Is there any hope for the Japanese yen?

Let’s face it: the famous safe-haven Japanese yen is the most undervalued major currency right now. The JPY has been trading much weaker against the other currencies since the beginning of February. Let’s find out the reasons behind this performance of the Japanese currency and set the key levels against other majors.

Reasons behind the JPY weakness

One of the main reasons is, of course, connected with the current optimism on trade negotiations. Despite any clear breakthrough, the US and Chinese sides express positive comments and expect the talks to end on Friday. On Thursday, China proposed to buy more of US agricultural goods, which include soybeans, corn, and wheat. In addition, the Chinese spokesman of the Ministry of Foreign Affairs confirmed that China would not devalue its currency in an attempt to resolve the trade dispute with the US. This positive news resulted in the risk-on sentiment across the markets and, therefore, weakened the Japanese yen.

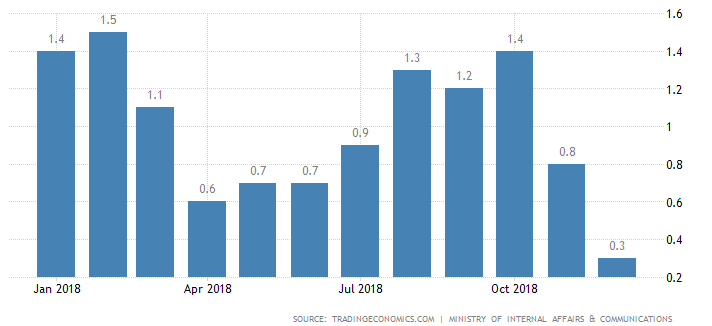

Also, don’t we forget that the Bank of Japan is one of the most dovish banks in the world? Last Tuesday the Bank of Japan governor Haruhiko Kuroda said that the Bank of Japan will ease its monetary policy further if currency moves have a high impact on the economy and prices and there is any difficulty in achieving the 2% target. It’s worth mentioning that Japan’s annual consumer inflation reached 0.3% in December. This is the lowest level since October 2017. That is why the Bank of Japan considers rate cuts and continuation of quantitative easing as primary tools of the further policy by the bank.

Another disappointing data for the JPY this week is the release of Japan’s balance of trade on February 19. The trade deficit came out at 1,415 billion JPY (vs. the expected -1,000 billion), making it the widest since 2014.

What may help the JPY to strengthen?

Despite the overwhelmed optimism on the trade negotiations, the solutions to the several key issues remain uncertain. On Thursday, the negotiators started to create six memorandums of understanding on the structural issues: intellectual property rights, services, and non-tariff trade barriers. According to the news, the sides still have differences on these key requirements. If they don’t reach an agreement until March 1 or decide to extend the deadline, it will bring the risk aversion to the market. This situation will make the JPY stronger.

From the fundamental side, February 22 will be highlighted by the release of Japan’s inflation rate. Analysts expect it to increase by 0.5%. Higher figures will be appreciated by the JPY traders.

From the fundamental side, we need to pay attention to the release of the level of consumer confidence for Japan on March 1. This data will likely bring additional volatility to the Japanese yen, too.

Now we understand that the Japanese yen is affected by a lot of factors, which pull the currency down. Let’s set the key levels for the JPY against other major currencies.

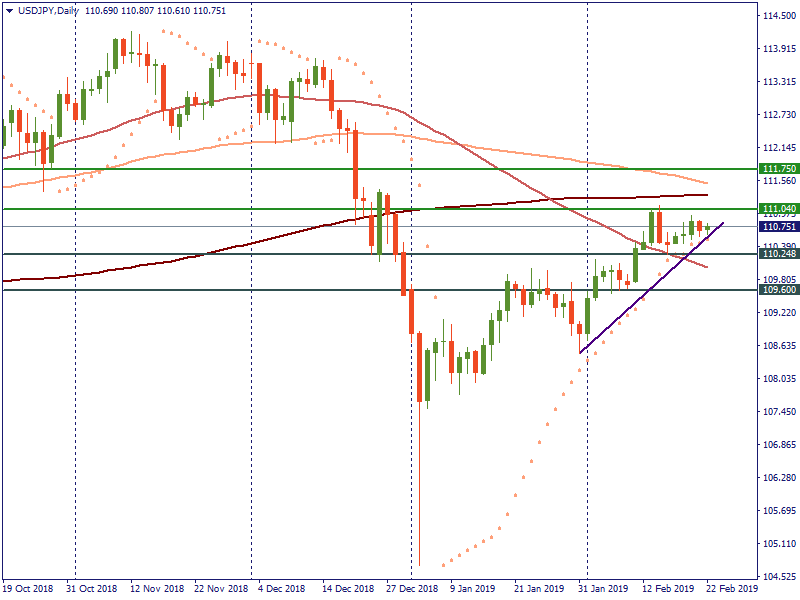

USD/JPY

On the daily chart, USD/JPY has been trading within the uptrend, as confirmed by Parabolic SAR. On Monday, the pair bounced from the support at 110.25 (50-day MA) and started to move further up. Thursday's releases of US durable goods orders made the USD weaker and pulled it down a little bit. If the risk on sentiment continues to dominate in the market, the pair will retest the resistance at 111.04. If this level is broken, the next resistance will lie at 111.75. In case of the risk-off sentiment or positive news for the Japanese yen, the slide towards the support at 110.25 will be expected. The next support for the pair is placed at 109.6.

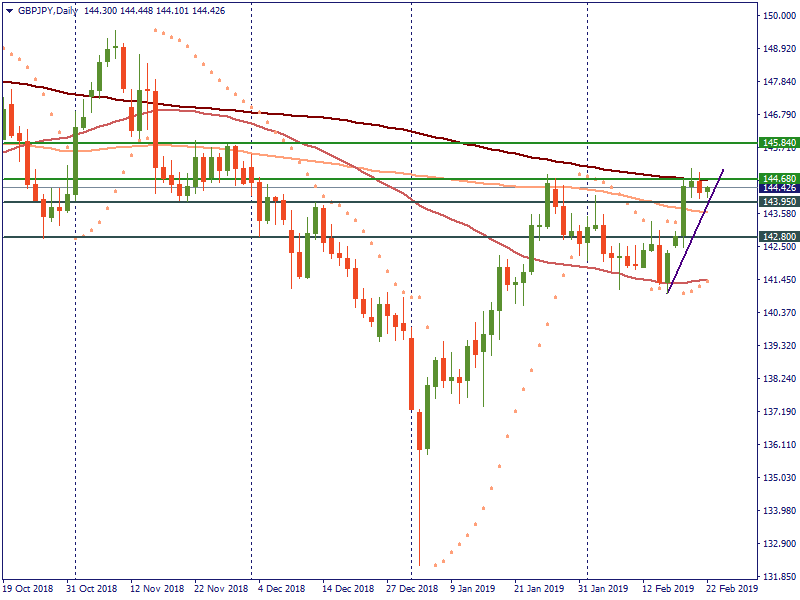

GBP/JPY

Despite the uncertainties on Brexit, the pair has formed an uptrend, too. GBP/JPY has knocked on the resistance at 144.68 (200-day MA) three times this week. On Thursday, GBP/JPY fell towards the support at 143.95. The break of this level will increase the possibility of the fall towards the support at 142.8.

Here, we need to pay attention to the Brexit updates. Positive news on reaching the deal ahead of the key deadline will push the pair above the 144.68 level towards the next resistance at 145.84.

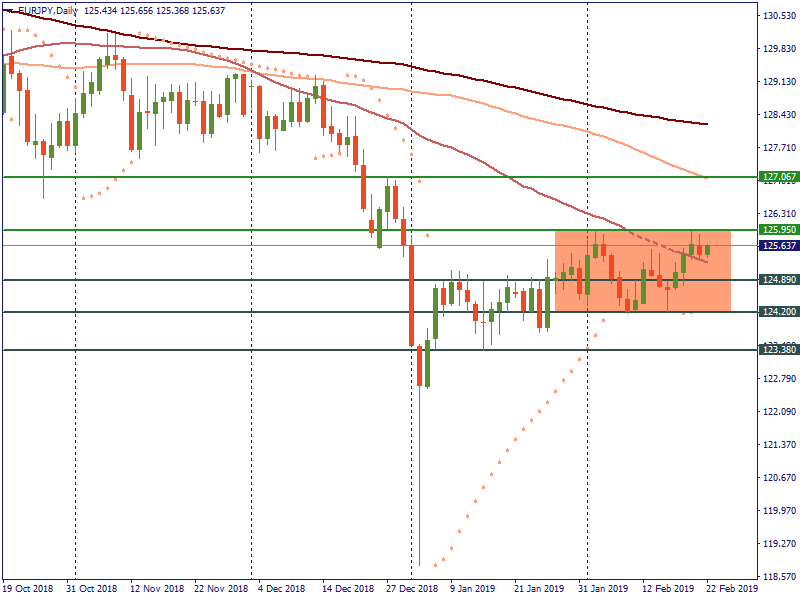

EUR/JPY

Finally, let’s consider the levels for EUR/JPY. The pair has been trading sideways within the 124.2 and 125.95 levels since the beginning of February. If bulls manage to break the upper border of the rectangle at 125.95, the next resistance will lie at 127.07. Vice versa, if bears get stronger, they will pull the pair downwards to the support at 124.89. The break of this level will pull the pair lower to the support 124.2.

Conclusion

The recent hunger for risks in the market affected the Japanese yen. But the overall economic conditions keep being uncertain and that is why we may expect the current situation to change.