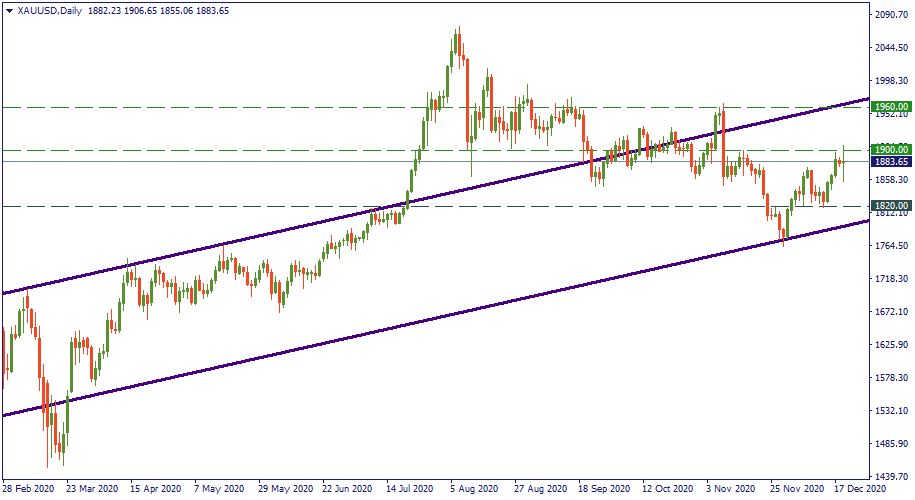

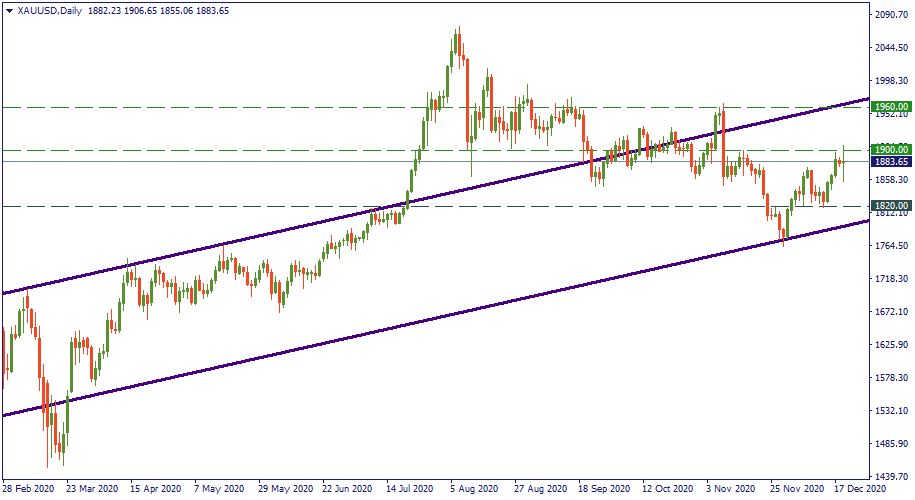

If we spot the uptrend that started in the middle of 2019 and project it into the future, we will see that the current movement of the gold price pretty much falls into it. Of course, only time will tell whether this projection is right or wrong. But If it is right, then we are to see gold rise to $2 000 by February and $2 100 by May. This projection includes possible downturns on the way and doesn’t assume the gold will be going upwards as smoothly as it did in April-July this year. Therefore, an expectation of $2 100 seems pretty well-balanced and realistic – unless a fundamental shift distorts the environment of the oil market. It may be something like a much-better-than-expected recovery of the global economy (which is rather unlikely, but things happen, right?), or, Bitcoin taking investors away from gold (which seems to be a realistic prospect now). On the other side, take into account the possibility of more aggressive growth. In this case, $ 2 100 may appear on the screen by February-March: at the end, gold rose by $150 in just the first two months of 2020 so expecting $2 100 in two months from December 2020 isn't unrealistic. Anyway, 2021 seems to be an interesting performance to watch - follow the gold news.

LOG IN