XBRUSD and XTIUSD might experience massive volatility due to the Chinese GDP release on Tuesday, October 18.

2021-07-26 • Updated

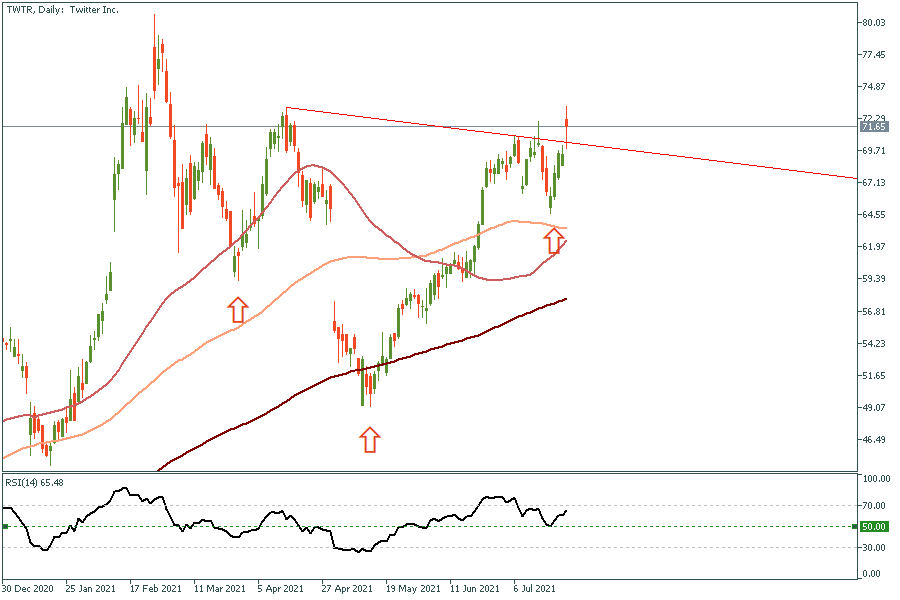

From last week's Twitter call, “Twitter showing some promising pattern here, with a possible inverted head and shoulders formation on the daily chart, while the neckline is now trading around 70.50 which might get tested in today’s session. A weekly close above the neckline would be a clear signal to start building a position gradually with every dip, with an initial target of 73”.

Twitter managed to close the week well above its neckline, nearing our $73 target mentioned last week. However, such a break might need some sort of confirmation through a retest of that broken neckline, a stabilization above that line would mean a new opportunity to a long for those who missed the initial rally last week.

Moving into this week, we will be watching seven key stocks which will be the biggest week f this earnings season. We will be waiting for the earnings of Tesla, Microsoft, Alphabet, Apple, Facebook, Amazon, and AMD.

We will dive into the details during this week and explain the impact and whether there will be a new signal to long or short these stocks, but for now, they look promising and if they beat the estimates like the other major shares last week, this would be another record for the US equities.

XBRUSD and XTIUSD might experience massive volatility due to the Chinese GDP release on Tuesday, October 18.

Fed Chair Powell’s comments on the Jackson Hole Symposium resulted in the worst weekly candle in the US500 index since June. Most risky assets experienced severe drawdowns, and EURUSD returned to the above-parity area. We explain everything you need to know about the Symposium in this article.

As central banks raise rates amid recession fears and companies deliver financial results, markets are super active and provide multiple trade opportunities. Let's see what awaits traders this week!

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!