Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

2022-06-06 • Updated

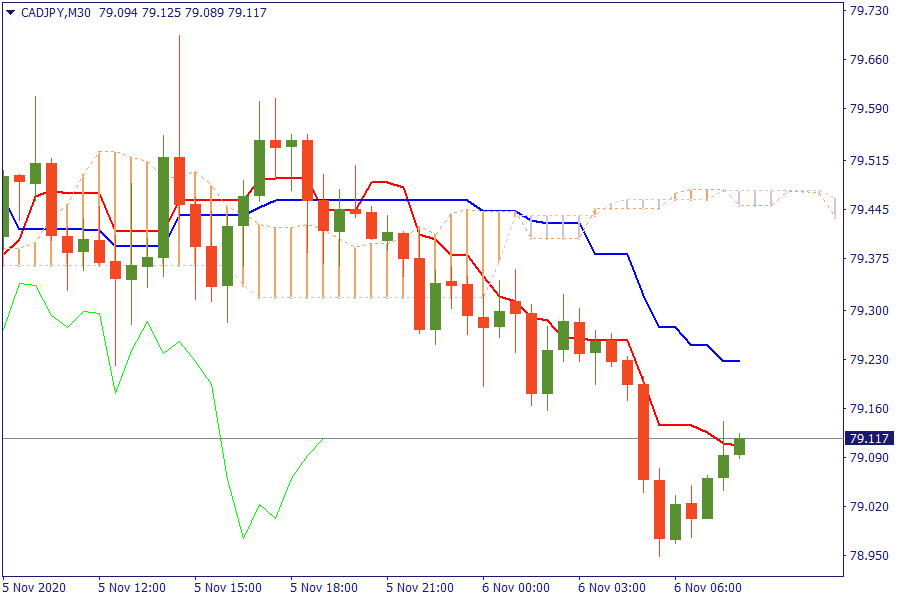

CAD/JPY: The pair is trading below the cloud. Further pressure from sellers will lead the pair lower.

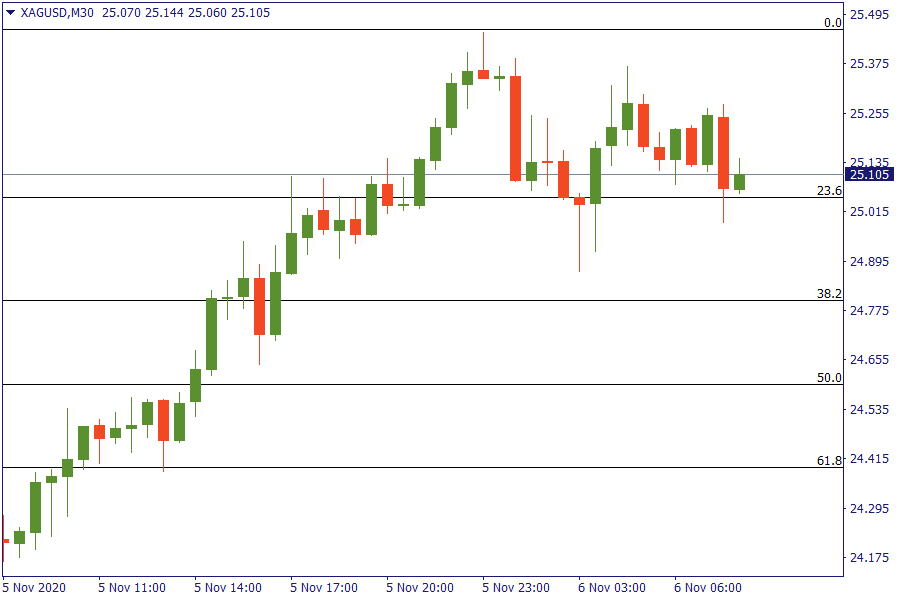

XAG/USD: Silver moves on 23.6% retracement level. It seems that silver buyers forming a bullish flag.

Democrat Joe Biden inched closer to winning the White House while President Donald Trump escalated his unprecedented efforts to cast doubt on the election's integrity.

Biden, the former vice president, was chipping away at the Republican incumbent's leads in Pennsylvania and Georgia even as he maintained narrow advantages in Nevada and Arizona, moving closer to securing the 270 votes in the state-by-state Electoral College that determines the winner.

The Bank of England increased its quantitative easing program by more than expected, paving the way for bigger government borrowing to deal with an expected double-dip recession.

The Bank expanded the envelope of its asset purchases by 150 billion pounds ($195 billion), or around 7% of U.K’s GDP, supporting that the economy to contract in the fourth quarter and to face extra headwinds at the start of next year from the end of the post-Brexit transition period.

Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

Bearish Scenario: Sell below 39600... Anticipated Bullish Scenario: Intraday buys above 39750... Bullish Scenario after Retracement: Intraday buys above 39150

Bearish scenario: Shorts below 18100 with TP1: 17900... Anticipated bullish scenario: Intraday Longs above 18130 with TP...

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!