Will S&P 500 stop falling?

S&P dropped to the one-month low amid the overall risk-off market sentiment. Indeed, everything is mixed up: rising new virus cases, the delay in the US stimulus package, no signs of soft Brexit, and the election uncertainty.

Hopes for the better-than-expected earnings reports of the four tech giants, Apple, Amazon, Facebook, and Google drove the stock index higher yesterday, but a 16% decline in iPhone sales pushed it deep down.

The risk-averse sentiment is likely to prevail during Friday, but perhaps US economic figures will change it. Follow US Personal Spending at 14:30 MT time, Chicago PMI at 15:00 MT time, and Revised Consumer Sentiment at 16:00 MT time!

Technical tips

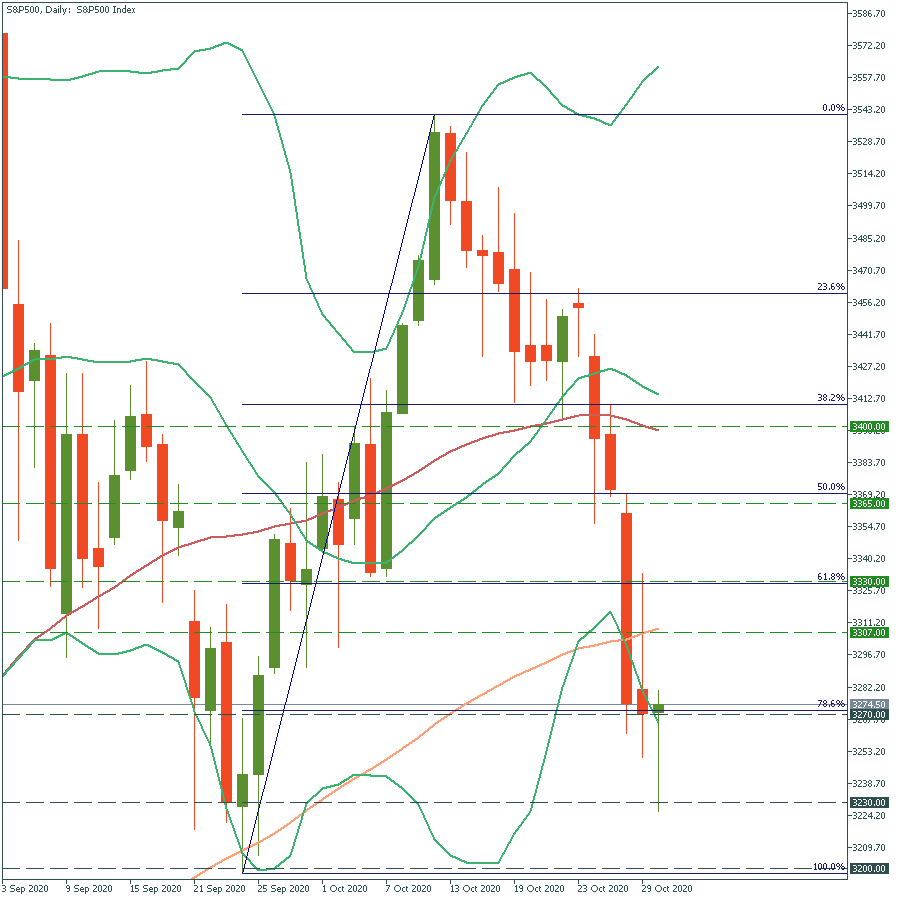

The S&P 500 has moved below the lower trendline of the Bollinger Bands indicator on the daily chart, that’s why we can assume it should reverse now from the 78.6% Fibonacci retracement level of 3 270. The move above the 100-day moving average of 3 307 will drive the stock index to the 61.8% Fibonacci retracement level of 3 330. On the flip side, if it manages to break the support of 3 270, it may drop to the low of September 23 at 3 230.