The missing factor in your fundamental analysis

In this article we will tell about one of the most significant fundamental factors the traders sometimes overlook while analyzing the currency’s movement. This is a country’s foreign exchange reserves. Then, we will talk about the banks’ “favorite” currencies (constituting the great share of the banks’ foreign reserves) in the recent years.

Almost all countries hold foreign currency reserves for multiple purposes. For a country with a fixed exchange rate and free cross-border capital flows, a large stock of reserves is indispensable for the maintenance of the desired exchange rate. A good example would be China, which pegs the value of its domestic currency – the yuan (renminbi) – to the USD. When China increases its holdings of the US dollars, it raises its values as compared to the yuan. That makes the country’s exports cheaper compared to the good of American origin.

From today’s headlines: China’s state-own banks selling USD/CNY to support the yuan – the result of this operation – depreciation of the USD against CNY.

For an advanced country with a floating exchange rate, a smaller, but still sufficient stock of reserves is required. The following country’s interventions in the exchange markets are normally infrequent. The primary purpose for holding the reserves in foreign currencies, therefore, may relate to the risk that extreme market disorder could compromise the functioning of the FX markets in ways that create significant difficulties for the country’s real economy. The advanced countries, like Japan, would also be willing to keep some foreign currencies to artificially support their currencies from unexpected valuations. Another purpose for the countries to keep sufficient foreign currency reserves is to be able to pay for three to six months of imports, to cover the country's debt payments and current account deficits for the next 12 months.

So, as you see, the decision of a bank to stockpile a certain foreign currency affects this currency’s and the bank’s domestic currency exchange rates. With this axiom we now may explicate the recent appreciation of some major currencies.

The USD has crashed down significantly this year (compared to the last year so-called “Trump’s rally). In contrast, the yen and the Aussie experienced some surprising rallies since the beginning of this year. What are the primary causes of the following FX market’s moves? To some extent, it’s the central banks’ handiwork.

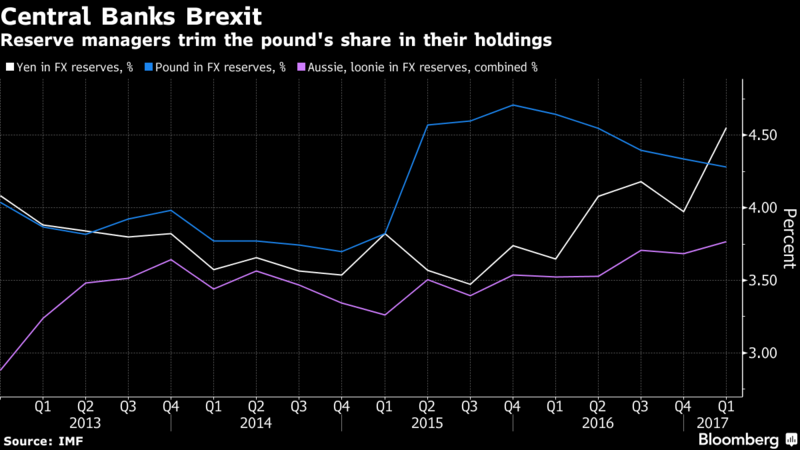

The International Monetary Fund released data last week on the composition of global foreign exchange reserves. We have identified some changing dynamics in the buy-and-hold investors’ preferences in the past few years.

The British pound was kicked out from the central banks’ list of all-time favorites constituting the largest shares of foreign currency reserves. The yen and Aussie were among the beneficiaries in the first quarter of this year as you may see from the chart. The same can be said about their outstanding performance in the given period.

In the second quarter, investors switched their attention to the euro and cooled on JPY and AUD. The euro picked up in the course of the period.

Source: IMF

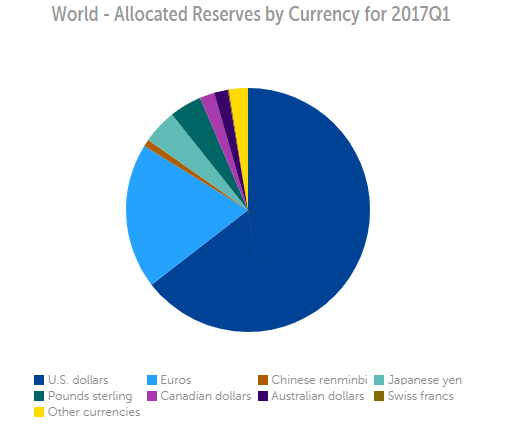

Despite some drops in the demand for the USD, it still remains the preeminent reserve currency.