OIL: turbulence ahead

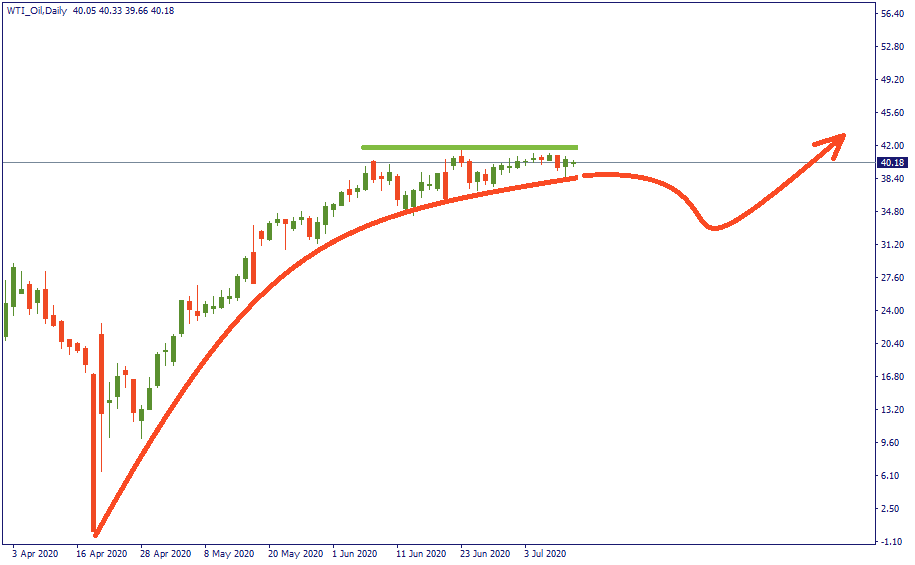

In May-June, WTI oil price was rising almost non-stop. In July, we have an obvious consolidation. The level of $41 per barrel so far serves as an iron wall for bullish intentions. What is the likely scenario ahead?

OPEC+ is having a meeting this week. They are going to discuss the possibility of loosening the tight regime of output cuts in view of expectedly improving outlook for global oil demand. Locally, investors are already factoring in an increase in the output – last Friday, WTI dropped to $38.5

Surely, for oil prices, the period of “simply growing” is over – at least, for now. This week, we will definitely see volatility. First, the OPEC+ will make its announcements; then, the market will take its time to react, retrace, and stabilize. So we are speaking about a couple of weeks of the full cycle of market reaction getting ready to pave the way for a new period of probable growth.

Therefore, expect some turbulence ahead. Dropdowns as deep as down to $30-35 would be nothing extraordinary. But the end of the month, though, it is likely to be over, and by that time $40 will eventually convert into support level.