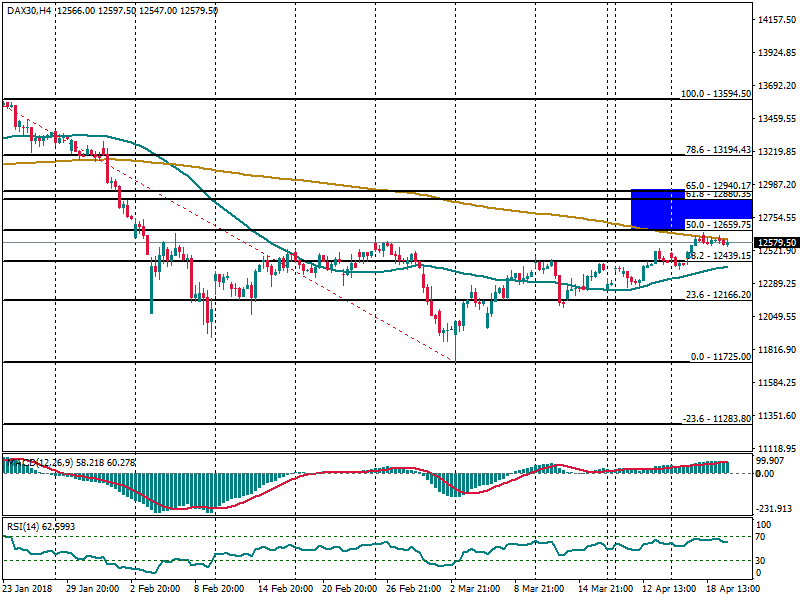

DAX 30: close to test a strong resistance zone

DAX has been moving in a recovery phase since March and while gains are capped by the 200 SMA at H4 chart, the index scopes to consolidate above the Fibonacci level of 50% at 12659. Around that area, we can expect a pullback that help to strengthen the overall bearish bias that takes it to reach the Fibonacci zone of -23.6% at 11283, as the main target to the downside. However, a break above 12940 should open the doors for visit the highs from January at 13594.

RSI indicator stays in the positive territory, calling for another higher extension.