S&P: final battles

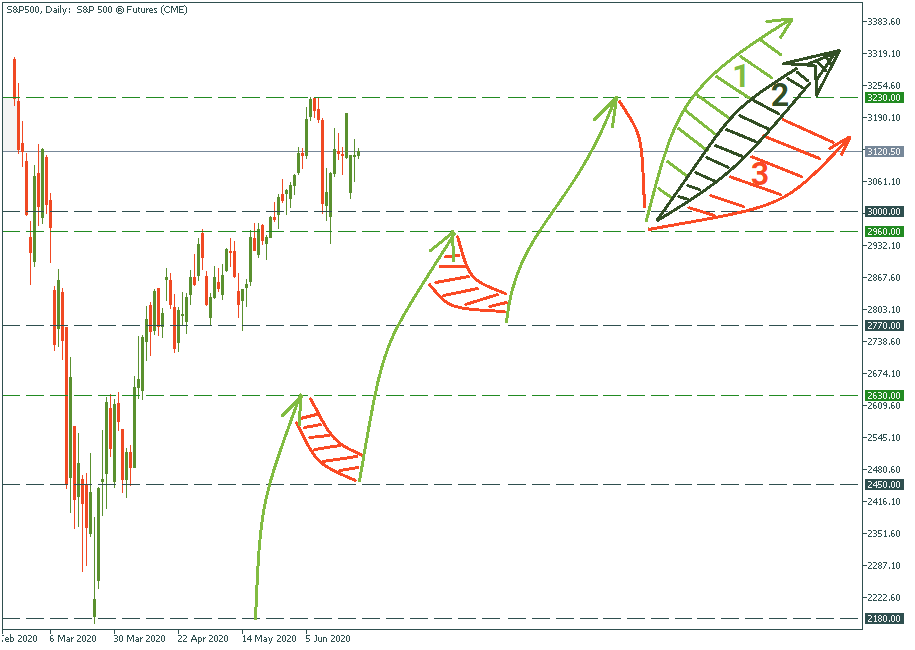

Two weeks ago, we were seeing the stock market and the S&P decline. On June 11, we provided prognosis that it would be a wave down to the levels of 3,000 after which a leap up would launch.

Eventually, it happened exactly like that although we missed in accuracy: the drop was down to 2,950.

Currently, the S&P is on the rise. Trading at 3,120, it is still below the last high, fighting through the fears of the second-wave virus.

The current wave, the fourth in the row of bullish pushes, would be the one to finally punch through the pre-virus high. For this reason, it may take longer to do that, and the wave may get protracted over time. The main reason for that is that significantly positive fundamental input and data are required to push the S&P above the pre-virus high: saying “we have recovered” needs proper justification.

Therefore, here are three areas we expect the S&P to go through in the mid-term.

The most optimistic scenario would follow area 1, with the swiftest recovery reaching 3,230 and above. Very likely, that’s too good to be true.

The pessimistic scenario is represented by area 3. It’s gravity would bend the overall uptrend into an almost sideways move parallel to horizon. Eventually, it would climb upwards by coming and securely to 3,230 would take a month in this case.

The neutral scenario falls into area 2 which is in between the pessimistic and the optimistic trajectories. It supposes there would be some turbulence on the way but the trend would be still at a steady 45 degrees aiming upwards.

Therefore, let’s watch the news and prepare for battles.