Kenaikan hara yang berlaku itu adalah sebelum mesyuarat FOMC di mana harga berjaya capai ketinggian 1…

2021-08-30 • Dikemaskini

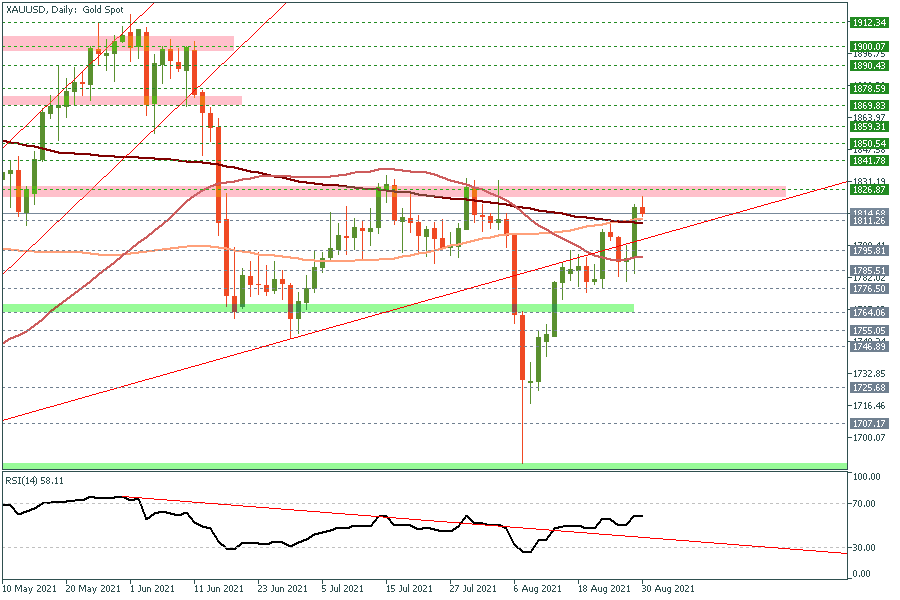

Daily Chart

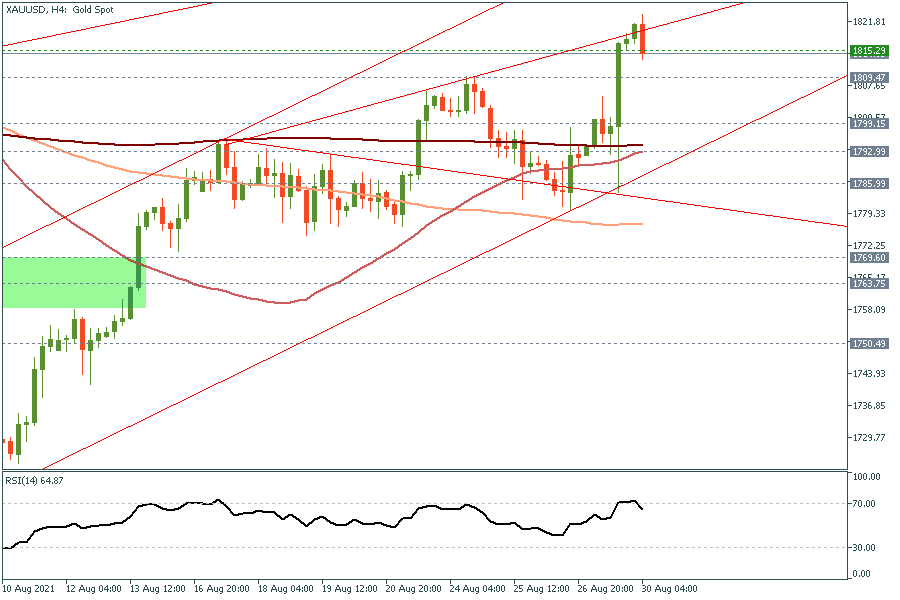

4H Chart

Gold managed to post further gains at the end of last week's trading amid fears of Covid19-Delta variant, in addition to the Federal Reserve's remarks about QE tapering. Despite multiple hawkish remarks by non-voters including Bullard, the Fed's chairman made it clear that tapering is coming later this year, but the Fed is not in a rush to taper. Such remarks were enough for gold to break above 1800, all the way to 1811 target mentioned in our previous reports. With that being said, our medium-term long positions from 1730 which was issued few weeks ago has +$80 profit so far and it would be wise to move our stop loss now to 1780 to reserve more profit and protect our positions. In the meantime, Gold may retrace to retest $1800 support area, but its likely to hold before the next leg higher, which may test $1830 later this week.

| S3 | S2 | S1 | Pivot | R1 | R2 | R3 |

| 1738.86 | 1773.06 | 1795.32 | 1807.26 | 1829.52 | 1841.46 | 1875.66 |

Kenaikan hara yang berlaku itu adalah sebelum mesyuarat FOMC di mana harga berjaya capai ketinggian 1…

Walaupun ia susut sedikit daripada paras-paras tertingginya sejak 2002, sekitar julat 109, itu hanyalah satu pembetulan, dan sang raja hijau, dolar AS, akan meneruskan ralinya semula…

Berdasarkan pemerhatian terkini, harga semasa…

Fed mengumumkan pada hari Rabu bahawa ia membiarkan kadar dasar tidak berubah pada 5…

Jepun melangkah lebih dekat kepada campur tangan mata wang dengan amaran terkuatnya apabila yen merosot ke paras paling lemah dalam kira-kira 34 tahun berbanding dolar…

Sentimen pasaran yang memulih pada pembukaan dagangan awal minggu semalam telah menukar semula haluan pergerakan USD…

FBS menyimpan rekod data anda untuk mengoperasikan laman web ini. Dengan menekan butang "Terima", anda menyetujui Polisi Privasi kami.

Permohonan anda telah diterima

Pengurus akan menghubungi anda dalam amsa terdekat

Permohonan panggil balik seterusnya untuk nombor telefon ini

boleh dilakukan dalam dalam

Jika anda mempunyai isu yang perlu disegerakan, sila hubungi kami menerusi

Live Chat

Masalah dalaman. Sila cuba sebentar lagi

Jangan bazir masa anda – pantau bagaimana NFP mempengaruhi dolar AS dan kaut keuntungan!