US Dollar (DXY): a selling wave could hit in the short-term

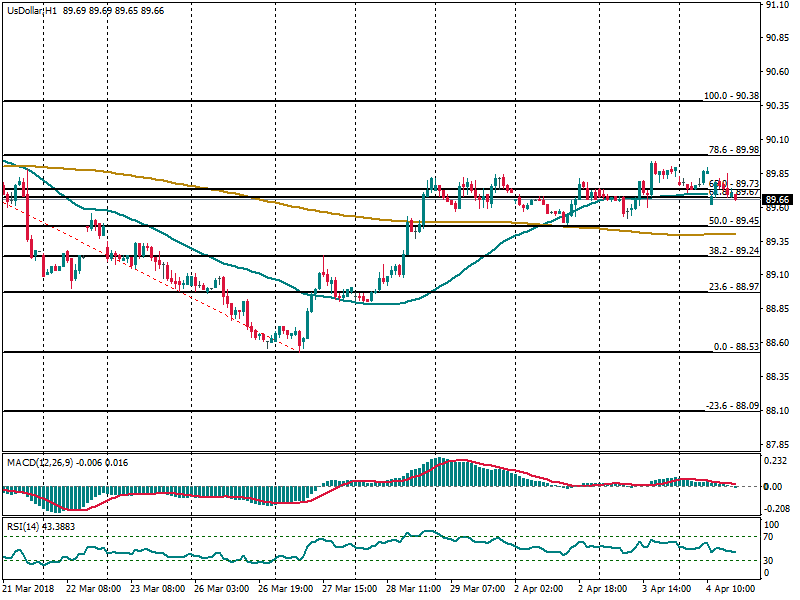

US Dollar remains confined within a range established since March 28th session and looks forward for a clear trend in the short-term, as it stays directionless. A pullback at the current stage should validate the idea of a strong resistance being found in the Fibonacci level of 78.6% at 89.98. If that happens then DXY -which gauges the buck against a basket of major currencies- could resume the bearish bias and eventually it can plummet towards the March 27th lows at 88.53 as a first target.

RSI indicator is hovering in the negative territory.