Canadian CPI, Top-down Analysis and Trade Ideas

The Consumer Price Index announcement by Statistics Canada is set for release in a short while and will uncover the state of inflation in the Canadian economy. Although the CPI data for last month indicated a decline in inflation rates, analysts are concerned the data for this month could very easily surpass the previous month's. It is also noteworthy that the BOC has had higher rate hikes than the Fed in recent months. The following are a compilation of interesting ideas to consider.

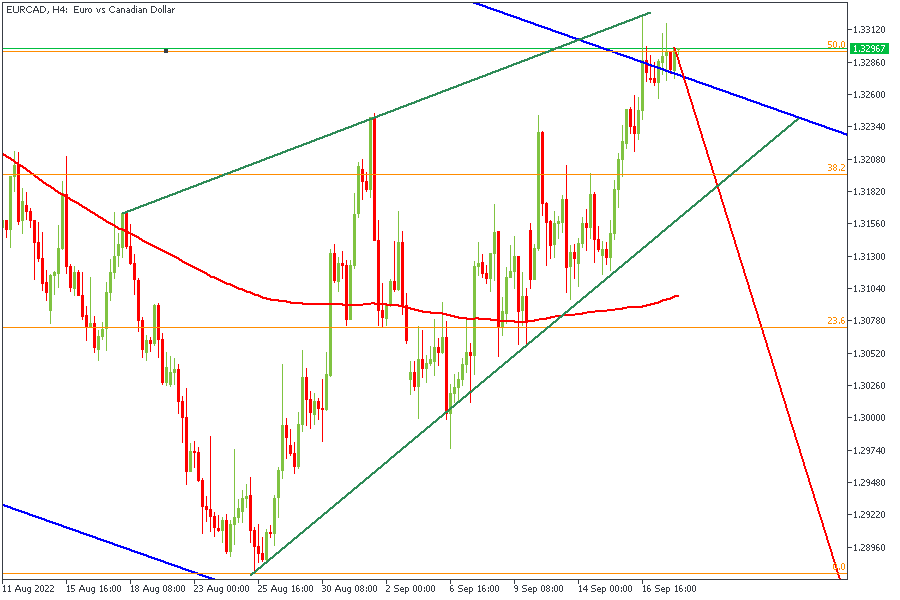

EURCAD

On the Daily Timeframe, we can see EURCAD retesting the upper limit of a descending channel. There is also a confluence with the 50% Fibonacci level.

The 4H timeframe also shows that price is being rejected off the top of the upper limit of an ascending wedge, thus providing clearer confirmations of a bearish movement.

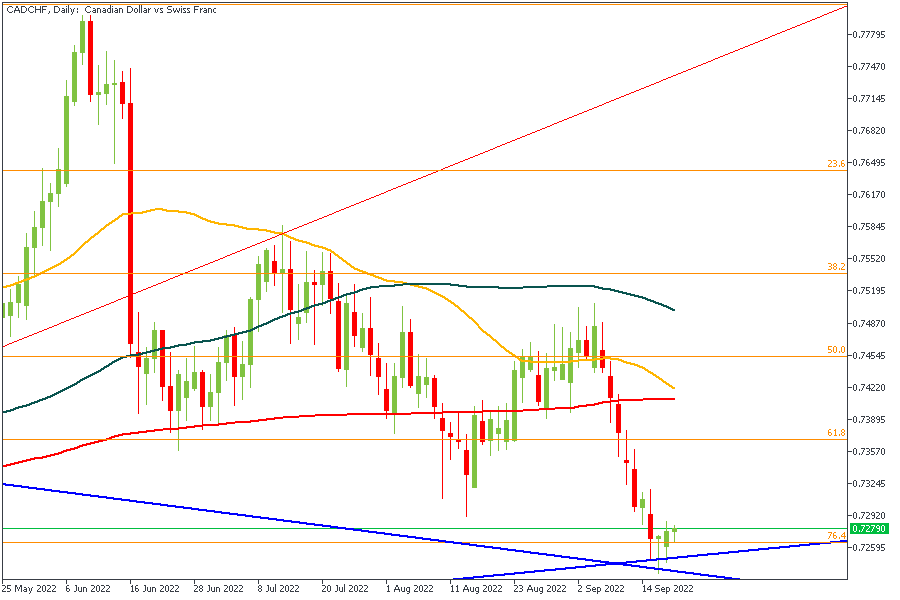

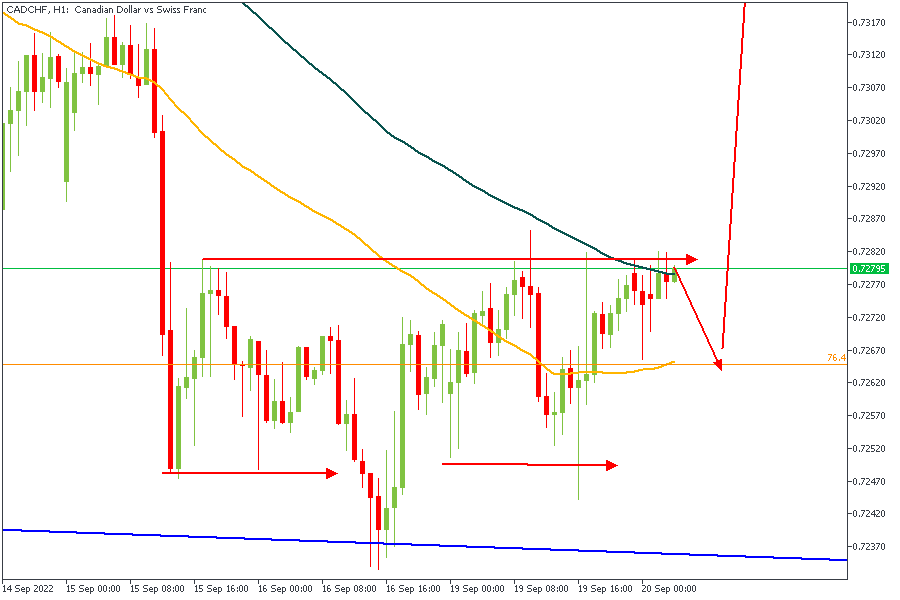

CADCHF

CADCHF has been rejected off the internal Trendline, which serves as support alongside the 76.4% Fibonacci level. The factors seem to favor a bullish Price Action.

On the 1-Hour timeframe, we see a trading range with high chances of a breakout. The breakout will signal further confirmation of the bullish bias.

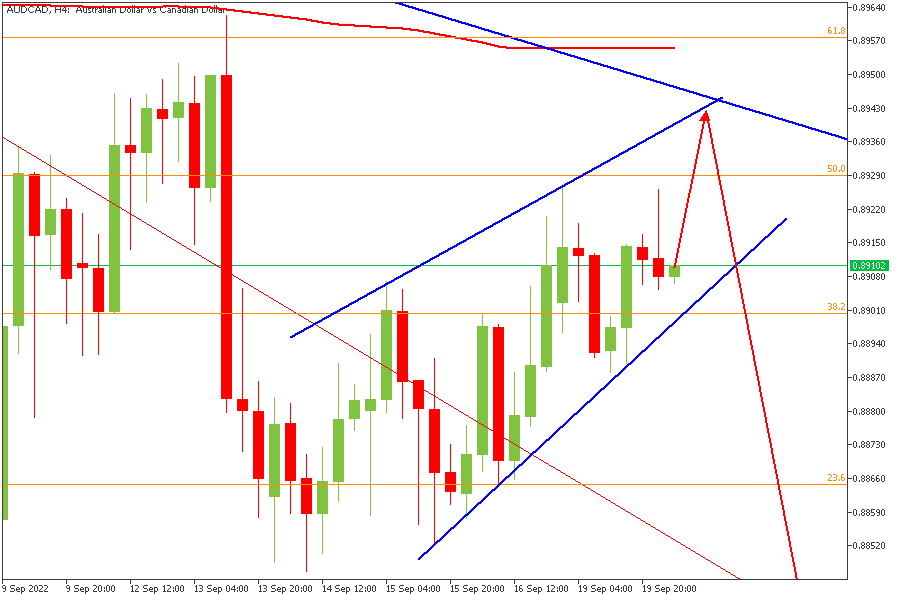

AUDCAD

AUDCAD seems to be reeling under selling pressure from the 50% Fibonacci level coupled with the upper limit of the descending channel.

On the 4-Hour timeframe, we also see the possibility of price breaking lower out of the rising wedge.

USDCAD

USDCAD is expected to experience some selling pressure based on the confluence of the resistance from September 2020 high and the upper boundary of a rising wedge.

CONCLUSION:

To trade any of these ideas, understand your risk exposure and observe due diligence to confirm the setups based on your preferred trading strategy. Sign-up or log in to your FBS account to get started.