NZD/USD: long-term perspectives

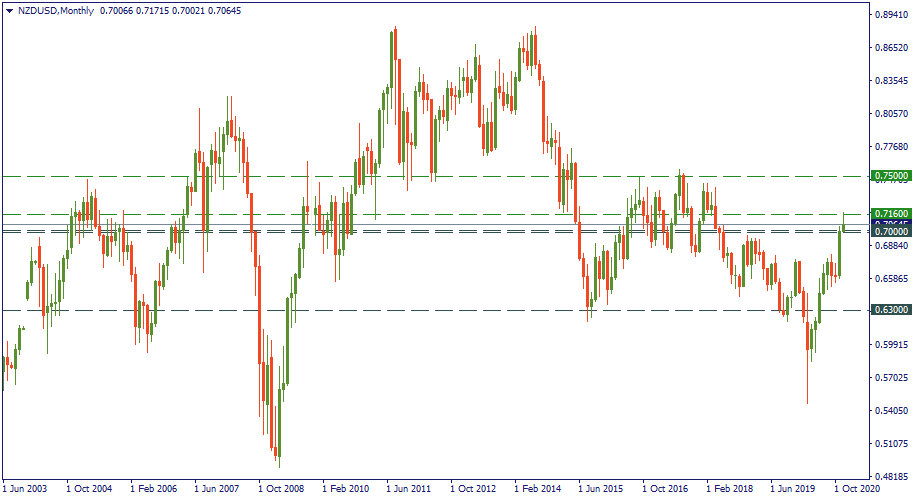

If there is a support to be found, that’s right here: in the channel 0.7000 – 0.7010. NZD/USD bounced from it not once during the last six weeks, every time going further into the upside. This logic suggests that what we are seeing now is a downswing that may touch 0.70 before launching the price back upwards again, going beyond 0.7160. Is that possible?

Hypothetically, yes. The last monthly candles are not the longest ones in the history of NZD/USD over the last 20 years. The fundamental layout has many factors in favor of the weakening of the US dollar – from the Fed’s low-interest-rate monetary policy line to the general loss of interest to the greenback among global investors. Therefore, the US dollar may indeed lose further ground allowing NZD/USD to make further gains in the upside. 0.75 would be the strategic resistance to look at, in the first place – who knows, very possibly, it will be reached in 2021 in a similar manner to the transition from 0.63 to 0.70 in 2015-2016. A stronger move upwards is rather unlikely, therefore, 0.75 seems a realistic upside scenario for the year 2021. Otherwise, 0.63 would be a ground for the performance of NZD/USD in the long-run.