Bearish scenario: Shorts below 18100 with TP1: 17900... Anticipated bullish scenario: Intraday Longs above 18130 with TP...

2020-04-22 • Updated

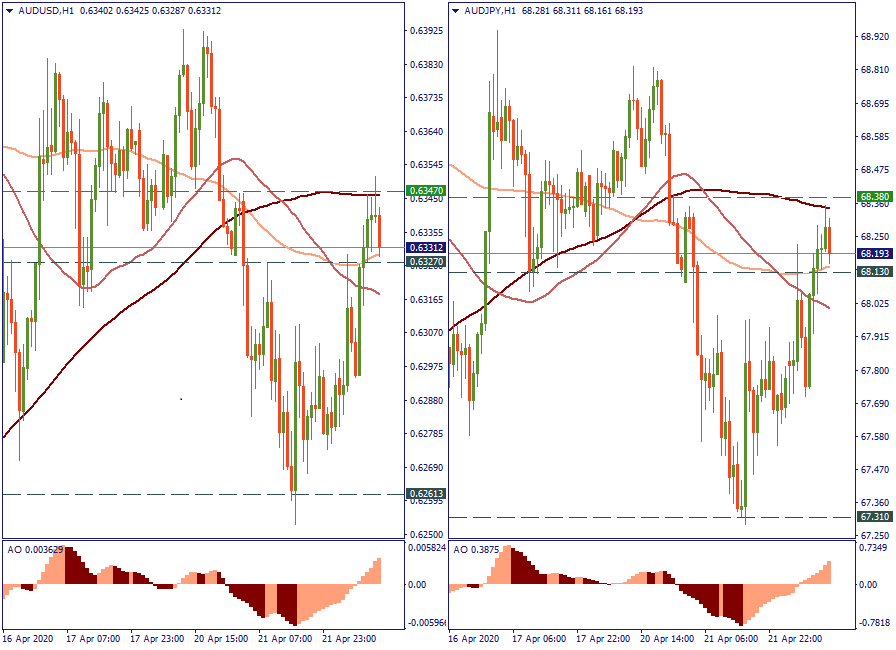

The Australian dollar gives an unusually strong picture in the Forex market lately. On the H1, behaving almost identically against the USD and the JPY, the AUD recovered its losses after reaching its local low on Tuesday. Interestingly enough, the currency pair entered a channel right between the 100-MA and 200-MA as if it was “caught” there.

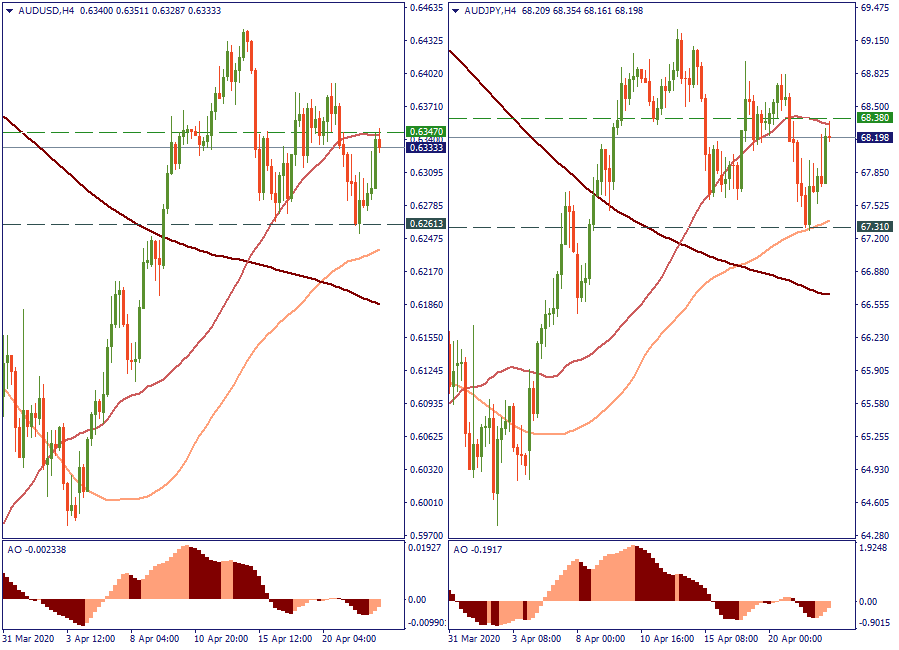

Switching to H4 timeframes gives the same peculiar formation: the currency pair trades between the 50-MA and 100-MA, showing an upward recovery after a recent drop. Technically, such a disposition makes it easy to evaluate the expected movement of the AUD: one it crosses the support or resistance of the respective Moving Average, it will confirm the taken direction.

The long-term outlook, however, offers no consolation for the AUD fans. The strategic picture has no support for the Aussie, even with the recovering China ahead of the rest of the world, as the country has little to put against the economic powers of the US or Japan in the Forex field. That’s why, betting on the AUD in the short-term or mid-term, keep in mind that in the long run, that’s a bearish current – which was confirmed a while ago when the AUD renewed its multiyear lows.

Bearish scenario: Shorts below 18100 with TP1: 17900... Anticipated bullish scenario: Intraday Longs above 18130 with TP...

Earnings season is a crucial time for investors and analysts, as it provides insights into how well companies have performed over the past quarter and gives indications of their future earnings. In 2023, expectations for US Q1 earnings were low due to economic challenges and rising interest rates. Surprisingly, many companies beat these low expectations, with 75% of S&P 500 companies surpassing forecasts.

When I started trading stocks a few years ago, I often needed to pay more attention to my technical analysis skills and trust that the market would play fair according to my analysis. I have since discovered that the safer approach to trading stocks is to, more often than not, seek out investing opportunities - that is, catching stock commodities with a potential to rise.

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!