Goldman Sachs set target price for S&P 500

The stock market takes a breath after the rally up for almost two weeks. What is the forecast?

According to Goldman analysts, stocks won’t keep moving up and “unloved but welcome” S&P 500 growth may stop soon. They anticipate that the price may go as low as 2,750 and as high as 3,200.

What pushed them up?

The market sentiment improved as investors have optimistic outlook for economies reopening and eased lockdowns. In addition, the US ADP report showed that only 3 million people lost jobs in May when economists expected at least 9 million. Also, rates of new coronavirus cases significantly decreased. Moreover, unprecedented amount of aid packages and reduced interest rates from central banks across the world underpinned investors and boosted their risk appetite.

What can push them down?

Any barriers in the way to the full recovery or political risks may send it down. We remember how long US-China tensions were deteriorating the market sentiment. Also, let’s look a bit inside the S&P 500 composition as analysts believe it’s better to trade single stocks than indexes. The five largest S&P 500 companies: Alphabet, Apple, Amazon, Facebook and Microsoft have gained 15% so far in 2020, while the remaining 495 companies have fallen 8%. As a result, other S&P 500 companies should join the top 5 to allow the stock index to rise further.

Goldman Sachs scenario

Goldman Sachs chief strategist, David Kostin, has set a year-end S&P 500 target of 3,000. On the one hand, certain companies can benefit from a positive outlook for a soon recovery, eased restrictions and the COVID-19 vaccine. On the other hand, there are several factors that can lead stocks down such as worsened US-China tensions or a resurgence in infection rates as countries reopen.

Technical outlook

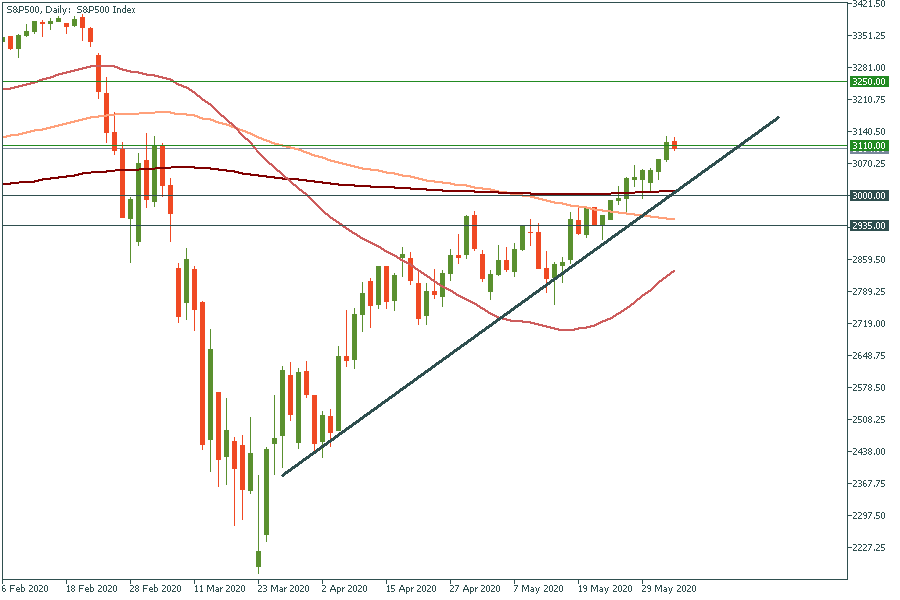

S&P 500 set a strong upward trend. It has been climbing up since March 20. Now the stock index is trading really high. It’s above all moving averages. If it crosses the resistance level at 3110, it will go further to the next one at 3250. Support levels are 3000 and 2935.

Read these articles to know more about stocks: "Trade the most famous stock indexes" and "How to trade stocks with FBS?"