US Dollar could be looking for fresh highs

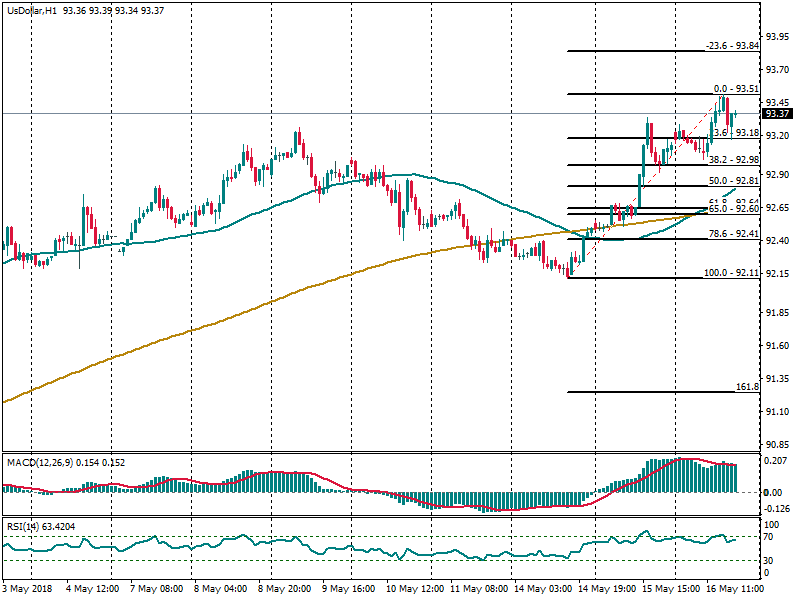

The US Dollar has been extending the bullish bias above the 200 SMA at H1 chart, but the resistance level of 93.51 is helping to cap further gains. That’s why we would like to stick with the idea of a possible decline to complete a cycle between the 92.81 and 92.60 level, where is located a strong demand area. If a rebound happens over there, then the index could be on its way to reach the Fibonacci level of -23.6% at 93.84.

RSI indicator stays in the positive territory, favoring to the bulls, but we should remind that indicator was before in the overbought zone.