What happened? It looks like the decline in EUR/CHF to 1…

2020-10-22 • Updated

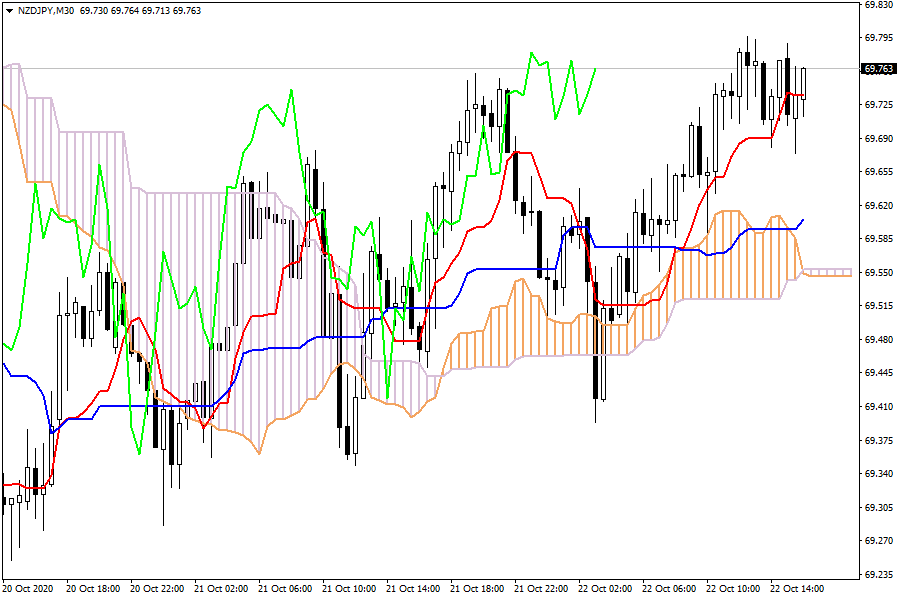

NZD/JPY: The pair is trading in a bullish sentiment above the cloud. The currency pair has just surpassed the Kijun-sen and the Tenkan-sen, confirming bullish momentum.

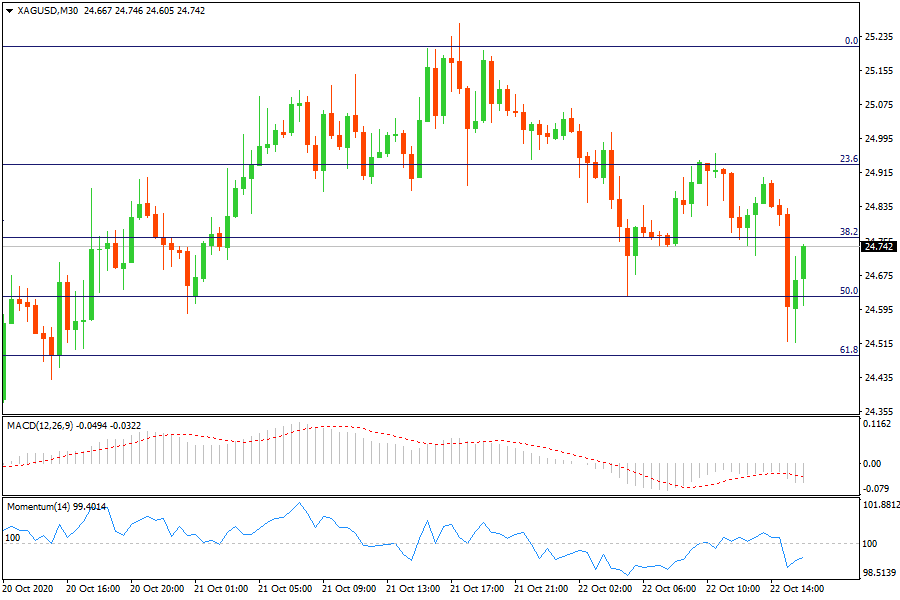

XAG/USD: Silver lose strength and moves further below 38.2% level. It seems that bears increase downside pressure.

The number of Americans applying for initial unemployment benefits fell to 787,000 last week, the lowest since April, but remained at levels indicating that the recovery in the labor market is struggling for momentum as the coronavirus pandemic enters its first full winter.

Economists had forecast a decline to 860,000. The prior week's figure was revised down to 842,000 from an initially reported 898,000.

The number of continuing claims, which are reported with a one-week lag to initial claims, fell sharply for a second straight week to 8.373 million. The previous week's figure was revised down to 9.397 million. Continuing claims are falling in part because many people have exhausted their eligibility for regular state benefits.

What happened? It looks like the decline in EUR/CHF to 1…

What happened? Japanese shares fell on Monday…

USDCAD began the week slightly higher reaching as high as 1.2510 but failed to sustain these gains.

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!