USD vs EUR, AUD, CAD, GBP: strategic softening

EUR/USD

The dollar eventually softened enough to give way to the Euro: the currency pair broke through the key resistance of 1.20 recently and climbed above 1.21. Tactically, EUR/USD is now in an upswing that started in February. If that upswing makes its way through 1.22 up to 1.24 and above, it will be an alarm bell that the 12-year-long downtrend of this currency pair may see its end soon. While that’s a possibility, keep in mind the potential for a downward correction as it frequently happens after strong advances such as the one we are witnessing.

AUD/USD

The Australian dollar is on the verge of making a multiyear breakthrough as well. The downtrend that’s been there for the last decade is being challenged right now, with AUD/USD coming to the heights of 0.75. If the currency pair manages to march to 0.81 and secure its position above that level, the ten-year-long downward trajectory may see a change to the upward-looking curve. While that’s one of the potential long-term scenarios, don’t forget to factor in the likelihood of a bounce downwards: the resistance of 0.75 may well send AUD/USD back to the local lows at 0.70. Fundamentally, it depends on the USD more as the domestic economic environment in Australia is pretty tense.

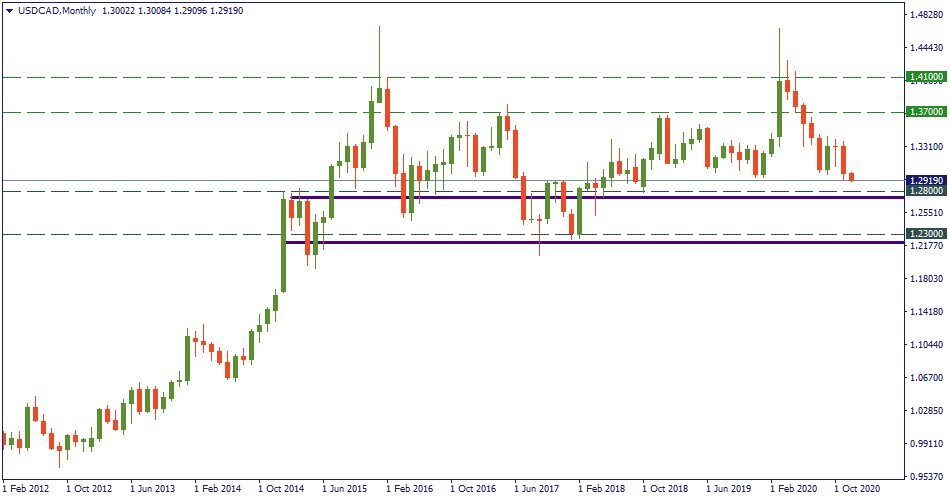

USD/CAD

The Canadian dollar has another tactical “objective” as compared to the Australian dollar and the euro. With USD/CAD, we have seen sideways movement contained in the five-year-long channel between 1.41 and 1.23. Currently, the currency pair is drifting to the downside of that channel, with 1.29 and 1.28 as the nearest downward checkpoints. Once and if those are crossed, 1.23 will be aimed at. If this support is crossed too, it may be an introduction to a shift to a downward trajectory after five years of moving mostly flat below 1.37. Now, while watching those key levels, beware of the reversal potential – as always. With USD/CAD, it would be a potential for a U-turn in the range of 1.28-1.29 to the upside.

GBP/USD

Leaving the Brexit issues aside, let’s see what’s happening to the GBP/USD. Technically, it’s trading now at August highs – that’s the resistance of 1.34. That’s a key level that has been guarding the upside for the last 24 months, and the British pound made another step forward to break it. With the possibility of the bullish breakthrough and the march above that level grows the possibility of a reversal over here. Be prepared and very careful with it, especially now, with Brexit tensions. If the outcome of the divorce is not in favor of the GBP, there may be more pressure down on it – for this scenario, keep the support of 1.30 in sight.