For the third time in a row, Apple reports a dip in sales as it releases its report for Q2 2023. The announcement led to a 7% drop in stock prices as more investors seemed to lose confidence in the stock’s performance.

2021-07-30 • Updated

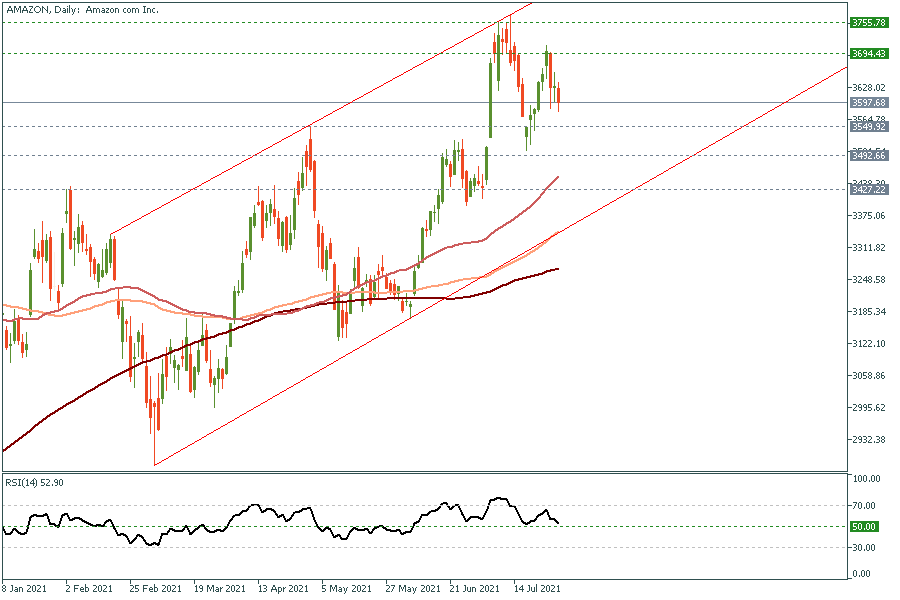

The world’s biggest e-commerce retailer on Thursday reported sales and gave a forecast that fell short of expectations. Shares declined by about 7% in the extended trading after the results were released. It marked the first time Amazon had missed quarterly sales estimates since 2018.

To be honest, this shouldn’t be a surprise. Amazon emerged as the essential store for homebound shoppers during the coronavirus pandemic, propelling its sales and profits to new highs. Now, the rush online is slowing down as vaccinated consumers peel away from computers and smartphones and revert to old habits like traveling and dining out.

Q2 sales increased 27% to $113.1 billion, missing the $115 billion estimated. While profit was $15.12 a share in the period ended June 30, compared with the average estimate of $12.28.

Nevertheless, Amazon is optimistic about the current quarter saying that revenue will be $106 billion to $112 billion in the period ending in September. Operating profit will be $2.5 billion to $6 billion. If so, this would cover the disappointment of Q2. With that being said, I would consider the current decline in Amazon as another price discount that many are waiting for.

For the third time in a row, Apple reports a dip in sales as it releases its report for Q2 2023. The announcement led to a 7% drop in stock prices as more investors seemed to lose confidence in the stock’s performance.

It was an intense week across all the markets! We saw decent movements of major pairs, gas, stock indices, and oil prices. What should we trade this week? Time to check!

Are you searching for trade opportunities for December 6-10? Here you go!

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!