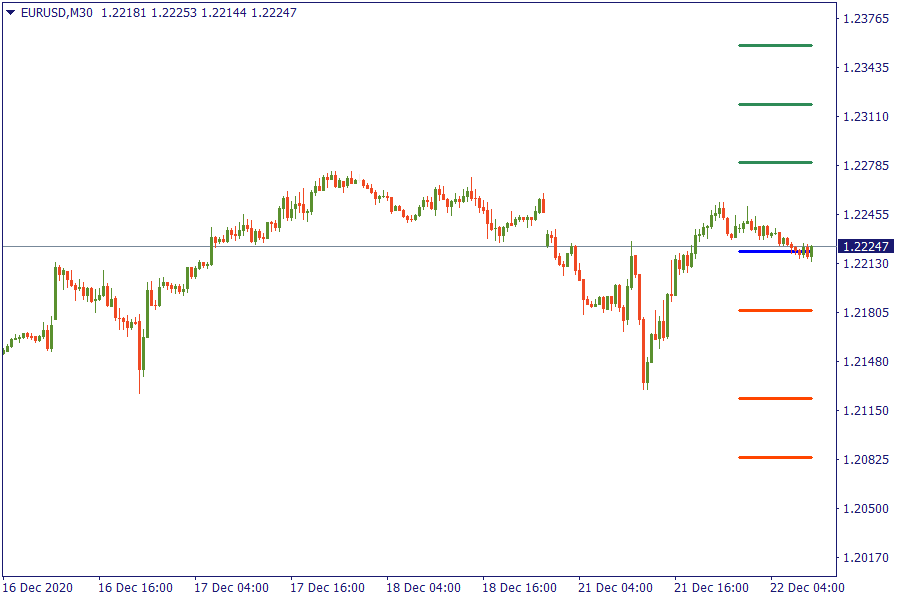

EUR/USD : remains resilient despite risk averse momentum

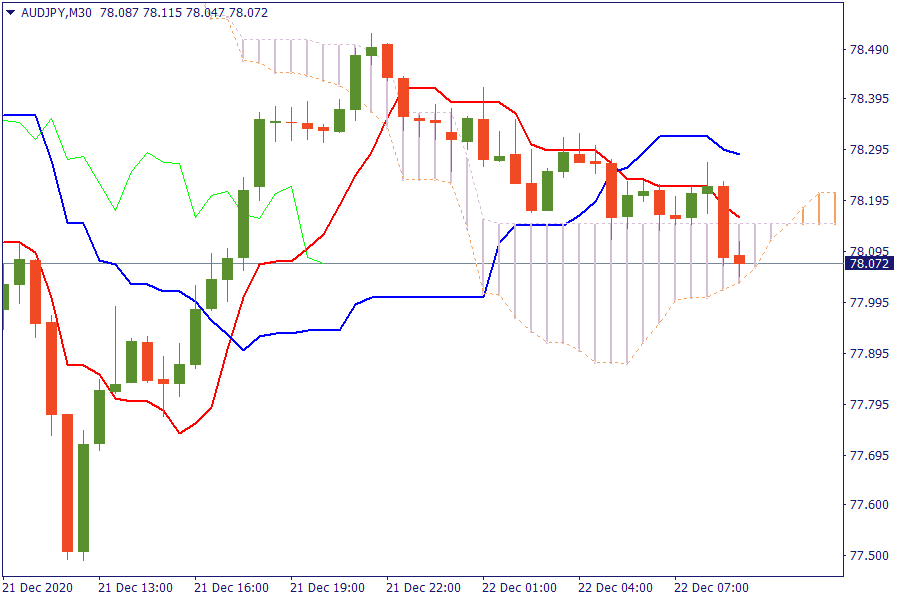

Ichimoku Kinko Hyo

AUD/JPY: The pair is trading below the cloud. Downward pressure would lead the pair to exit further the cloud, confirming a bearish outlook.

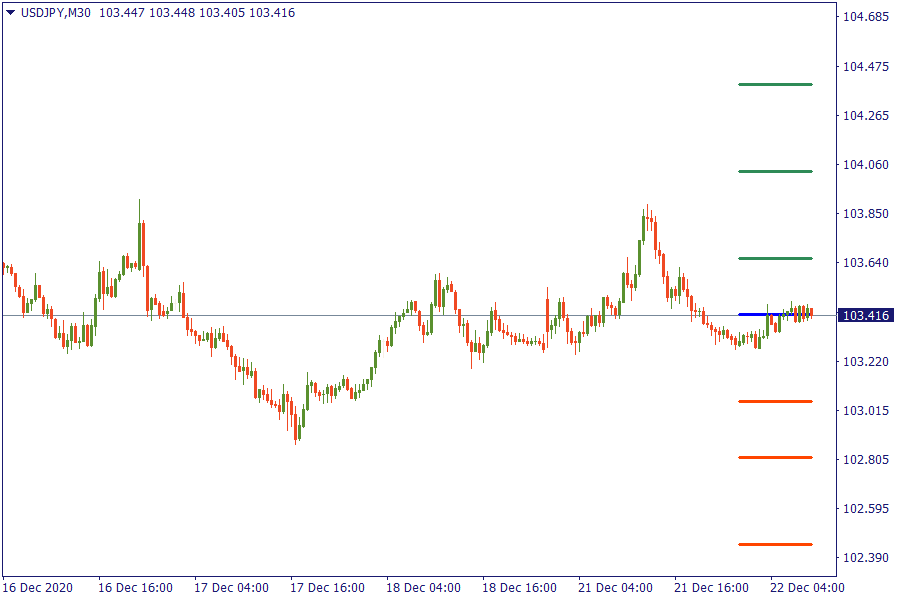

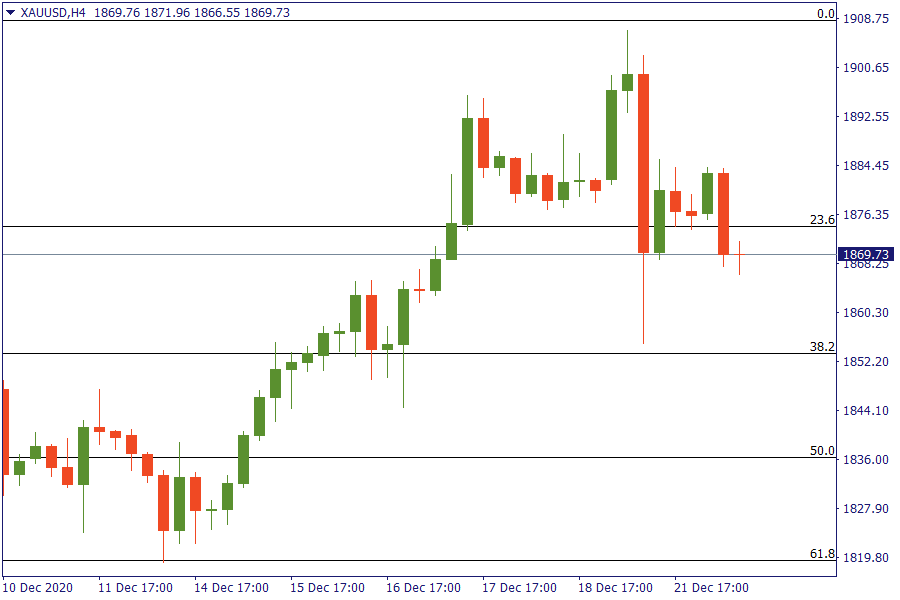

Fibonacci Levels

XAU/USD: Gold is struggling to move higher from the key retracement area of 23.6%.

EU Market View

Asia-Pac equities traded lower following a mixed lead from Wall Street; ASX 200 underperformed. Asian shares widened losses on Tuesday, extending a pullback from multi-year highs hit last week on fears a highly infectious new strain of COVID-19 that hit Britain could lead to a slower global economic recovery. Looking ahead, highlights from the macroeconomic calendar include German GfK Consumer Confidence, US GDP (Final) and Existing Home Sales. Illiquid conditions will persist through year-end, but dips like this could present more of an opportunity to fade than anything else. Countries across the globe shut their borders to Britain on Monday due to fears about a new strain of coronavirus, said to be up to 70% more transmissible than the original, causing travel chaos and raising the prospect of food shortages days before Britain is set to leave the European Union.

The discovery of the new strain, just months before vaccines are expected to be widely available, renewed fears about the virus, which killed about 1.7 million people worldwide. As a result, European shares fell on Monday in their worst session in almost two months.

EU Key Point

- Germany January GfK consumer confidence -7.3 vs -7.6 expected

- Dollar holds firmer ahead of European trading

- Japan maintains its assessment of the economy for the month of December

- Germany reports 19,528 new coronavirus cases in the latest update today

- Japan is considering strengthening its border control rules for the UK