in the global economic rhetoric, the pressure will keep dragging the USD down in the mid-term, and JPY will be its best counterpart to indicate where the market goes.

Support 107.40

Resistance 108.30

Bearish scenario: Shorts below 18100 with TP1: 17900... Anticipated bullish scenario: Intraday Longs above 18130 with TP...

Earnings season is a crucial time for investors and analysts, as it provides insights into how well companies have performed over the past quarter and gives indications of their future earnings. In 2023, expectations for US Q1 earnings were low due to economic challenges and rising interest rates. Surprisingly, many companies beat these low expectations, with 75% of S&P 500 companies surpassing forecasts.

When I started trading stocks a few years ago, I often needed to pay more attention to my technical analysis skills and trust that the market would play fair according to my analysis. I have since discovered that the safer approach to trading stocks is to, more often than not, seek out investing opportunities - that is, catching stock commodities with a potential to rise.

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!