Coinbase (#COIN) saw its revenue rise to $773 million in Q1 2024, marking a 23% increase from the previous quarter and surpassing analyst expectations.

2020-09-04 • Updated

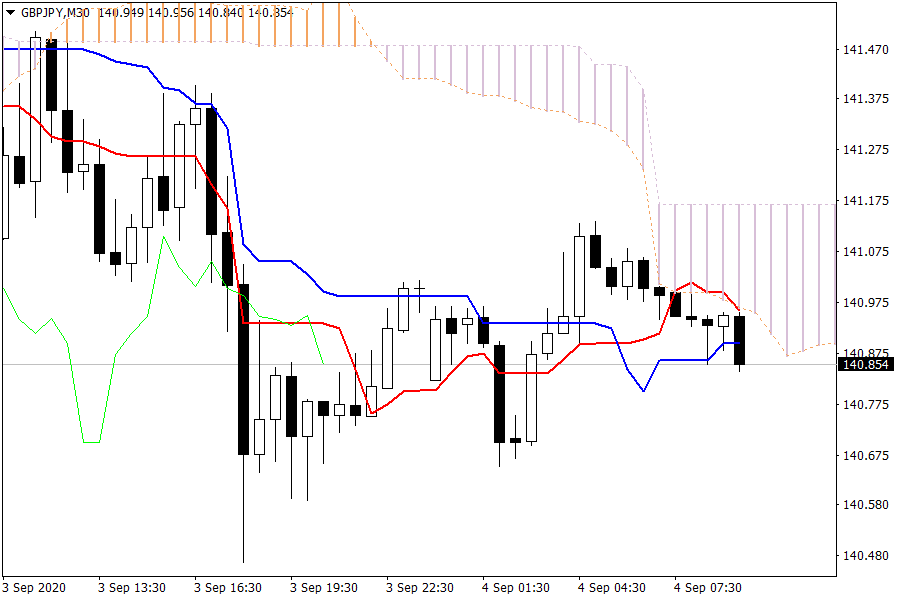

GBP/JPY: The GBP/JPY pair has just breached the Kijun Sen level. Further bearish sentiment will push prices into lower ground.

U.S. stocks tumbled as the rotation away from super-charged technology shares picked up pace. The Nasdaq 100 lost more than 5%, its biggest fall since March, having gained in 11 of 13 sessions prior despite cries of stretched valuations. The rout was even more brutal in the options market.

European futures are flat to slightly lower.

It's non-farm Friday. Today's U.S. jobs report could deliver the last positive print before losses strike again. Private-sector payrolls, as reported by ADP, showed a much weaker-than-expected pace of hiring last month. The latest statistics suggest companies continue to hire at a more moderate pace than immediately following the lifting of business lockdowns months ago.

U.S.-China relations remain on the radar, with President Xi Jinping setting a combative tone in latest remarks.

Elsewhere, we'll get a reading of the U.K. construction purchasing managers index as well as German factory orders after data Thursday showed the euro area’s recovery ran out of steam during the third quarter.

Coinbase (#COIN) saw its revenue rise to $773 million in Q1 2024, marking a 23% increase from the previous quarter and surpassing analyst expectations.

Bearish scenario: Shorts below 18100 with TP1: 17900... Anticipated bullish scenario: Intraday Longs above 18130 with TP...

During his program on CNBC on February 28, Jim Cramer expressed frustration with the impact of earnings reports on market behavior, noting how they often prompt rash decisions by average investors. He criticized the short-term focus and lack of attention to nuance in news coverage of earnings. Cramer cited examples of Home Depot and Lowe's, highlighting how investors reacted hastily to headline news without considering the broader context provided in earnings calls.

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!