Saudi Arabia and Russia, two of the world's largest oil producers, have decided to extend cuts to their oil production to support oil prices and boost income. This move comes despite weakened demand due to the sluggish economy.

2022-08-31 • Updated

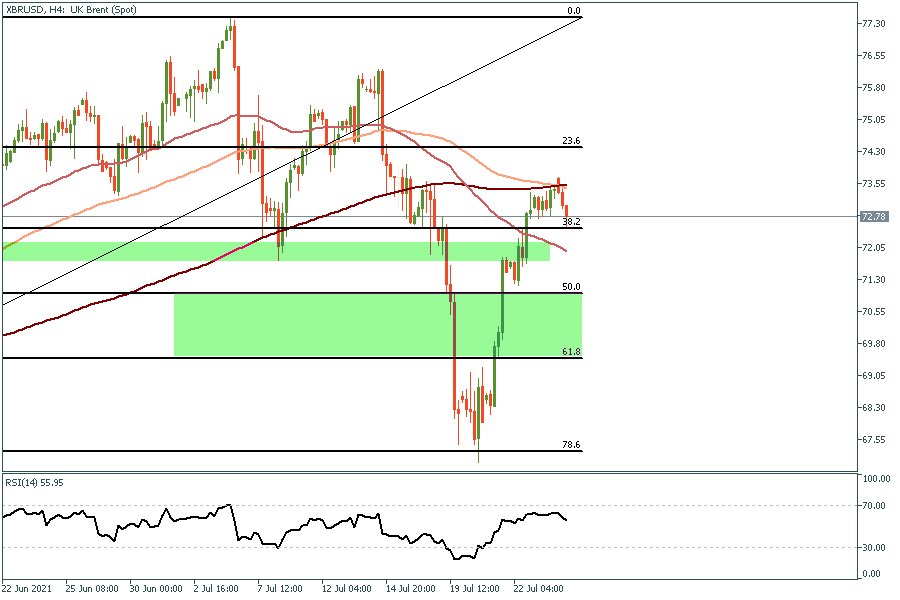

4H Chart

Daily Chart

After closing our short positions on Brent Crude which fell from around 76.60’s all the way down to 67.50, we stated clearly that it would be wise to close our positions and wait for a new opportunity. At the same time, I wasn’t into trading the upside retracement. As always, I prefer to wait for the retracement before I join/rejoin the move. This week I would prefer to short Brent Crude between 73.50 all the way to 74.0 with a stop at 75.40 with a target of 71.00 followed by 69.70 once again, which could be seen later this week.

|

S3 |

S2 |

S1 |

Pivot |

R1 |

R2 |

R3 |

|

|

72.04 |

72.29 |

72.53 |

72.78 |

73.02 |

73.27 |

73.51 |

Saudi Arabia and Russia, two of the world's largest oil producers, have decided to extend cuts to their oil production to support oil prices and boost income. This move comes despite weakened demand due to the sluggish economy.

Oil prices fell to a three-month low following the release of US inflation data which was in line with expectations. The annual inflation rate of 6%...

Western countries are trying to find other options for oil and gas supplies after a 10th package of sanctions, which will put more pressure on Russian oil and decrease global oil supply. Italy, for example, is in talks with Libya.

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!