Last week marked the consolidation for the most active assets of March 1-15 (which is oil and gold). But next week has a lot to show, be ready to take part!

2019-11-11 • Updated

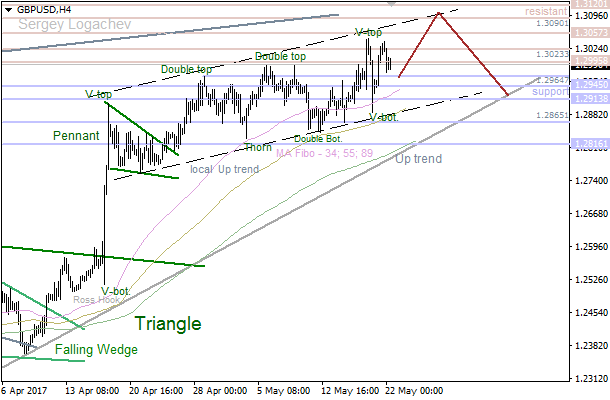

We've got an upward consolidation, which is developing between the 34 Moving Average and resistance at 1.3023. It's likely that the pair is going to move up towards the closest resistance at 1.3090 - 1.3120. If we see a pullback from this area, bulls will probably try to test support at 1.2945 - 1.2913.

The 34 Moving Average has acted as support, so the price is consolidating. Therefore, the market is likely going to test the 55 Moving Average in the short term. If a pullback from this line happens, there'll be an opportunity to have an upward price movement in the direction of the next resistance at 1.3047 - 1.3057.

Last week marked the consolidation for the most active assets of March 1-15 (which is oil and gold). But next week has a lot to show, be ready to take part!

GBP/USD has managed to rise for the third trading day in a row including today’s Asian session, while the daily technical indicators are moving higher gradually.

Discover the outlook for EUR/USD, EUR/GBP, and GBP/USD.

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!