EUR/USD 4H chart EUR/USD surged after Powell’s speech on Friday…

2020-10-29 • Updated

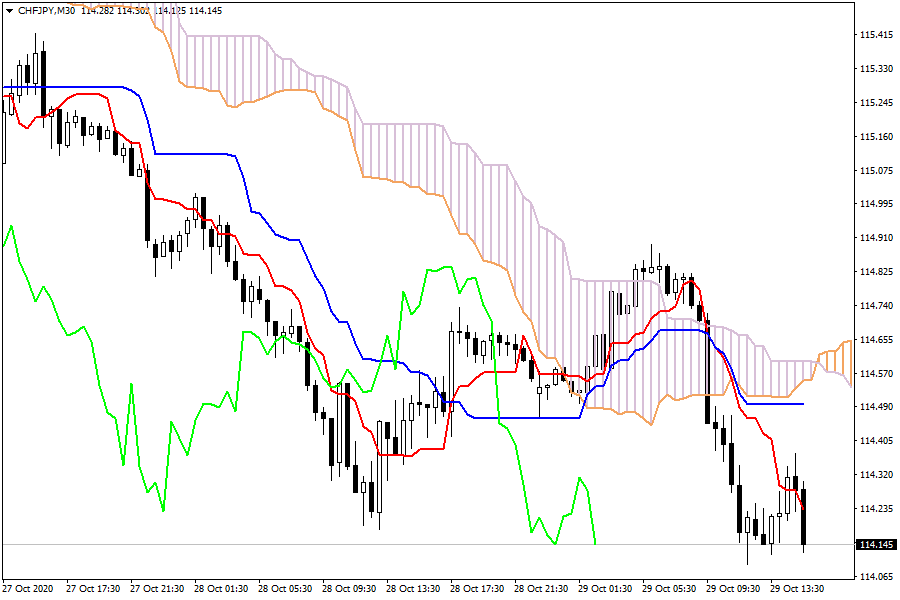

CHF/JPY: The pair is trading in a bearish sentiment below the cloud. The currency pair has just surpassed the Kijun-sen and the Tenkan-sen, confirming a bearish momentum.

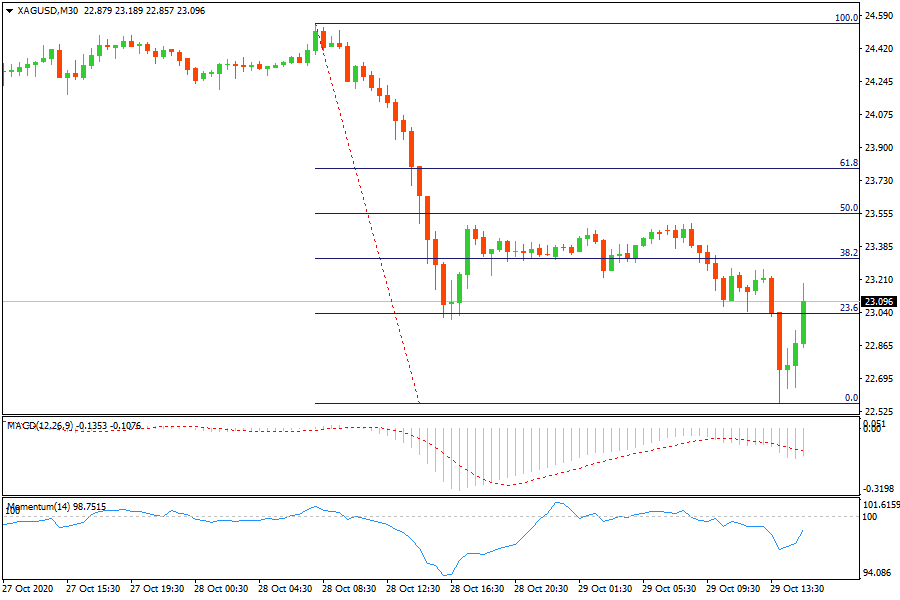

XAG/USD: silver moves above 23.6% retracement level at $23.10. Silver bulls still struggling to move the market higher.

It is an earnings season, with Apple, Amazon, Facebook, and Alphabet all reporting after the close. The earnings again come only a day after some of their CEOs were in Congress, the timing thus sparing them the embarrassment of having to defend their monopoly profits at a time of widespread hardship across the economy. The U.S. economy grew at its fastest rate since records began in the third quarter, reversing much but by no means all - of the output lost in the second quarter under the impact of the coronavirus pandemic. The figures, while spectacular, are essentially backward-looking and exaggerated by the habit of annualizing GDP data. They reflect the reopening of many businesses in the summer after government-mandated stay-at-home orders had crippled both manufacturing and services output in the spring.

EUR/USD 4H chart EUR/USD surged after Powell’s speech on Friday…

What happened? It looks like the decline in EUR/CHF to 1…

What happened? Japanese shares fell on Monday…

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!