Bearish scenario: Shorts below 18100 with TP1: 17900... Anticipated bullish scenario: Intraday Longs above 18130 with TP...

2020-12-17 • Updated

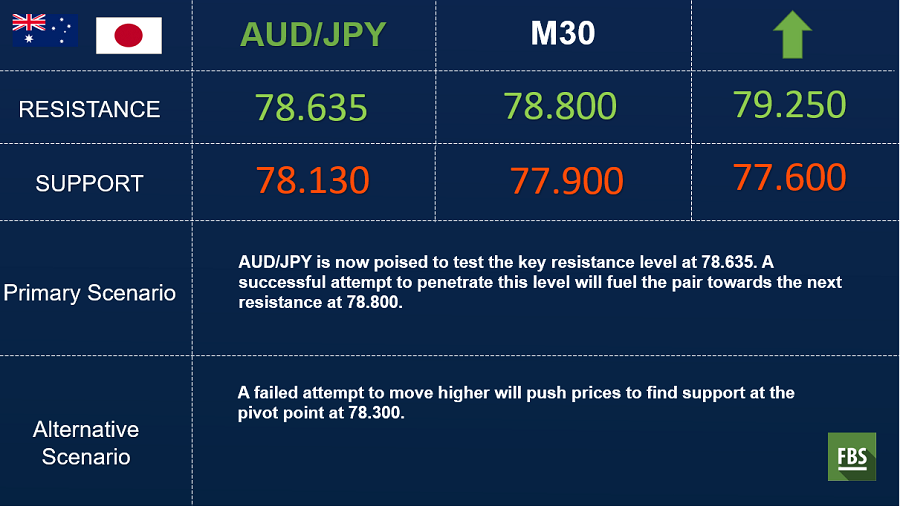

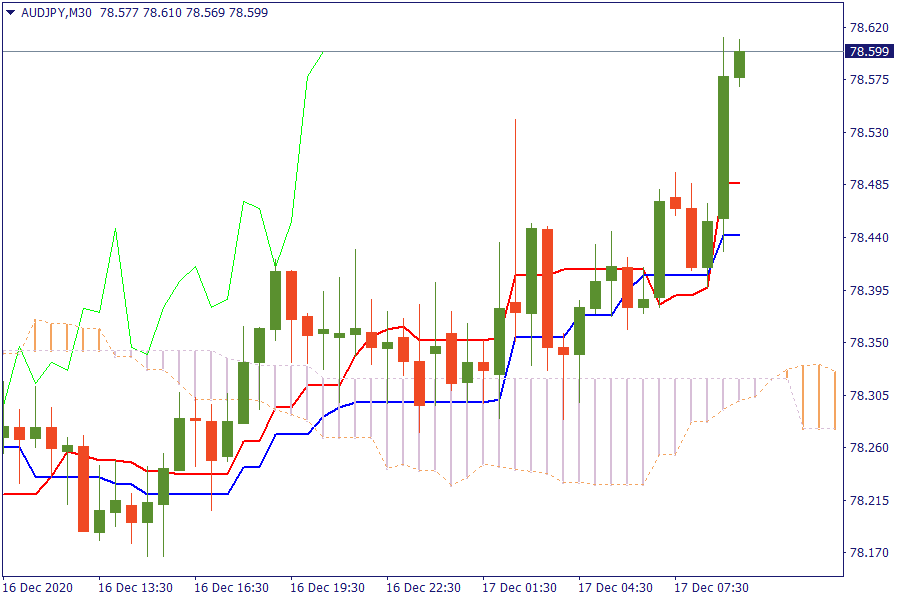

AUD/JPY: The pair is trading above the cloud. Further bullish pressure will lead the currency pair to retest the previous highs.

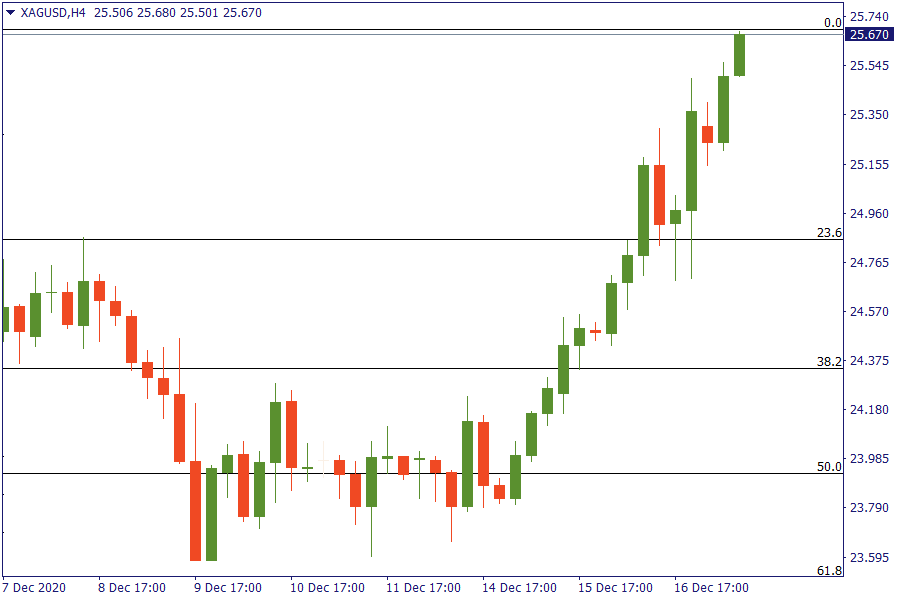

XAG/USD: Silver is flying higher and breaking out all resistance areas.

The Fed kept rates unchanged, enhanced guidance and refrained from extending the weighted average maturity of purchases. Looking ahead, highlights from macroeconomic calendar include BoE, SNB, Eurozone CPI (final), US building permits, housing starts, IJC, Philadelphia Fed, Japanese CPI, NZ trade, ECB's Schnabel, de Guindos speeches. Stocks scaled record heights, the dollar plumbed two-year lows and oil prices hit their strongest since March on Thursday, as monetary support and the hope of fiscal stimulus in the United States put traders in a festive mood. U.S. lawmakers edged closer to agreement on a $900 billion virus-relief spending package on Wednesday with top Democrats and Republicans sounding more positive than they have in months about getting something done.

The proposal is expected to include $600-$700 stimulus checks and extended unemployment benefits and cannot come soon enough as U.S. COVID-19 infections soar to record levels.

Bearish scenario: Shorts below 18100 with TP1: 17900... Anticipated bullish scenario: Intraday Longs above 18130 with TP...

Earnings season is a crucial time for investors and analysts, as it provides insights into how well companies have performed over the past quarter and gives indications of their future earnings. In 2023, expectations for US Q1 earnings were low due to economic challenges and rising interest rates. Surprisingly, many companies beat these low expectations, with 75% of S&P 500 companies surpassing forecasts.

When I started trading stocks a few years ago, I often needed to pay more attention to my technical analysis skills and trust that the market would play fair according to my analysis. I have since discovered that the safer approach to trading stocks is to, more often than not, seek out investing opportunities - that is, catching stock commodities with a potential to rise.

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!