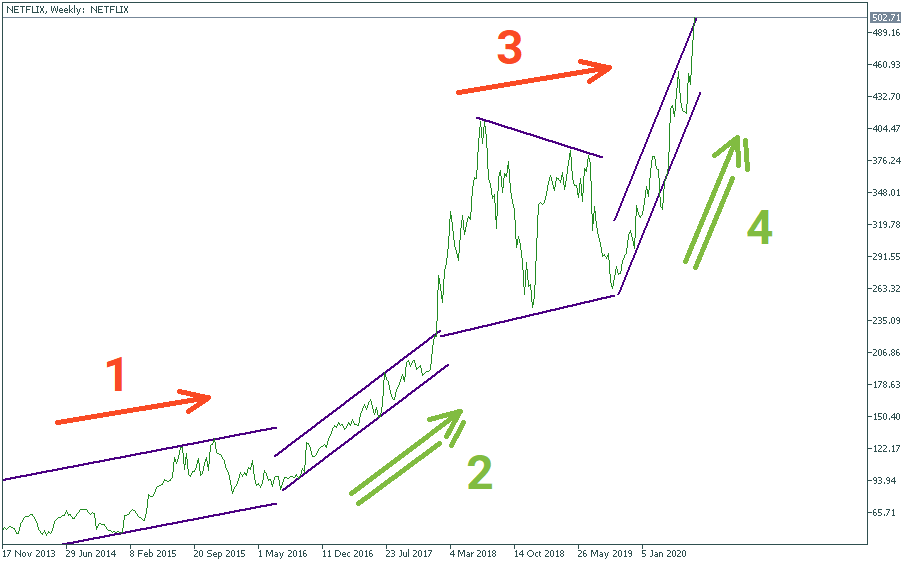

NETFLIX stock: acceleration period

Strategically, the last decade may be divided into four alternating periods of this stock’s performance. Periods 1 (2013-2015) and 3 (2018-2019) follow a milder upward inclination, while periods 2 (2016-2017) and 4 (2019 - 2020) are more vertically aggressive. So the question for Netflix is: how long will the company be able to generate enough revenue to fuel the current accelerated growth?

From the mid-term perspective, currently, the price is slightly above the upper border of the channel marked as Period 4 in the above chart. There is a fundamental reason for that – the virus increased the demand for Netflix’s services. However, sooner or later, a retrace will be there. In line with this assumption, $470 appears to be a more stabilized baseline level for this stock to come to as it is now overheated. After that, however, it will go up again.

Keep in mind: on Thursday, July 16, at 2300 MT time Netflix is announcing the Q2 financial performance - that will have it's impact on the mid-term performance. Watch out!

Your plan to trade Netflix:

- You download the Metatrader 5 .

- You open the MT5 account in your personal area.

- After that, open all trading instruments by clicking “show all” at the “Market Watch” window.

- Start trading!