Ichimoku Kinko Hyo

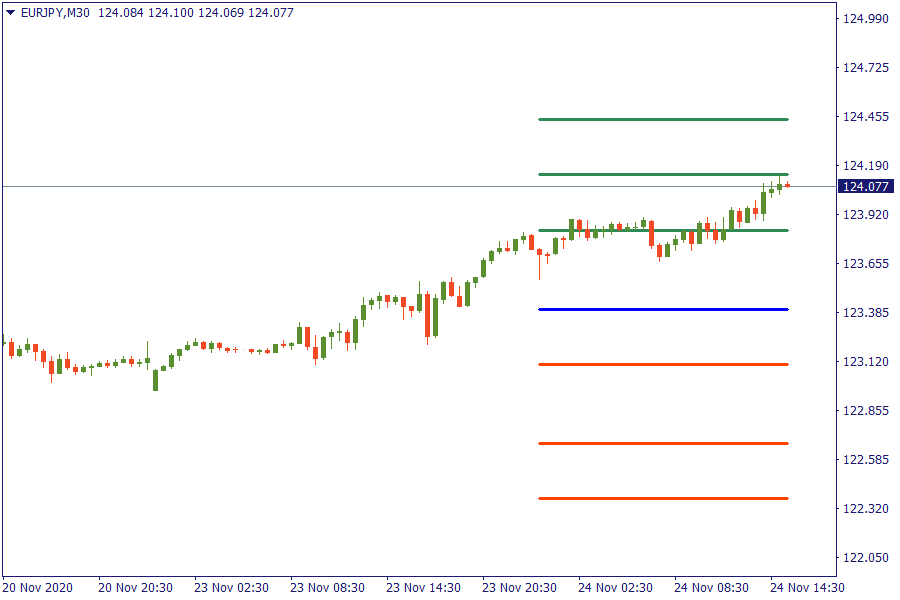

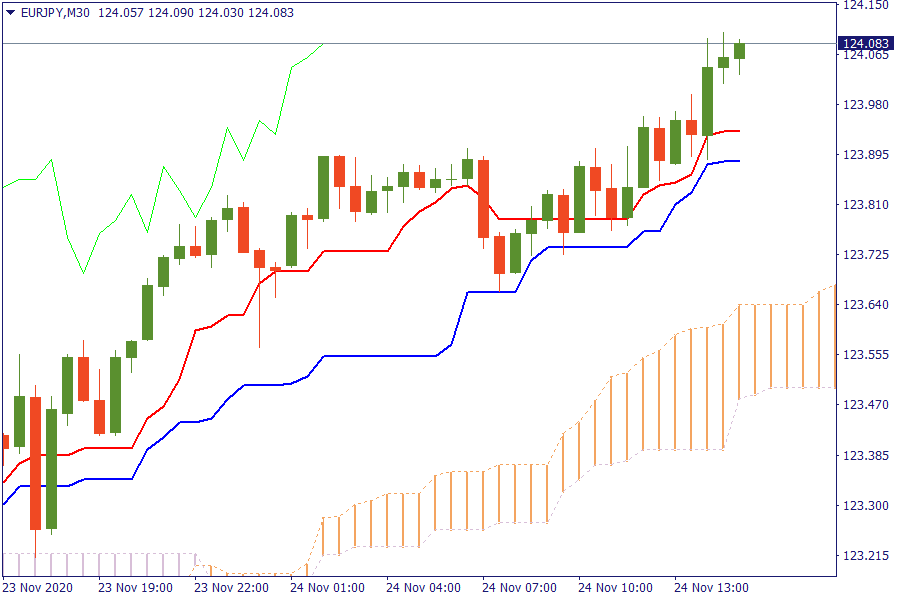

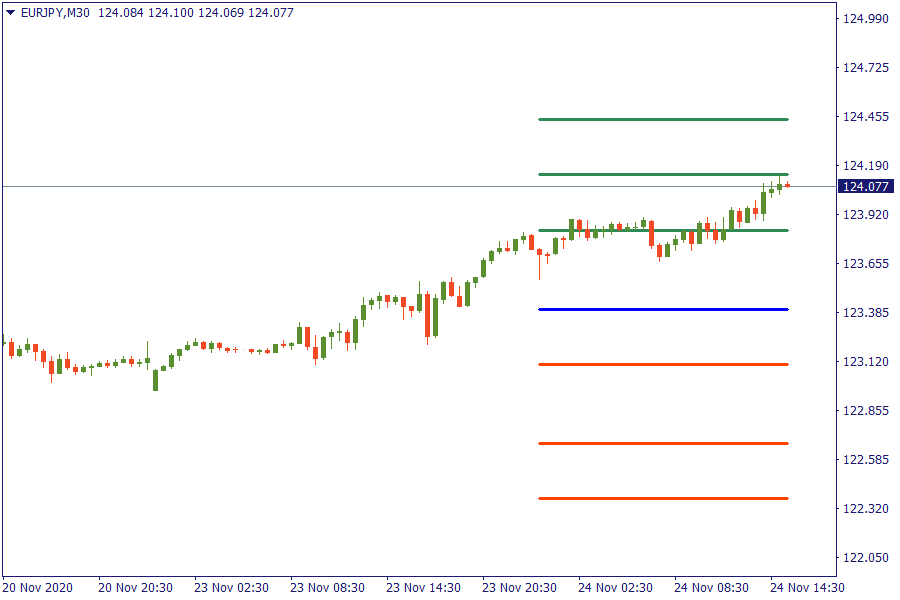

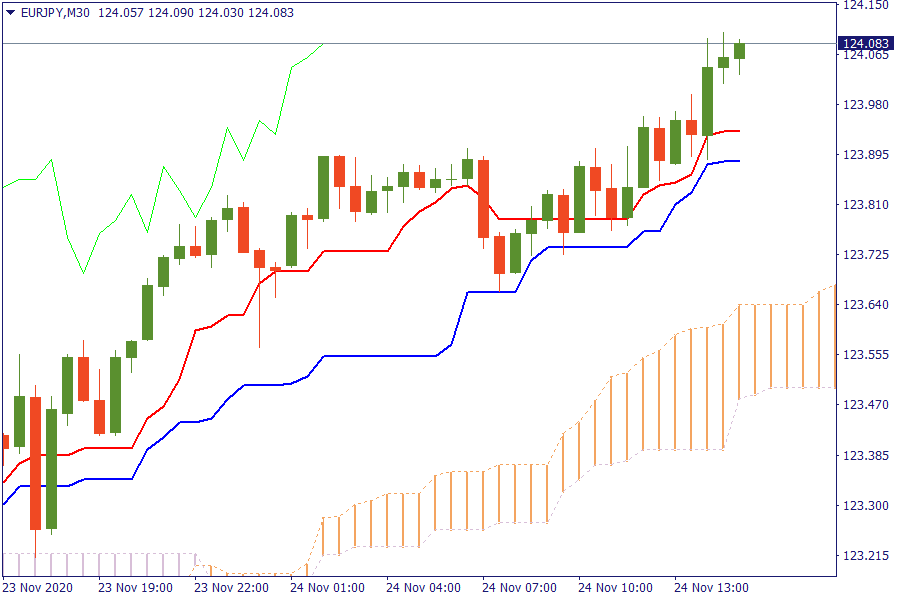

EUR/JPY: The pair is trading above the cloud. An upward pressure would lead the pair to exit further the cloud, confirming a bullish outlook.

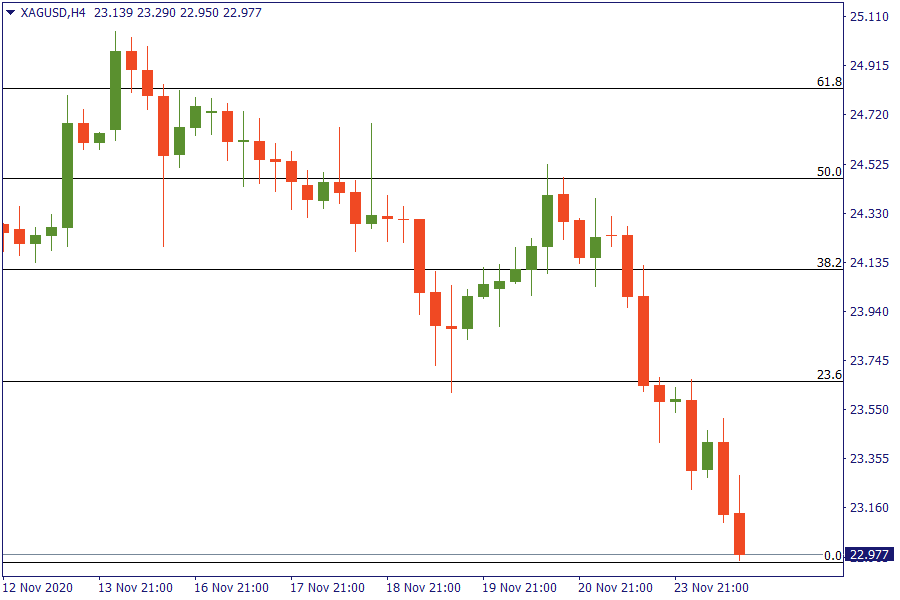

Fibonacci Levels

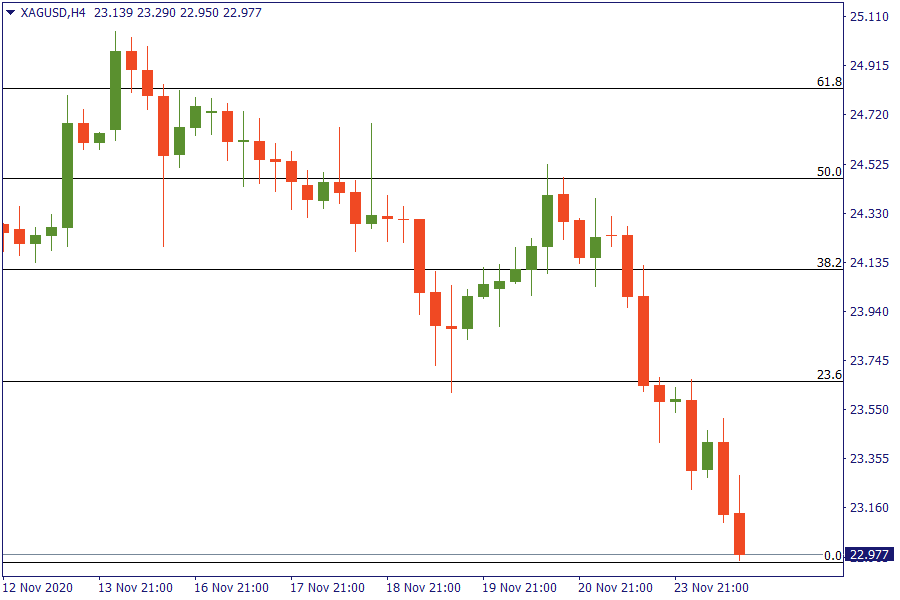

XAG/USD: Silver after a remarkable sell off is trading significantly lower.

Market View

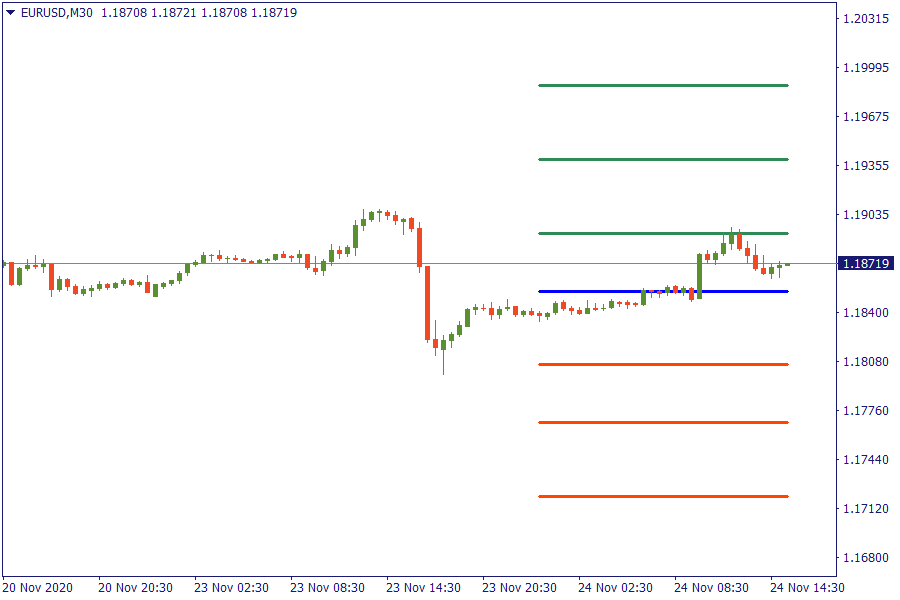

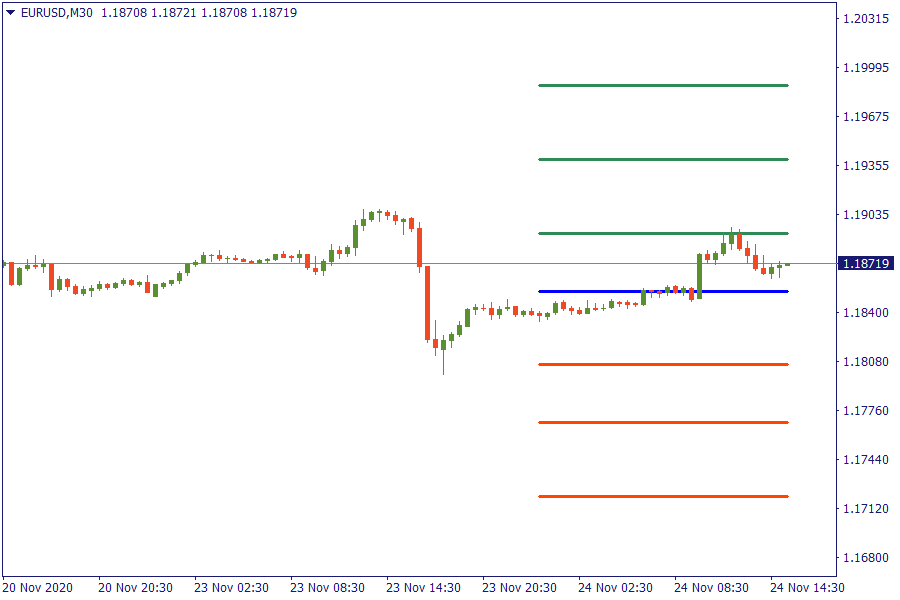

Stocks, oil, and risk currencies gained on Tuesday as the formal go-ahead for US President-elect Joe Biden to begin his transition burnished a November already boosted by Covid-19 vaccines. President Donald Trump tweeted that he had told his team "do what needs to be done with regard to initial protocols", an indication he was moving toward a transition. The euro was gaining towards $1.19 again and the dollar index, which tracks the greenback against a basket of six major rivals, nudged down to 92.235. Gold continued to lose its shine too, falling to $1,826.3 an ounce having now dropped 10% this month. Brent crude futures rose 45 cents, or 1%, to $46.51 a barrel to add to a more than 20% surge this month.

Key Point

- BOJ's Kuroda supports that central bank measures have helped with global pickup

- Russia says first international deliveries of its Sputnik V vaccine to follow in January

- Gold slips by 1% on the day as $1,800 draws closer

TRADE NOW