Last week marked the consolidation for the most active assets of March 1-15 (which is oil and gold). But next week has a lot to show, be ready to take part!

2019-11-11 • Updated

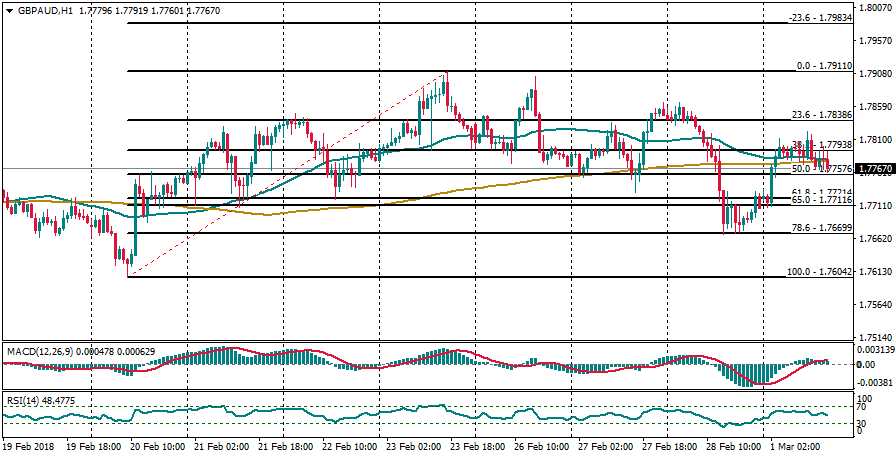

The pair is making a retracement that has helping to develop some fractals across the board, according to the projections in the H1 chart. That’s why we shall not discard the idea of a possible demand area to be found at the 78.6% Fibonacci level of 1.7669. If GBP/AUD manages to rebound at such area, the pair could travel towards the -23.6% Fibo zone at 1.7984. The invalidation point for this forecast lies at 1.7604.

RSI indicator remains in the negative territory.

Last week marked the consolidation for the most active assets of March 1-15 (which is oil and gold). But next week has a lot to show, be ready to take part!

GBP/USD has managed to rise for the third trading day in a row including today’s Asian session, while the daily technical indicators are moving higher gradually.

AUD/USD has been trying to break higher for an extended period but without any chance. From April until today, all rallies’ attempts have faded as shown on the daily chart.

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!