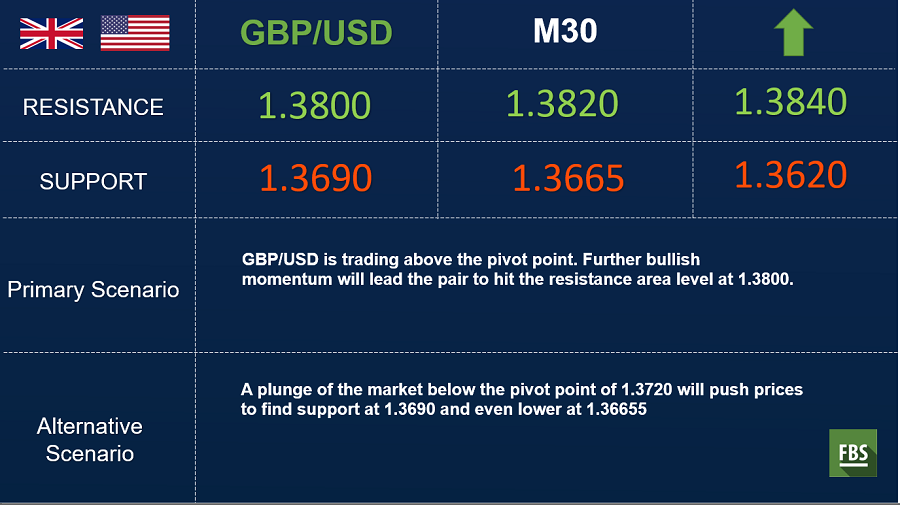

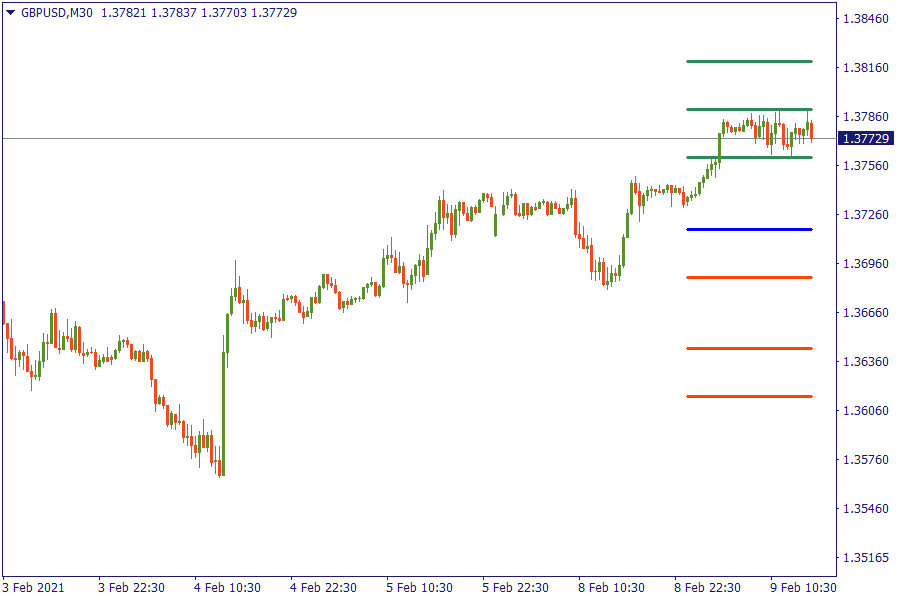

Cable hit record high since 2018

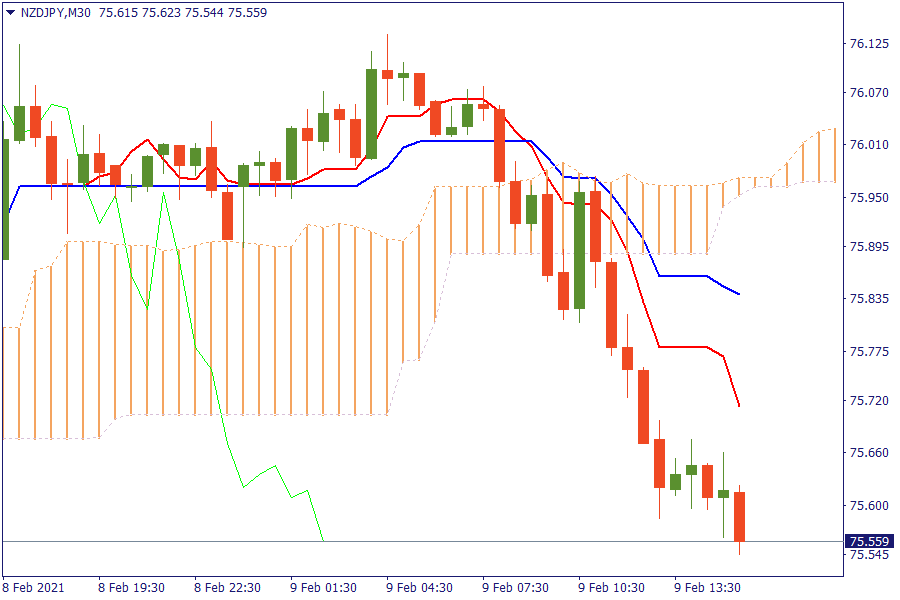

Ichimoku Kinko Hyo

NZD/JPY: The pair is trading below the cloud. A downward pressure would lead the pair to exit further the cloud, confirming a bearish outlook.

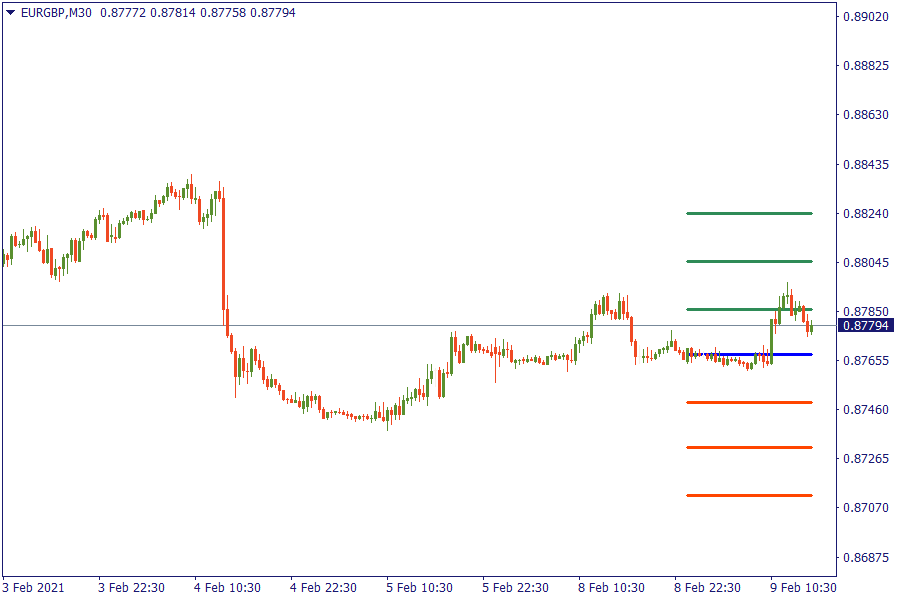

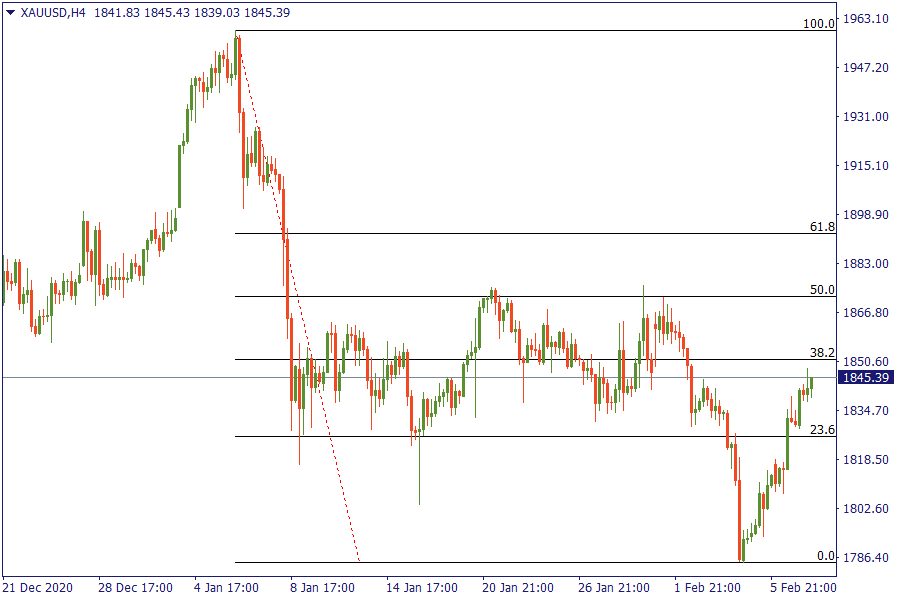

Fibonacci Levels

XAU/USD: Gold bulls return and send price above the 23.6% retracement area.

US Market View

US stocks are seen trading slightly lower Tuesday, consolidating from record levels, with investors keeping a wary eye on the ongoing earnings season and ahead of Donald Trump’s second impeachment trial. All three major indices on Wall Street closed at all-time highs on Monday. The Dow Jones Industrial Average and S&P 500 have now advanced for six straight sessions, their longest win streaks since August, while the Nasdaq Composite has finished higher on five of those six days. Also helping the tone has been a largely positive earnings season so far, coupled with improving numbers on the pandemic. The United States reported a 25% drop in new cases of Covid-19 to about 825,000 last week, the biggest fall since the pandemic started, while deaths fell 2.5%.

Sino-US ties will stay tense as US President Joe Biden is unlikely to rush into new deals with the world's second-largest economy or reduce tariffs on China, even if he is willing to re-engage with multilateral trade, economists and strategists said.

USA Key Point

- USDJPY trending lower and stepping through technical levels in the process.

- The CHF is the strongest and the USD is the weakest.

- Risk trades ease lower as the market catches its breath.

- Silver up by nearly 2% on the day as buyers’ eye $28 again.

- Italian 10-year bond yields fall to record low as Draghi government eyed.

- EUR/USD extends gains to 1.2100 as the dollar slips further on the day.