Amazon: rise to 6-month resistance?

Amazon reports it Q4'2020 earnings on February 3, 00:30 MT time (after Tuesday’s midnight).

Technical

Since August 2020, the highest point for the Amazon stock price has been 3 545 and the lowest – 2 900. For six months, the price has been oscillating between these two extremes with diminishing magnitude to gradually convert into the last episode of sideways channel 3 100 – 3 345. Logically, as long as the fundamental outlook for Amazon is positive, the price is likely to bounce upwards and eventually cross the resistance levels of 3 345, 3 445, and 3 545 to take direction to new all-time highs. Otherwise, it may be going sideways for quite a considerable period. That’s why we need to see the Quarterly Earnings Report on February 3, 00:30 MT time (after Tuesday’s midnight).

Fundamental

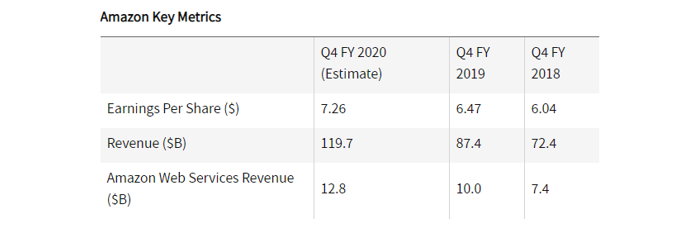

While in the 3000-plus zone, Amazon’s stock price is slightly underperforming against the Wall Street 52-week expected mark of 3 800. In terms of EPS, the expectation is 7.26 for the Q4’2020. Observers are mostly positive about the possible results: the performance of Amazon’s key businesses (cloud computing and e-commerce) is expected to be promising. Also, Amazon Prime Day took place during Q4 and it will likely contribute to the financial result. Therefore, a rise back up to 3 545 seems to be a likely result of the Q4 performance announcements. In the mid-term, it may turn out to be an impulse required to push the stock price above the 6-month resistance.

Source: Investopedia

Don't know how to trade stocks? Here are some simple steps.

- First of all, be sure you’ve downloaded Metatrader 5 or FBS Trader app. FBS allows you to trade stocks only through this software.

- Open the MT5 account in your personal area (in account in FBS Trader)

- Start trading!