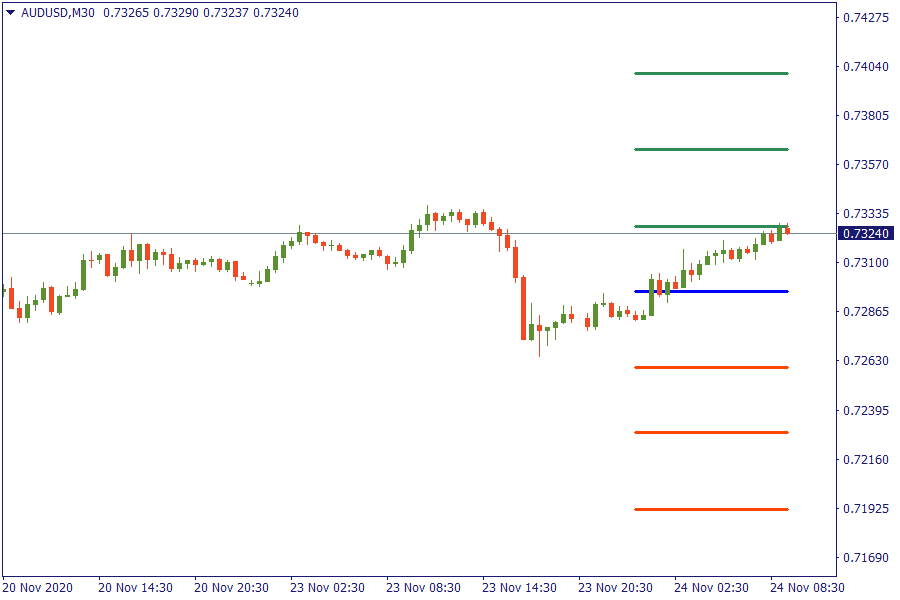

Aussie bullish trend reveals an appetite for risk

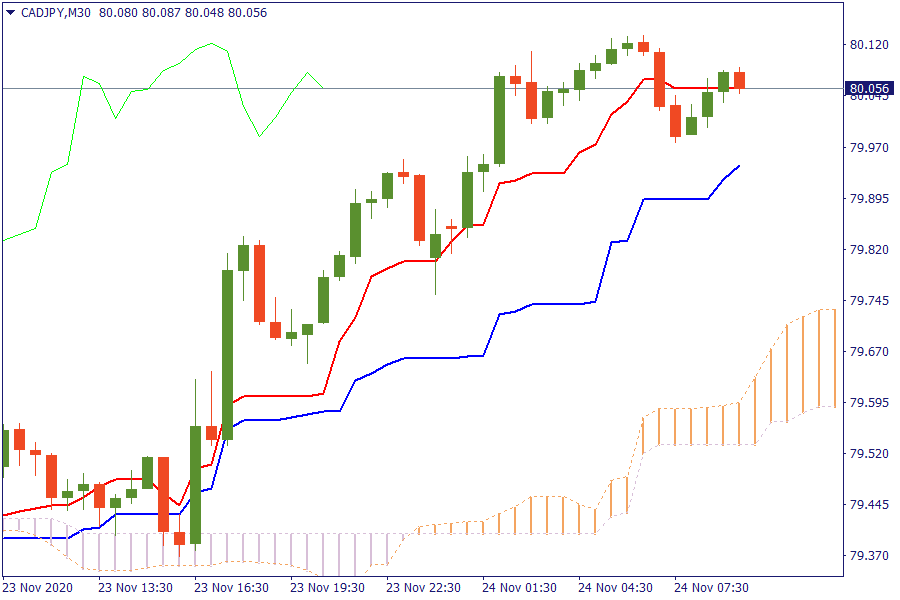

Ichimoku Kinko Hyo

CAD/JPY: The pair is trading above the cloud. An upward pressure would lead the pair to exit further the cloud, confirming a bullish outlook.

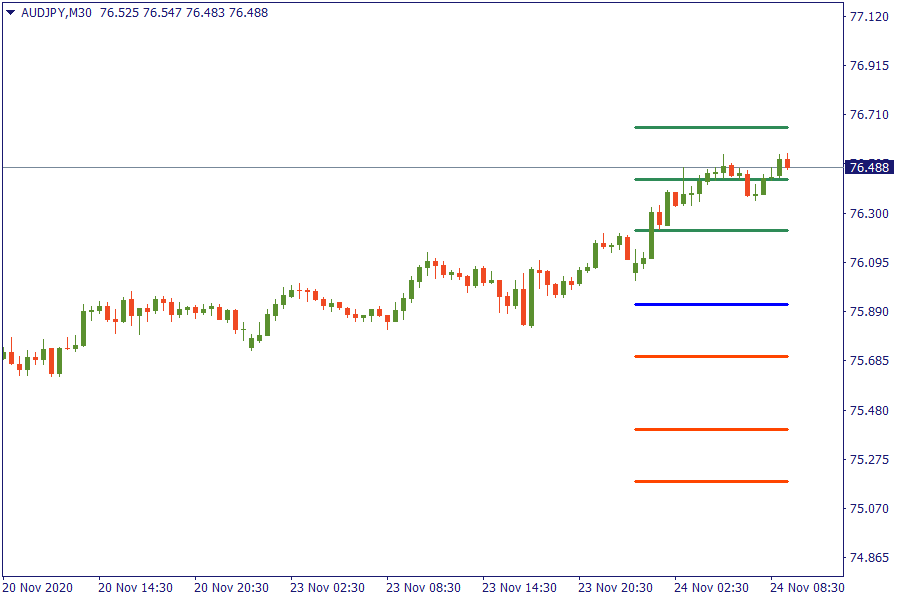

Fibonacci Levels

XAU/USD: Gold further sell off disappoints traders who were looking for a bullish rebound. Gold broke down all retracement areas.

EU Market View

Asian equity markets were mostly positive amid several bullish factors including ongoing vaccine hopes, strong US PMI data and reports that President-elect Biden is to pick former Fed Chair Yellen for Treasury Secretary. President Donald Trump tweeted that he had told his team "do what needs to be done with regard to initial protocols", an indication he was moving toward a transition after weeks of legal challenges to the election results.

Further reports note that the EU and UK are on the cusp of a Brexit deal, with Barnier set to return to London on Friday, should he test negative for COVID. Looking ahead, highlights from macroeconomic calendar include German IFO, US Consumer Confidence, BoE's Haskel, Fed's Bullard, Williams, ECB's Schnabel, Lagarde, Lane speeches.

EU Key Point

- German states reportedly propose extending virus relief payments for companies into December

- Germany reports 13,554 new coronavirus cases in latest update today

- BOJ's Kuroda supports that will take additional easing steps if virus impact becomes more severe

- ECB's Lagarde and Lane will both speak on Tuesday

- Trump tweets that he "Will never concede"