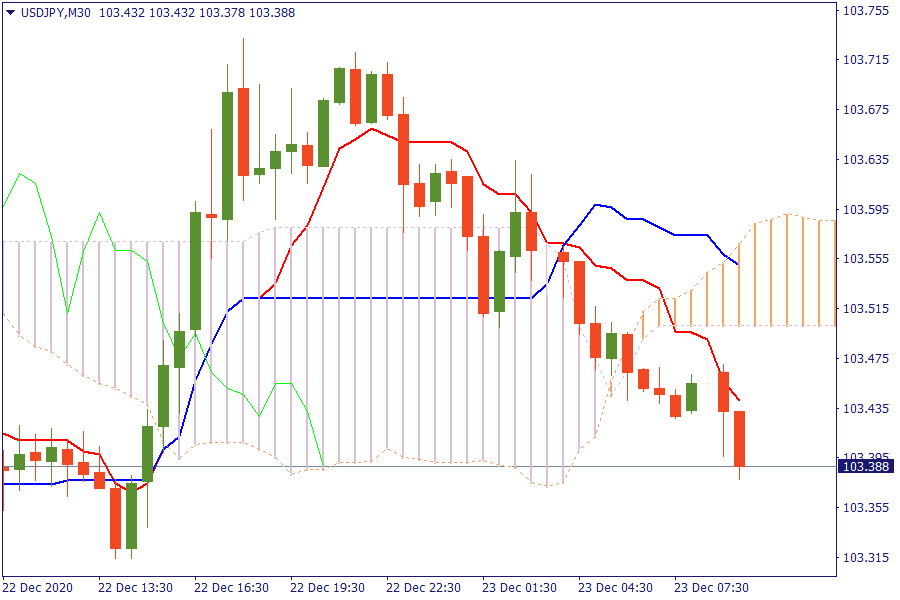

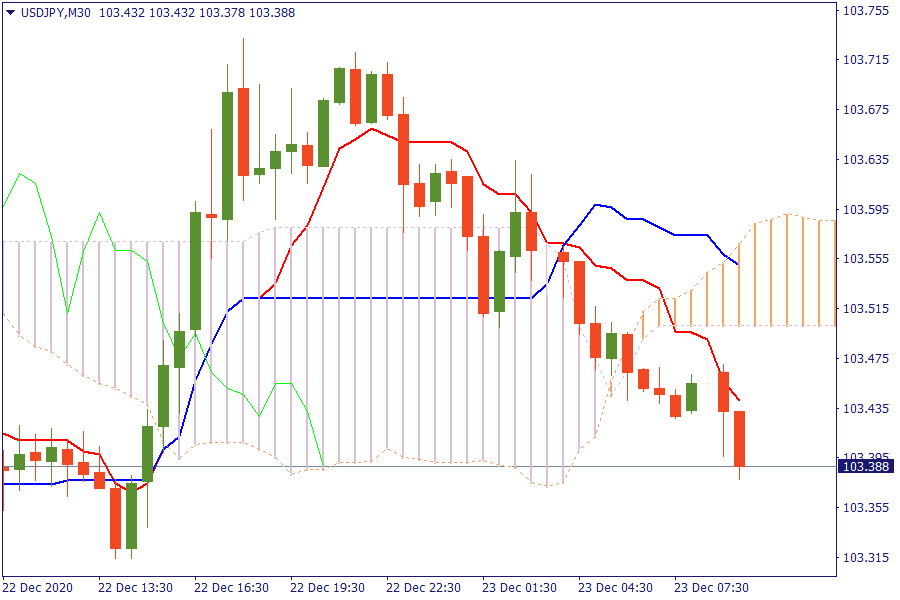

Ichimoku Kinko Hyo

USD/JPY: The pair is trading below the cloud. A downward pressure would lead the pair to exit further the cloud, confirming a bearish outlook.

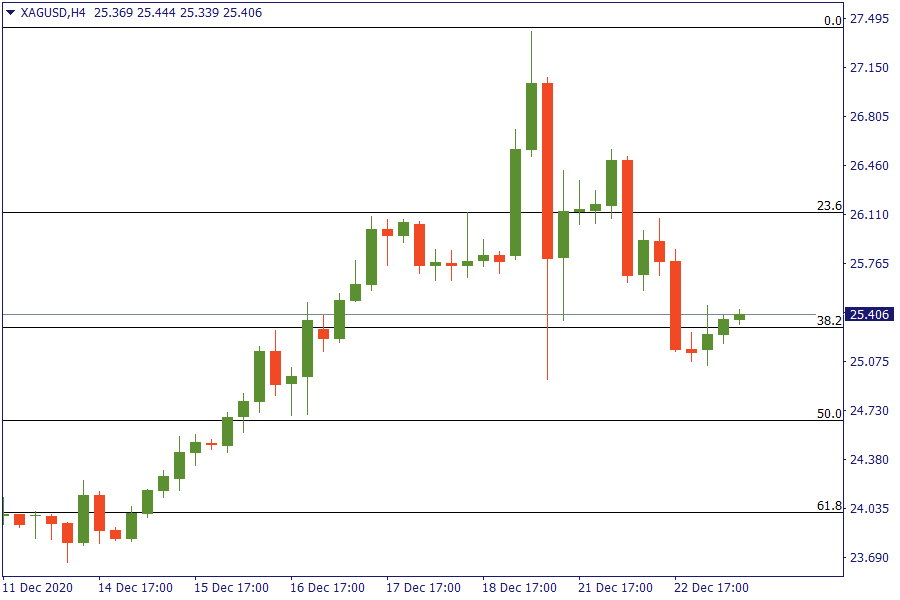

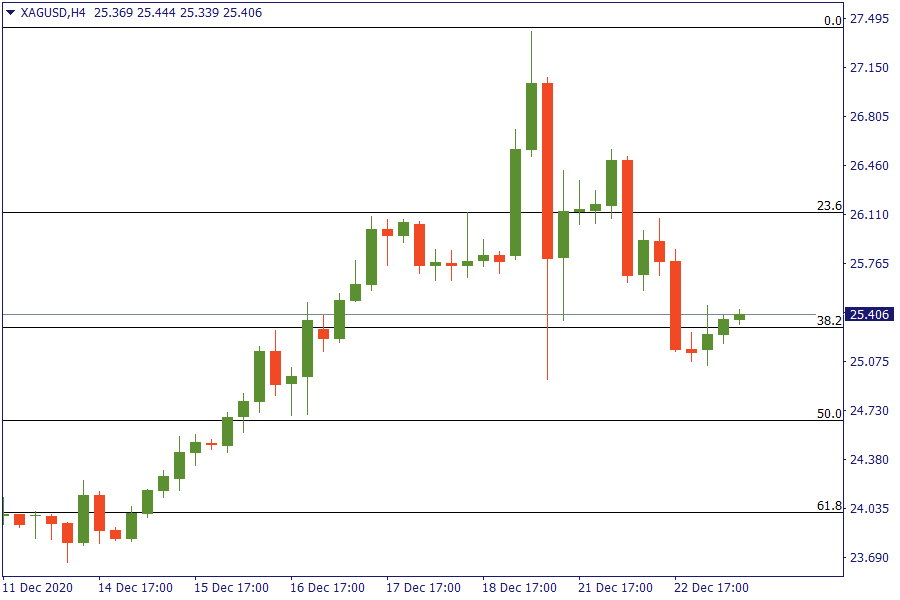

Fibonacci Levels

XAG/USD: Silver after a remarkable strength yesterday lost 4% and now stands above 38.2% retracement area.

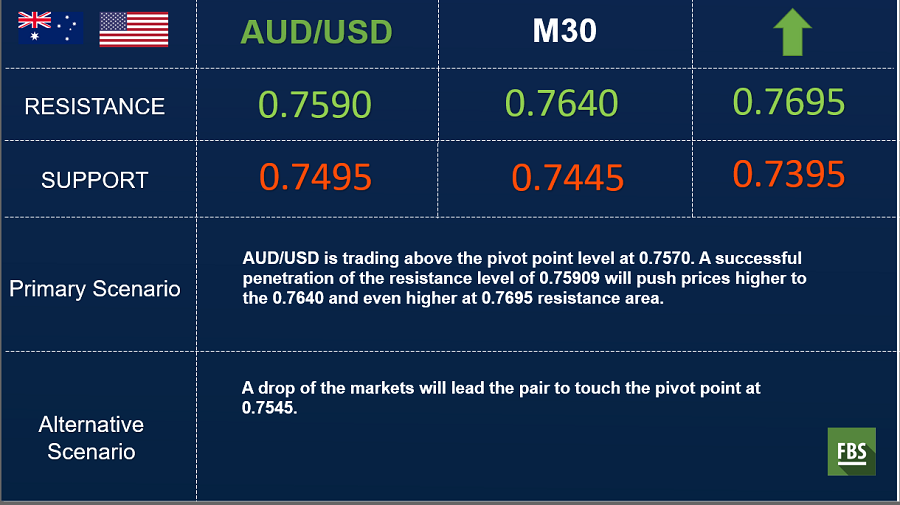

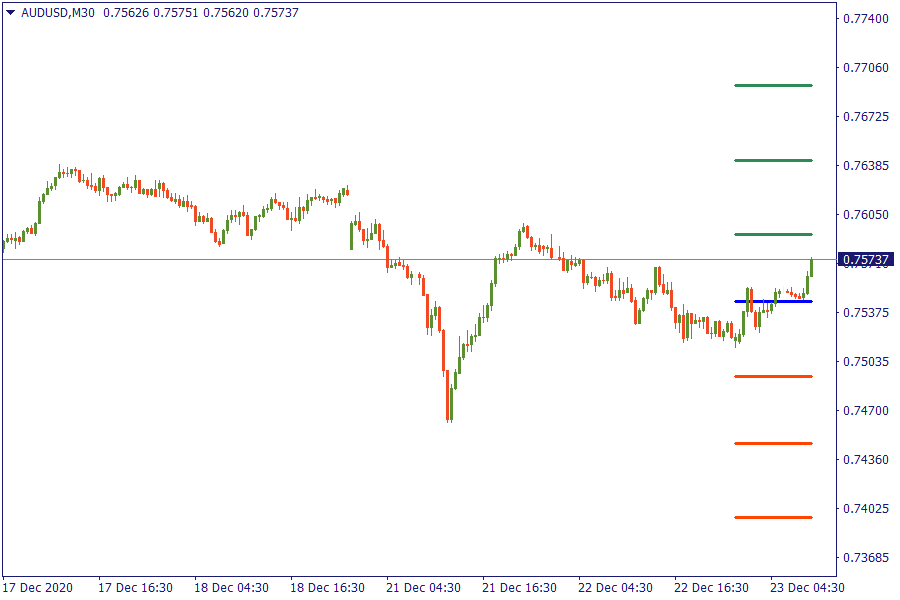

EU Market View

The dollar was down on Wednesday morning in Asia, despite caution over the new B.1.1.7 strain of the COVID-19 virus pushing investors turn toward safe-haven assets. The discovery of the B.1.1.7 strain, first seen in the U.K., saw London and southeastern England put under Tier 4 lockdowns. The Philippines banned all U.K. flights from Dec. 24 earlier in the day, joining over 40 countries that have closed their borders to the U.K. and causing travel chaos just a few days before Christmas. Demand for the dollar had been weakening as the rollout of vaccines and the possibility of more U.S. stimulus measures boosted hopes for a global economic recovery from COVID-19, sapping demand for the dollar and other safe-haven currencies.

EU Key Point

- Gold down on day and remains below 100 day MA

- Japan says to ban travel from UK starting from Thursday amid new virus strain

- Germany reports 24,740 new coronavirus cases in latest update today

- Pelosi says eager to provide $2,000 checks

LOG IN